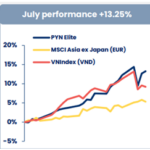

VN-Index ended July at 1,502.5 points, an impressive 9.2% increase, bringing the year-to-date gain to 18.6%. SSI Research attributes this to improved investor sentiment fueled by several catalysts…

In their recently published August strategy report, SSI Research highlights the following key factors that have contributed to the positive sentiment: (i) Favorable macroeconomic conditions with Vietnam securing a trade agreement with the US, resulting in a lower tax rate of 20% compared to the previously announced 46% in April; (ii) Positive spillover effects from the US stock market; and (iii) Q2/2025 financial results that exceeded expectations across most sectors.

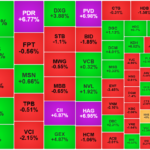

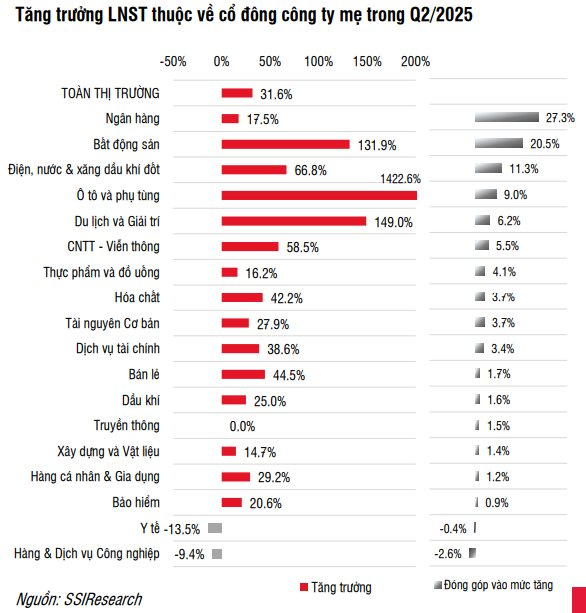

A closer look at the financial results reveals a modest 6.9% year-over-year revenue growth for the second quarter of 2025, while net profit after tax attributable to parent company shareholders (NPATMI) surged by 31.5%—outpacing the 20.9% growth achieved in Q1/2025.

The banking sector remained the primary growth driver, contributing 44% to the total NPATMI market-wide and accounting for 28% of the NPATMI growth. This was followed by the real estate sector (contributing 8% to NPATMI and 20% to growth) and utilities (7% NPATMI and 12% growth).

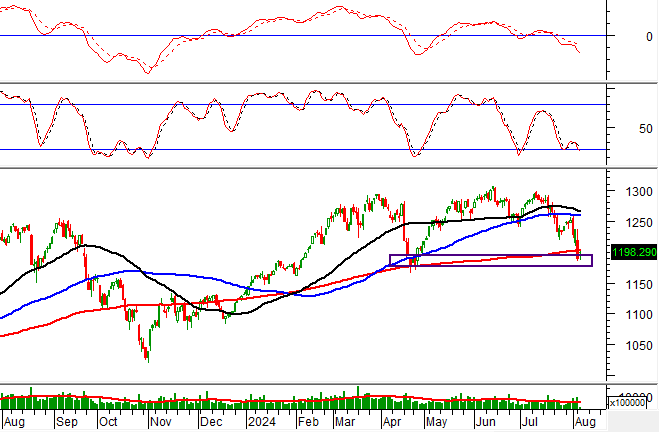

Despite potential short-term fluctuations due to increased profit-taking pressure after a period of high margin trading in late July, SSI remains optimistic about the market’s outlook, projecting VN-Index to reach the 1,750-1,800 range in 2026…

This projection is underpinned by several factors that are expected to drive a robust recovery in profit growth: (1) Resurgence in the real estate market and public investment; (2) Favorable interest rate environment; (3) Easing concerns over tariff-related risks; and (4) Anticipated market upgrade in October.

SSI Research maintains its forecast for a 13.8% growth in market-wide NPATMI for the full year of 2025, implying a 15.5% growth in the second half of the year, although this may be subject to slight adjustments as the earnings season concludes.

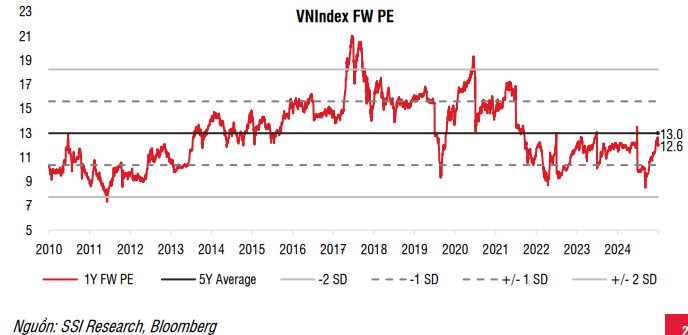

The projected P/E ratio for the market has increased from 8.8x on April 9 to 12.6x as of August 6, but it still remains below the 5-year average of 13x and the peak levels of 15-17x witnessed during the previous market highs.

With regards to the anticipated market upgrade, SSI expects Vietnam to be promoted to emerging market status by FTSE Russell in October 2025. This event has the potential to attract approximately $1 billion in funds from ETF index-tracking funds.

Historical observations from other markets suggest that there is typically a positive performance in the lead-up to an upgrade, driven by expectations of increased foreign capital inflows and improved investor sentiment. This will be a significant supporting factor for the Vietnamese market in the second half of 2025.

SSI Research maintains its positive outlook on Vietnam’s mid-to-long-term prospects, underpinned by stable macroeconomic conditions and economic recovery. The government remains committed to accelerating public investment disbursements, particularly in transportation and energy infrastructure. Additionally, policies aimed at easing bottlenecks in the real estate sector, such as streamlining legal procedures and expediting the disbursement of social housing credit packages, are being actively pursued.

“At the same time, Vietnam remains the most promising candidate in Southeast Asia for an upgrade from frontier to emerging market status by MSCI and FTSE. Efforts to amend the Securities Law, Investment Law, and improve foreign ownership limits are underway to facilitate this upgrade,” the report emphasized.

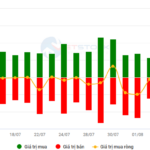

Stock Market Week of 04-08/08/2025: Holding the Line

The VN-Index remained in positive territory despite a volatile session to end the week, capping off a strong performance with a near 90-point gain. While foreign investors have been net sellers in recent sessions, a reversal of this trend in the coming week could further bolster the current upward momentum and propel the index to new highs.

The Business is in the Red, but Stock Prices Soar: What do Experts Make of It?

Stock price increases are merely symptomatic; discerning investors must focus on the underlying causes. Is it a reflection of improved financial performance, positive news, or perhaps a result of price manipulation? Savvy investors delve beyond surface-level indicators to uncover the true drivers of stock price movements.