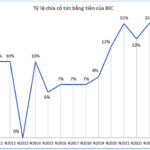

The Board of Directors of Nam Tan Uyen JSC (code: NTC) has recently approved the list of shareholders for the 2024 cash dividend payout at a ratio of 60% (shareholders owning 1 share will receive VND 6,000). The record date for the dividend payment is August 25, and the expected payment date is September 25.

With almost 24 million shares currently in circulation, Nam Tan Uyen needs to allocate approximately VND 144 billion for this dividend payout.

As of Q2 2025, the largest shareholder of Nam Tan Uyen is Cao su Phuoc Hoa JSC (code: PHR), holding 32.85% of the capital. Vietnam Rubber Industry Group – Joint Stock Company (GVR) owns 20.42%, and Saigon VRG Investment Joint Stock Company holds 19.95% of the shares. These three major shareholders are expected to receive VND 47 billion, VND 29 billion, and VND 28 billion in dividends, respectively.

Established in 2004, Nam Tan Uyen has a charter capital of VND 240 billion. The company is the main investor in the infrastructure development of three key industrial parks in Tan Uyen, (former Binh Duong province): Nam Tan Uyen Industrial Park with an area of nearly 332 hectares, Nam Tan Uyen Expanded Industrial Park with 288.52 hectares, and Nam Tan Uyen Expanded Phase 2 with 346 hectares.

In addition, the company has invested in several intra-industry and off-industry projects, including Binh Long Rubber Industrial Park (Binh Phuoc, holding 37.79%), Bac Dong Phu Industrial Park (Binh Phuoc, holding 40%), Cao su Truong Phat Joint Stock Company (owning 20%), and Dau Giay Industrial Park (Dong Nai, holding 22.17%).

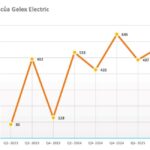

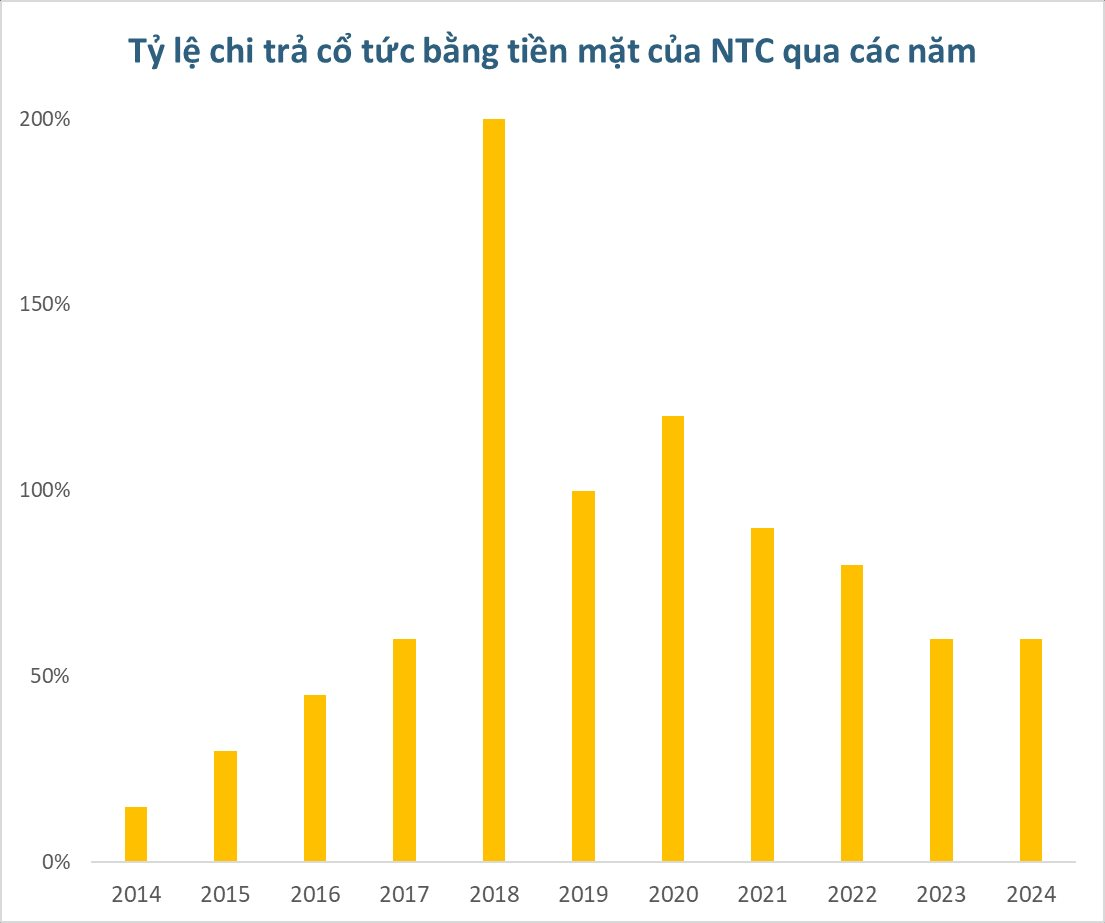

Nam Tan Uyen is also known for its tradition of consistently paying high cash dividends to its shareholders. During the period of 2017-2023, the company maintained cash dividend payouts ranging from 60% to 120%. Notably, in 2018, the company paid out an impressive 200% cash dividend. Most recently, in 2024, the company approved a minimum dividend payout of 60%.

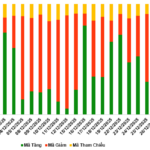

Regarding the Q2 2025 financial results, NTC’s revenue surged by 114% compared to the same period last year, reaching VND 143 billion. According to the company, this growth was mainly driven by the recognition of industrial infrastructure lease revenue from allocating the contract value over the number of years by recognizing the entire value of a land lease contract at once.

During this period, financial revenue decreased by 9% to VND 43 billion. After deducting expenses, Nam Tan Uyen’s pre-tax profit was VND 115 billion, a 49% increase compared to Q2 2024. Correspondingly, after-tax profit reached VND 97 billion, a 50% increase year-over-year.

For the first six months of 2025, Nam Tan Uyen recorded a remarkable performance with VND 277 billion in revenue and VND 166 billion in after-tax profit, representing a significant growth of 124% and 27%, respectively, compared to the same period in 2024. For the full year 2025, the company has set a business plan with a revenue target of nearly VND 793 billion and an after-tax profit of VND 284 billion. Thus, NTC has already accomplished approximately 59% of its annual profit target.

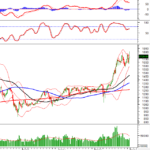

In the stock market, NTC closed at VND 170,500 per share on August 7, a 3% increase. Recently, the Ho Chi Minh City Stock Exchange (HOSE) announced that it has received the registration dossier for listing 24 million NTC shares.

“SJ Group Successfully Issues Over 182 Million Shares as Dividend and Bonus Payout”

On July 31, 2025, SJ Group concluded its distribution of over 182.6 million shares as dividends to its 2,302 shareholders. This issuance of shares has increased the total number of outstanding shares to nearly 297.5 million.