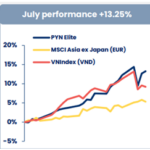

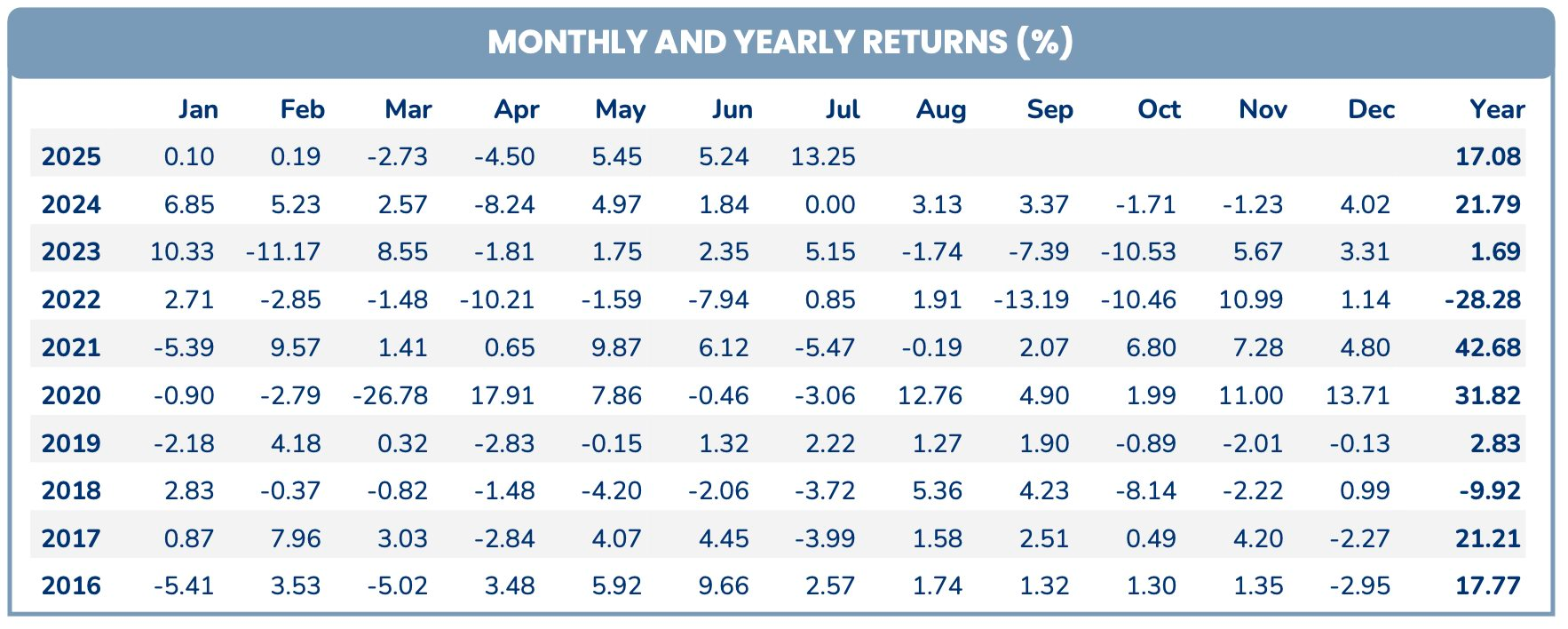

The newly released report for July 2025 reveals an impressive performance by the Pyn Elite Fund, achieving a monthly return of 13.25% – the highest in 55 months since January 2021. This outperformed the VN-Index’s 9.2% gain, despite the index reaching a new historic peak of 1,557 points on July 28. The fund’s success can be largely attributed to its strategic focus on banking and securities stocks.

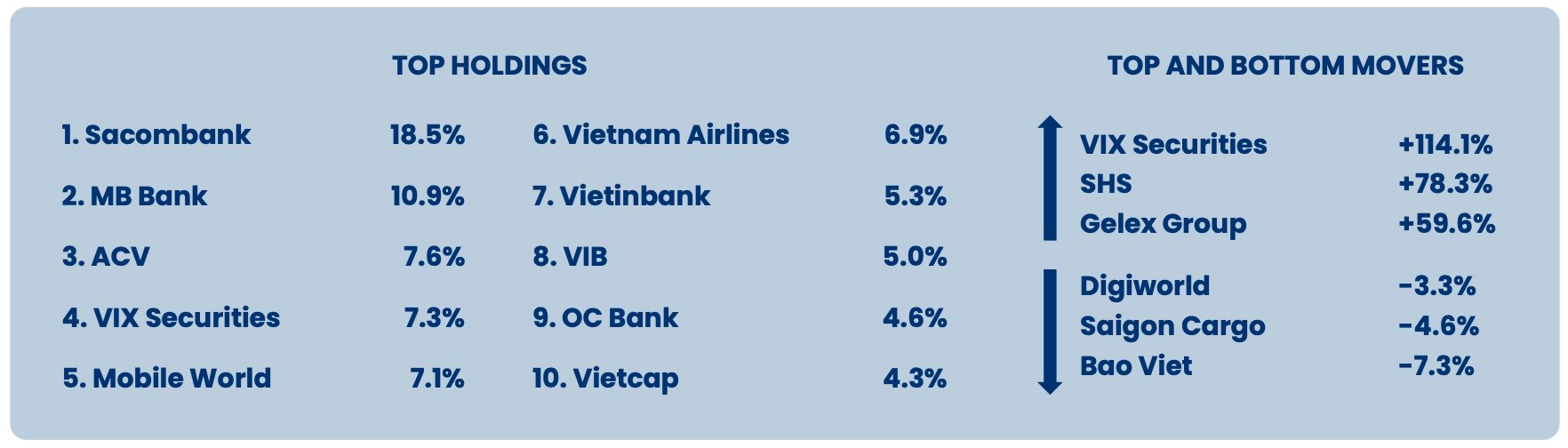

Pyn Elite Fund disclosed that it doubled its exposure to securities stocks to 14% at the beginning of the year by adding VIX and SHS to its portfolio. In July, these stocks soared by 114% and 78%, respectively, significantly contributing to the fund’s outstanding performance. Notably, VIX, the fund’s fourth-largest investment as of the end of July, accounted for 7.3% of the portfolio.

With a management scale of over 912.5 million EUR (approximately 27 trillion VND or 1 billion USD) as of the end of July, Pyn Elite Fund’s investment in VIX is estimated to be worth around 66.6 million EUR (roughly 2 trillion VND). VIX has been a favored investment choice for the fund, as they previously held a significant stake in the company, then known as IB Securities, back in 2016. In October 2018, the fund decided to exit its position, realizing profits. However, VIX made a surprising comeback in the fund’s top 10 investments starting in May this year and has maintained its presence as of the end of July.

According to Pyn Elite Fund, VIX is currently the fifth-largest brokerage firm in terms of total equity. With a primary focus on proprietary trading and margin lending, the company has delivered an impressive five-year average ROE of 19%. Notably, VIX’s net profit for the second quarter surged by 10.5 times compared to the same period last year, reaching 1,302 billion VND, the highest among listed securities companies.

This remarkable profit growth is attributed to their proprietary trading activities, with key positions poised to sustain this upward trajectory in the second half of 2025. Pyn Elite Fund strategically accumulated a 4.7% stake in VIX in March when the stock was trading at a 40% discount to its peers in price-to-book value. This position has since generated a remarkable 127% profit over the four-month period.

Regarding the broader market, Pyn Elite Fund remains optimistic, citing several positive macroeconomic indicators. Vietnam’s GDP growth for the second quarter surpassed expectations, reaching 7.96% year-over-year. The government has also raised its GDP target for 2025 to 8.3-8.5%, setting the stage for ambitious growth plans in the coming years. Additionally, the PMI index hit an 11-month high of 52.4 points, while exports, retail sales, and disbursed investment capital increased by 16%, 9.2%, and 25.4%, respectively.

The fund also highlights several landmark decisions made in July, reflecting a strong pro-business stance and a commitment to reform. These include the National Assembly’s resolution to establish International Financial Centers in Ho Chi Minh City and Da Nang with breakthrough incentives, proposed amendments to the Land Law to address bottlenecks in the real estate market, and reforms to the Personal Income Tax Law to reduce tax burdens and stimulate consumption. A large-scale administrative reform has also been completed, reducing the number of provinces from 63 to 34.

Moreover, the regulatory body has proposed extending the trading hours to include the lunchtime period starting in Q1/2026 and announced the roadmap for implementing the CCP mechanism in Q1/2027, a crucial step towards enabling intraday trading. The State Securities Commission remains confident about Vietnam’s prospects for an upgrade to emerging market status by FTSE in October, based on positive feedback on regulatory improvements and technical infrastructure.

SSI Research Eyes VN-Index Marching Towards 1,800 Points

SSI maintains high hopes that Vietnam will be upgraded to Emerging Market status by FTSE Russell in October 2025. This anticipated upgrade could potentially attract approximately $1 billion in capital inflows from index-tracking ETF funds.

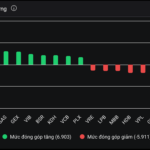

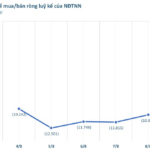

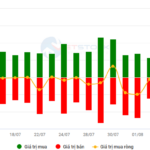

Stock Market Week of 04-08/08/2025: Holding the Line

The VN-Index remained in positive territory despite a volatile session to end the week, capping off a strong performance with a near 90-point gain. While foreign investors have been net sellers in recent sessions, a reversal of this trend in the coming week could further bolster the current upward momentum and propel the index to new highs.

The Power of Persuasion: Crafting Compelling Headlines

“Unleashing the Potential: PYN Elite’s Stellar Performance with Two Stock Codes”

In July 2025, PYN Elite Fund, a foreign-owned investment fund, boasted an impressive 13.25% return, the highest it has seen in 55 months since January 2021. This remarkable performance surpasses the VN-Index’s 9.2% gain, which peaked at a historic high of 1,557 points on July 28.