On August 7, entrepreneur Le Hung Anh, Chairman of BIN Corporation (also known as Shark Le Hung Anh), conducted a field survey and explored investment opportunities in Hiep Duc Ward, Da Nang City.

The team surveyed the famous tourist attraction Hon Kem Da Dung, Khe Cai, and along the Tranh River.

Shark Le Hung Anh exploring investment opportunities in Hiep Duc, Da Nang (Photo: TRAN VAN LUAN)

The People’s Committee of Hiep Duc Ward shared their goal of achieving double-digit economic growth. They emphasized the need to identify clear directions and solutions to effectively exploit the potential of their land, forming a medicinal herb and organic agricultural region.

Additionally, the locality should continue to promote its natural potential and environmental advantages at Hon Kem Da Dung, Khe Cai, and Thuy Dien Song Tranh 4 to attract investments. This will facilitate the development of community and eco-tourism destinations.

To materialize these goals, Hiep Duc Ward seeks the collaboration and investment of businesses and investors.

The local government of Hiep Duc Ward proposed that the city continue to prioritize investments in dynamic transportation infrastructure. They also suggested reviewing and supplementing the construction planning to create favorable conditions for attracting investments in several important projects to boost economic growth.

Shark Le Hung Anh (from his personal page)

Previously, Shark Le Hung Anh has explored and made investment decisions in several potential areas in Da Nang City.

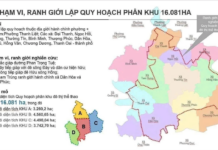

For instance, in late May 2025, the People’s Committee of Quang Nam Province (now Da Nang City) approved the investment policy for the construction and infrastructure business of Sub-area B – Nam Thang Binh Industrial Park, with a total investment of over VND 3,373 billion in phase 1.

In this decision, the People’s Committee of Quang Nam Province also approved the investor, Nam Thang Binh Industrial Park Infrastructure Investment Joint Stock Company, which is a member of the BIN Corporation ecosystem, founded and currently chaired by Mr. Le Hung Anh.

The project aims to invest in the construction and business of industrial park infrastructure, industrial real estate business, warehouse services, and other supporting services.

Earlier, in early 2023, BIN Corporation received an agreement from Quang Nam Province (now Da Nang City) to research and propose an investment project for the construction and business of infrastructure in Sub-area B – Nam Thang Binh Industrial Park, with an area of 346 hectares.

This industrial park is oriented to develop an eco-industrial park model, focusing on attracting high-tech industries such as information technology, telecommunications, and electronics; deep processing of silica products; and processing of medicinal herbs and local agricultural products for export.

BIN Corporation is a multi-industry group headquartered in Ho Chi Minh City. The group’s business areas include enterprise management consulting, financial consulting, digital marketing, e-commerce, tourism, real estate, and technology.

Da Nang Real Estate Sees Unusual Trends

According to reports, the market in Da Nang City witnessed an increase in the supply of apartments for sale, while new tourism property products were scarce. Despite price growth in both segments, transaction volume and absorption rates declined significantly due to high prices and investors’ cautious psychology.

A Neighboring Country’s 40-Year-Old Conglomerate, Worth $17 Billion, Seeks to Expand Investments in Vietnam.

This corporation has undertaken several projects in Vietnam within the animal feed and aquaculture industries. With a proven track record of success, they now seek to expand their horizons and venture into the energy sector.

The Capital City’s Foreign Investment Appeal: Hanoi’s Race to the Top

Amidst a volatile global economic landscape, Hanoi has emerged as an impressive beacon of foreign investment attraction in the first half of 2025. The city has attracted over 3.67 billion USD, setting not only a quantitative record but also testifying to the international investors’ confidence in its growth prospects.

Mr. Tran Hoang Son (VPBankS): VN-Index Poised for New Uptrend After Correction

“It is quite normal for the VN-Index to experience a correction after a strong rally, and this pullback is likely a result of short-term profit-taking,” said Tran Hoang Son, Market Strategy Director at VPBank Securities (VPBankS), during the Vietnam and the Indices show on August 4th. He added, “The index is fully capable of entering a new uptrend.”

The Power of Profits: How a 30.2% Rise in Earnings for Over 1000 Businesses is Impacting Stock Performance

The stock market is a vibrant and dynamic arena, where you’ll always find stocks that exhibit a disconnect between their stellar financial performance and their stagnant stock prices. These stocks often fly under the radar, belonging to the mid-cap or small-cap category, unnoticed by most investors.

The Flow of Capital: The Rhythm of Adjustment Endures

The market has experienced its most significant correction since the April lows, following a remarkable 42% surge in the VN-Index. The abrupt 4.1% decline on July 29, accompanied by record-breaking trading volumes, signaled the conclusion of a short-term cycle. It’s essential for the market to cool off and consolidate before embarking on the next upward trajectory.