The total value of bonds issued to the public has reached 41,000 billion VND so far this year, the highest in recent years. Meanwhile, 36,000 billion VND worth of bonds will mature in August, the highest amount this year.

According to VIS Ratings, 1,200 billion VND worth of these bonds face a high risk of first-time payment delays. These bonds were issued by two real estate companies with “extremely weak” credit profiles.

Additionally, there are 14,400 billion VND worth of matured bonds that have been delayed in interest payments, including 10,500 billion VND from four companies related to Van Thinh Phat Group. The remaining bonds are from Novaland, Trung Nam, and Hai Phat, all of which are undergoing debt restructuring.

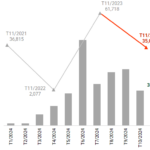

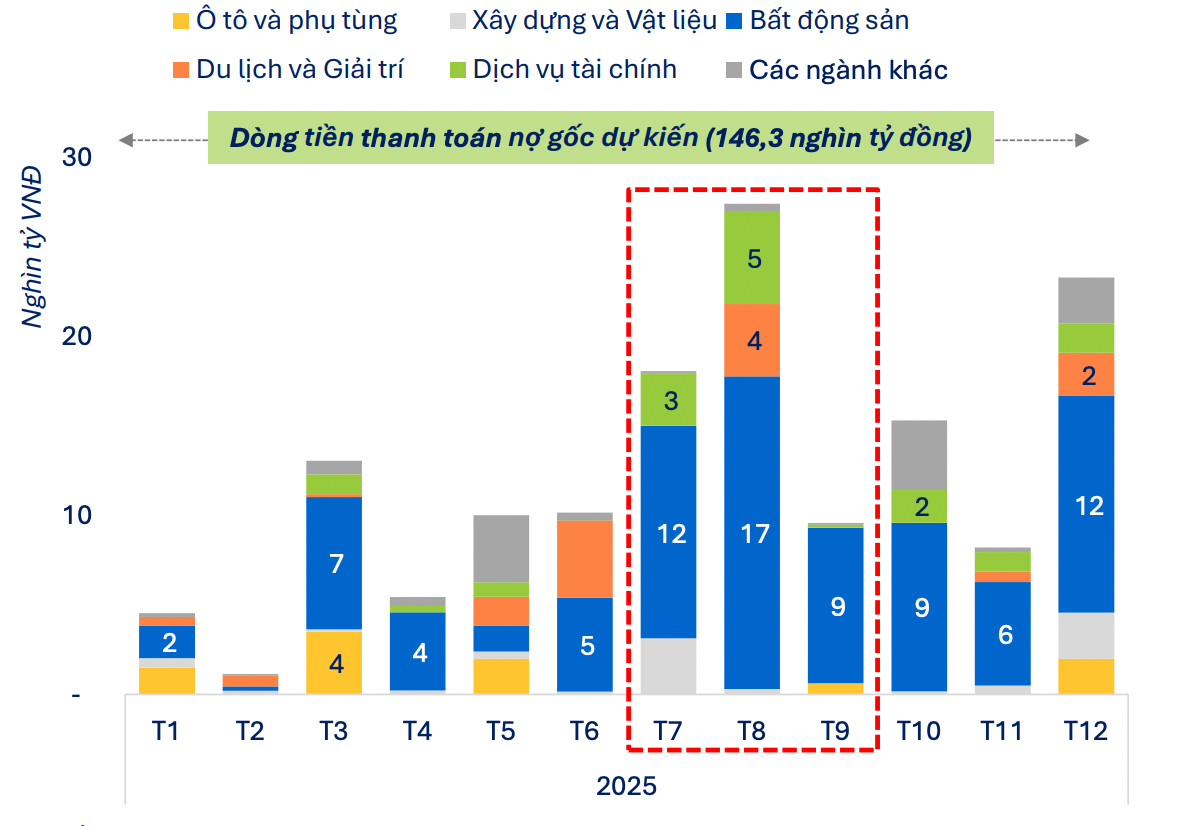

Excluding banks, data from FiinGroup also shows that the pressure to repay corporate bonds in August is expected to increase significantly, with a total of 27,400 billion VND in principal maturing, the highest this year, and a 51.7% increase compared to the previous month.

The pressure on real estate bond maturities is expected to peak in August and then decrease.

Real estate continues to dominate with approximately 17,500 billion VND worth of bonds maturing in August, accounting for 63.8% of the non-bank sector’s principal obligations. This scale is 3.8 times higher than the average maturity amount in the first seven months (4,600 billion VND). The pressure on real estate bond maturities is expected to peak in August and then decrease in the following months.

Some companies with large volumes of maturing bonds include Quang Thuan Investment Joint Stock Company (6,000 billion VND), Trung Nam Land (2,500 billion VND), and Ho Chi Minh City Service and Trading Joint Stock Company (2,000 billion VND). All three companies have previously violated their interest payment obligations.

In the second half of 2025, the total principal value of maturing bonds for the non-bank group is estimated at approximately 101,900 billion VND, more than double that of the first half (44,400 billion VND), indicating existing pressure. Real estate alone accounts for about 64% with 65,300 billion VND.

In addition to principal obligations, the non-bank group is expected to pay approximately 6,600 billion VND in bond interest in August, an increase of 22.8% from the previous month. Real estate remains at the top with about 4,200 billion VND, equivalent to 63% of the total interest obligations. The following industries include financial services (670 billion VND), tourism and entertainment (654 billion VND), utilities (347 billion VND), and construction and materials (241 billion VND).

The analysts at S&I Ratings believe that financial pressure on real estate businesses will persist for the next 12 to 18 months.

On a positive note, S&I Ratings suggests that the government’s recent efforts to resolve legal issues for real estate projects will facilitate the resumption of project implementation and improve cash flow for businesses. Once projects are unblocked and eligible for deployment, companies can use them as collateral to secure bank loans and start selling early to repay bond debts.

Along with the increasing trend of bond issuance by banks to supplement medium and long-term capital, S&I Ratings expects the corporate bond market to continue its recovery in the second half of 2025.

Furthermore, the National Assembly has passed amendments to the Law on Enterprises, which came into effect in July 2025. Notably, the amendments include a provision that requires enterprises issuing private placement bonds to maintain a debt-to-equity ratio not exceeding five times. However, this rule excludes certain special issuers, including credit institutions and real estate developers, which have accounted for almost all issuance values in the market in recent years. S&I Ratings views this as an initial step towards enhancing the quality of the corporate bond market and managing financial risks, especially for weaker companies.

The Looming Maturity Pressure on Real Estate Bonds in August Intensifies: Marking the Market’s Most Strained Period

“August sees a significant spike in the maturity value of non-bank group bonds, with an estimated face value of VND 27.4 trillion, a substantial 51.7% increase from the previous month’s value of VND 18.1 trillion. This surge in maturity value makes August the peak month for bond repayments in 2025.”

Bond Leverage at The Maris Vung Tau Project

“As 2024 drew to a close, Allgreen Vuong Thanh Trung Duong Ltd. successfully raised an additional 535 billion VND through bond issuances, bringing their total capital raised via this route to 2,270 billion VND within just one month. This injection of funds is dedicated to expediting the development of their premium resort project, The Maris Vung Tau.”

The Green Bond Revolution: November’s Foreign-Backed Water Utility Bonds

The corporate bond issuance activities remained subdued in November, with approximately VND 35 trillion (face value) being issued, a slight increase from the previous month of October.