Vietnam’s Stock Market Recap: VN-Index’s Resilient Week with Historic Trading Volume

The Vietnamese stock market witnessed a resilient week from August 4th to 8th as the VN-Index recovered from the previous week’s dip below 1,500. While the main index continued to face corrective pressures, it staged a strong comeback, closing the week at a new high of 1,584.95 points, surpassing the 2022 peak. The highlight of the week was the historic trading session on August 5th, with a staggering 3.2 billion shares traded and a turnover of nearly VND 83,000 billion across the market.

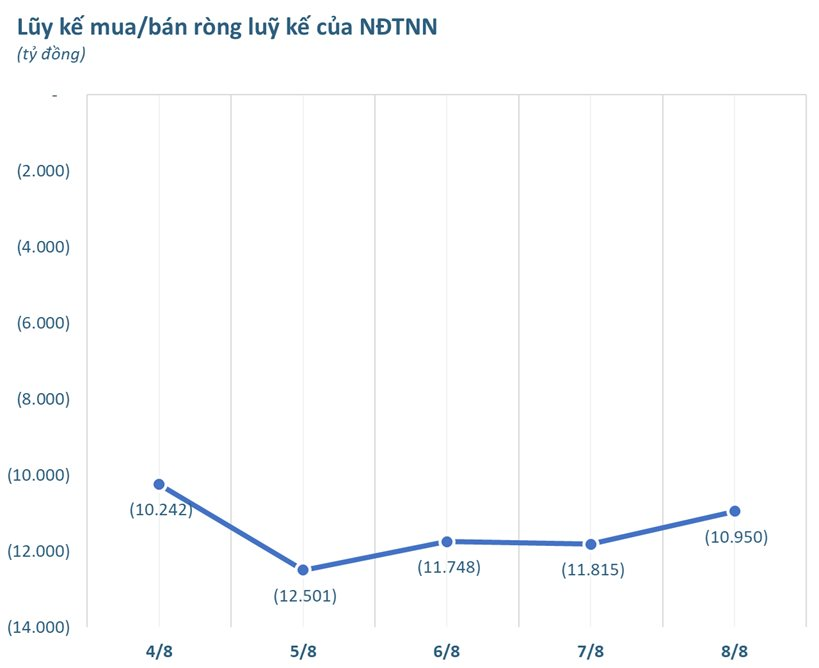

In terms of foreign investment flows, foreign investors maintained their net selling trend, focusing on block deals. Cumulatively, foreign investors sold a net VND 10,950 billion during the five sessions. However, excluding the net selling in VIC through block trades, foreign investors remained net buyers in the matched order segment.

A breakdown of the exchanges reveals that foreign investors net sold VND 11,501 billion on HoSE, net bought VND 678 billion on HNX, and net sold VND 127 billion on UPCoM.

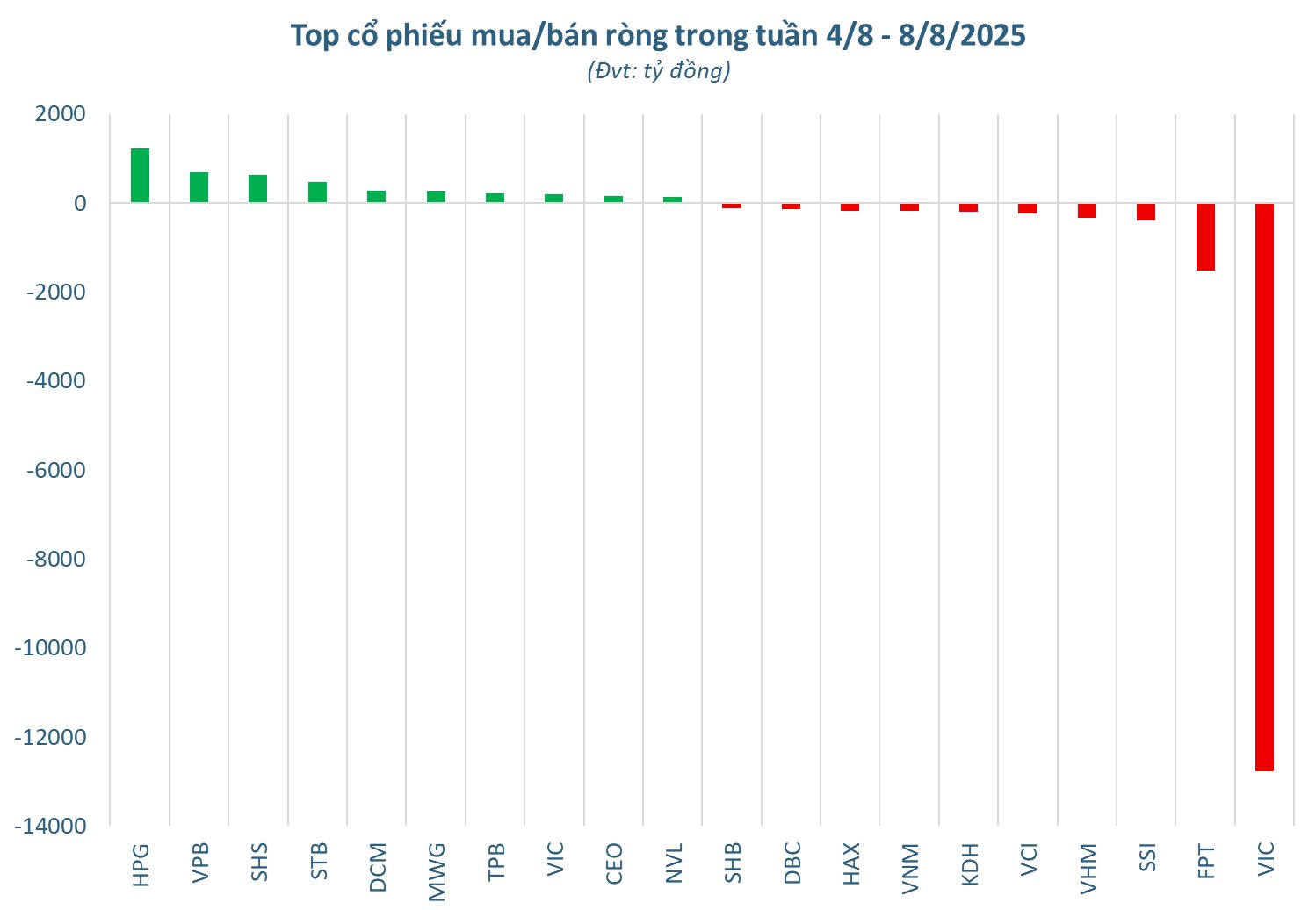

Analyzing the stock performance, VIC stood out as the focal point of net selling, recording a staggering net sell-off of VND 12,777 billion, dwarfing the rest. Today’s net selling by foreign investors involving SK was part of SK’s previously announced global investment portfolio restructuring strategy. VIC is one of several investments that SK has been divesting from.

Given VIC’s strong performance this year, SK deemed it an optimal time to exit their investment. SK will continue its strategic partnership with Vingroup and seek collaborative opportunities. The Group is also exploring renewable energy ventures in Vietnam.

FPT ranked second in net selling with VND 1,517 billion, followed by SSI (VND 388 billion) and VHM (VND 335 billion). Other stocks facing notable outflows included VCI (VND 245 billion), KDH (VND 194 billion), VNM (VND 179 billion), and HAX (VND 172 billion). DBC, SHB, CTR, HHS, and VND also experienced net selling in the hundreds of billions of VND each.

On the buying side, foreign investors displayed a strong appetite for large-cap stocks and banks. HPG topped the list with net buying of VND 1,228 billion, followed by VPB (VND 681 billion) and SHS (VND 627 billion). STB (VND 464 billion), DCM (VND 281 billion), and MWG (VND 266 billion) also attracted significant foreign investment. Additionally, stocks such as TPB, VIC, CEO, NVL, KBC, and GMD witnessed net buying ranging from over VND 100 billion to VND 200 billion each.

SSI Research Eyes VN-Index Marching Towards 1,800 Points

SSI maintains high hopes that Vietnam will be upgraded to Emerging Market status by FTSE Russell in October 2025. This anticipated upgrade could potentially attract approximately $1 billion in capital inflows from index-tracking ETF funds.

Stock Market Week of 04-08/08/2025: Holding the Line

The VN-Index remained in positive territory despite a volatile session to end the week, capping off a strong performance with a near 90-point gain. While foreign investors have been net sellers in recent sessions, a reversal of this trend in the coming week could further bolster the current upward momentum and propel the index to new highs.

The Power of Persuasion: Crafting Compelling Headlines

“Unleashing the Potential: PYN Elite’s Stellar Performance with Two Stock Codes”

In July 2025, PYN Elite Fund, a foreign-owned investment fund, boasted an impressive 13.25% return, the highest it has seen in 55 months since January 2021. This remarkable performance surpasses the VN-Index’s 9.2% gain, which peaked at a historic high of 1,557 points on July 28.

The Business is in the Red, but Stock Prices Soar: What do Experts Make of It?

Stock price increases are merely symptomatic; discerning investors must focus on the underlying causes. Is it a reflection of improved financial performance, positive news, or perhaps a result of price manipulation? Savvy investors delve beyond surface-level indicators to uncover the true drivers of stock price movements.