|

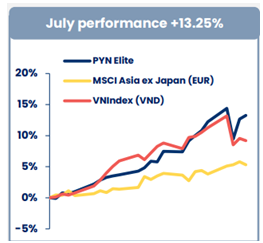

PYN Elite’s Performance vs. the VN-Index

Source: PYN Elite Fund

|

According to PYN Elite’s report, the main drivers were the banking and securities sectors. Since spring, the fund has doubled its exposure to securities stocks to 14% by adding VIX and SHS. In July, these stocks surged by 114% and 78%, respectively, significantly contributing to the fund’s outperformance. Additionally, GEX stock soared by 59.6%, further boosting July’s investment performance to its highest level in over four years.

Market sentiment was bolstered by a series of positive news: Q2 GDP grew by 7.96% year-over-year, surpassing expectations; net profits of companies in the fund’s core investment portfolio increased by 32% year-over-year. Regulatory authorities proposed extending the trading hours past noon starting Q1/2026 and announced the roadmap for implementing the CCP mechanism in Q1/2027 – a crucial step towards intraday trading. The State Securities Commission also reaffirmed its confidence in Vietnam’s potential upgrade to an emerging market by FTSE in October, based on positive feedback on regulatory improvements and technical infrastructure.

|

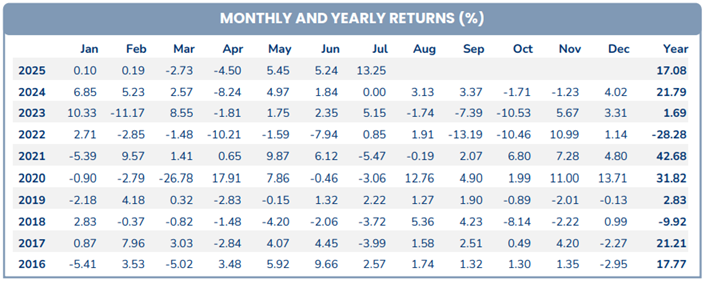

PYN Elite’s Investment Performance for 2016-2025

Source: PYN Elite Fund

|

Thanks to a record-breaking month, PYN Elite’s cumulative profit for the first seven months of 2025 reached 17.08% – the highest in over a decade, since 2013.

Vietnam’s economic landscape also witnessed several bright spots in July, with key indicators surpassing expectations: PMI reached 52.4 points, an 11-month high; exports grew by 16% year-over-year; retail sales increased by 9.2%; and public investment disbursement rose by 25.4%. The government raised the 2025 GDP target to 8.3-8.5%, aiming to lay the foundation for growth above 10% in the 2026-2030 period.

July also marked a series of pivotal decisions, demonstrating strong support for businesses and a determination to implement the most robust reforms in decades: The National Assembly passed Resolution 222 on establishing the International Financial Center in Ho Chi Minh City and Da Nang with breakthrough incentives; proposed significant amendments to the Land Law to untangle the knot for the real estate market; and reformed the Personal Income Tax Law to reduce tax burdens and stimulate consumption. A large-scale administrative reform was also completed, reducing the number of provinces from 63 to 34.

– 21:04 08/08/2025

The Business is in the Red, but Stock Prices Soar: What do Experts Make of It?

Stock price increases are merely symptomatic; discerning investors must focus on the underlying causes. Is it a reflection of improved financial performance, positive news, or perhaps a result of price manipulation? Savvy investors delve beyond surface-level indicators to uncover the true drivers of stock price movements.

The Evolution of Structural Dynamics

“Development is often likened to ‘running and queuing simultaneously’. Speed is represented as ‘running’, while structure is likened to ‘queuing’. Queuing is fundamental and long-term; it not only affects the running speed but also impacts various states of stability and crisis, agriculture or industrialization, market-oriented or non-market-oriented economy, and so on. Given its significance, structure and structural transformation deserve more attention.”

Foreign Investors Reverse Course: From Net Buyers to Sellers, Contrasting the Massive Buying Spree of a Bank Stock

The FPT stock witnessed a significant sell-off in the afternoon, making it the most heavily sold-off stock in today’s session with a value of VND 369 billion.