|

Mr. Đặng Đình Tuấn, a member of the Board of Directors of Bamboo Capital Joint Stock Company (HOSE: BCG), has registered to sell his entire holding of nearly 1.2 million BCG shares, equivalent to 0.13% of capital, from August 13 to September 10, for personal financial arrangements.

BCG unexpectedly surged to its daily limit of 3,900 VND per share in the August 8 trading session. At this price, Mr. Tuan is estimated to reap over VND 4.5 billion if the transaction is successful. This trading session witnessed a surge in liquidity with over 24 million shares matched, 2.5 times the yearly average, and a buying queue of more than 2.6 million shares at the ceiling price.

The BCG stock is still in the recovery phase after plummeting from its peak of over 24,000 VND per share in 2022. In 2025, the stock tumbled from above 6,000 VND per share at the end of February – right before the leadership was prosecuted – to below 3,000 VND and has lingered at low prices for several months.

| BCG Share Price Movement since the beginning of 2025 |

Delayed financial report disclosure and postponed AGM

On August 1, HOSE issued a reminder to BCG for failing to publish its Q2/2025 financial statements (separate and consolidated) in both Vietnamese and English by the deadline. The Exchange requested the Company to strictly comply with its reporting obligations.

BCG also announced that it could not hold the 2025 AGM as it has not yet issued its 2024 audited financial statements. This delay stems from personnel changes, including the investigation of major shareholders and the Company’s management. The audited consolidated financial statements are expected to be released in early September 2025.

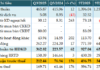

According to the self-prepared 2024 financial statements, BCG recorded revenue of VND 4,372 billion, up 9% year-on-year. Post-tax profit reached VND 845 billion, nearly four times higher than in 2023. However, these figures are yet to be confirmed by the audit firm due to delays in the consolidation process.

– 15:33 08/08/2025