Vietnam’s Stock Market Soars to New Heights, but FPT Stock Lags Behind

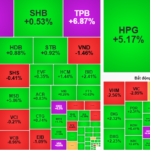

Vietnam’s stock market is on a roll, recently surpassing the 1,581-point mark. However, many leading blue-chip stocks, notably FPT, have been left out of the rally. FPT shares have dropped about 20% from their historic peak in mid-January.

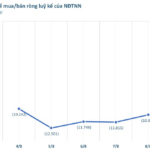

As the market surged in early July, FPT stagnated amid intense selling pressure from foreign investors. The stock has witnessed net foreign selling for 12 consecutive sessions, totaling over VND3,200 billion. As a result, FPT’s foreign ownership limit has increased to 140 million shares (over 9% of charter capital), a record high in recent years.

Source: CafeF – Vietnamese Stock Market News

It’s not just FPT that’s underperforming; tech stocks like CMG, ELC, and VNZ are also lagging behind the VN-Index and have been in decline since the beginning of the year. This can be partly attributed to profit-taking after a stellar 2024 for the tech sector. Additionally, loose monetary policies have directed funds towards the financial sector, neglecting other industries.

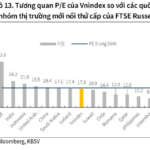

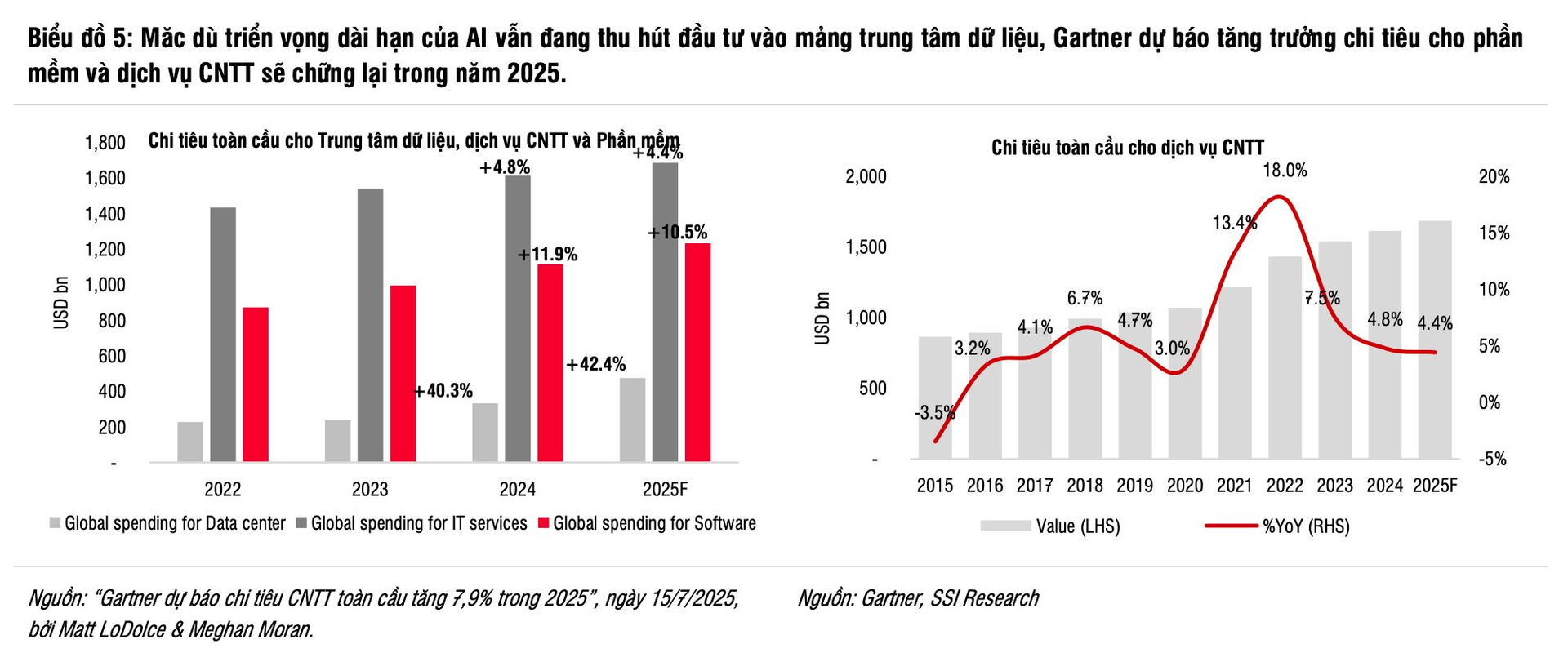

FPT’s business performance faces certain challenges, particularly in its core technology sector. According to a recent analysis by SSI Research, global businesses have significantly reduced their IT services spending from 9% to 4.4% svck, indicating a cautious approach amidst macroeconomic uncertainties.

In July 2025, Gartner, a leading US-based technology research and consulting firm, lowered its forecast for global IT spending growth in 2025 to 7.9% svck (down from 9.8% in January 2025). Similarly, the International Data Corporation (IDC) projected global IT spending growth for 2025 to be between 5-9% svck.

Source: SSI Research

For the second half of 2025, SSI Research anticipates a slowdown in FPT’s profit growth to around 15-16% svck. This pressure is likely to come from the technology segment, as the growth rate of new contract values has plateaued. Meanwhile, the telecommunications segment is expected to remain a key growth driver, benefiting from expanded market share in less developed cities.

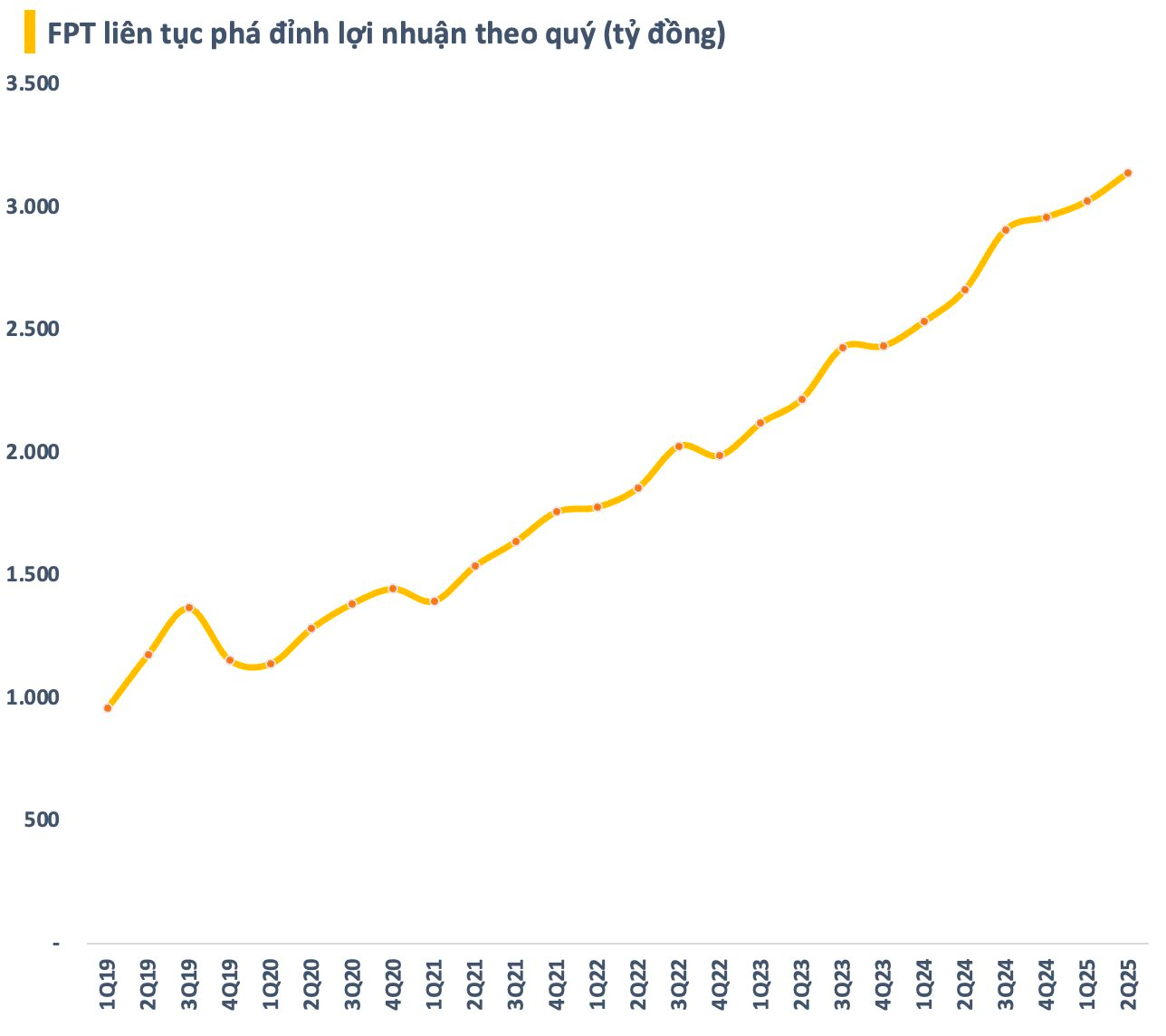

In the first half of 2025, FPT recorded VND32,700 billion in revenue (+11% svck) and VND5,300 billion in net profit (+20% svck), with net profit increasing by 19% svck. Specifically, in Q2 2025, revenue grew by 9%, and net profit increased by 20% svck, indicating a slight slowdown in revenue growth but maintaining positive profit momentum.

Source: FPT 2025 Second Quarter Financial Report

The main growth drivers were the technology and telecommunications segments, with revenue and net profit growth ranging from 11-14% svck and 15-19% svck, respectively. However, compared to the previous year, the technology segment’s revenue growth slowed to 11% svck (down from 27% svck in the first half of 2024 and 24% for the full year 2024).

According to SSI Research, this development is the primary reason for FPT’s overall revenue growth stagnation, as the technology segment accounts for over 60% of total revenue. While this outcome was anticipated, it fell slightly short of expectations due to the performance in the APAC market.

Nonetheless, FPT has maintained improved profit margins through efficient cost management, particularly in telecommunications. Moreover, higher-than-expected dividend income, primarily from its investment in TPBank (TPB), has also contributed to the continued double-digit profit growth.

The Great Foreign Sell-Off: A Week of Unprecedented Outflows and a Single Stock’s $500 Million Dump

“Foreign sell-off continues with a strong net sell-off, with the highlight of trading on the matching channel. “

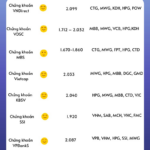

The Top-Performing Small-Cap Companies for IR Awards 2025

CCL, CNG, HAX, NAF, ST8, and TIP are the Small Cap companies that have been nominated for the prestigious IR Awards 2025. These outstanding businesses have showcased their excellence and are now part of the final round of voting for the IR Awards.