“**Vietnam’s Stock Market: Navigating the Waves of a Mega Uptrend**”

Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS), shared his insights on Vietnam’s stock market outlook at the “Vietnam and the Indices” program on August 11, 2025.

Mr. Tran Hoang Son, Director of Market Strategy at VPBank Securities (VPBankS), shared his insights at the “Vietnam and the Indices” program on August 11, 2025

|

The “mega uptrend” continues

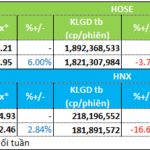

Vietnam’s stock market has reached new highs in terms of index levels and liquidity. Mr. Son attributed this to four main factors.

Firstly, the global monetary policy easing by central banks after inflation was curbed played a crucial role. Many banks are lowering interest rates to support economic growth, notably the European Central Bank (ECB) and the US Federal Reserve. This has positively impacted global asset and stock markets.

Secondly, the global market sentiment recovered after the tariff shock. Negotiations helped reduce tariffs, stabilize sentiment, and resume the market’s upward trajectory following the sharp decline in April.

Thirdly, the weakening US dollar prompted investors to reduce their holdings of USD-denominated assets and shift to riskier assets such as stocks and cryptocurrencies, resulting in strong performances in both US equities and the crypto market.

Domestically, the fourth factor is Vietnam’s economic recovery, supported by monetary and fiscal policy easing. Vietnam’s GDP in Q2 2025 grew by 7.96%, the highest since the post-COVID-19 era. Credit growth in the system as of July increased by 9.64%, the highest post-pandemic level. This abundance of liquidity in the market pushed liquidity to new highs. Additionally, disbursed public investment in the first six months rose by 25% year-on-year, completing over 40% of the plan.

The government’s efforts to upgrade the market also provided a significant boost. This included legal framework improvements and removing bottlenecks, such as eliminating the Non-prefunding requirement and upgrading the KRX trading infrastructure. Active collaboration with international organizations like FTSE Russell further enhanced Vietnam’s appeal to global investors.

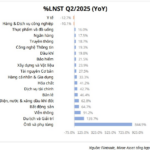

The final driver was the substantial growth in corporate profits. In Q2 2025, the market-wide profit increased by approximately 33% year-on-year, the fastest pace since the COVID-19 pandemic. The leading sectors included real estate, electricity, retail, aviation, rubber, and fertilizers, which generally grew above the low base of the previous year. Additionally, banks posted a stable 17.5% growth, while financial services surged by nearly 43%.

Mr. Son believes that these factors have collectively formed a “mega uptrend.” In the short term, these factors remain in play, and the upward trend is expected to extend into the rest of the year.

Navigating the waves: Avoiding “market whiplash”

While the market is experiencing a strong upward cycle since the April lows, investors should pay attention to several factors to make informed decisions.

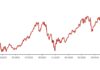

Looking back at the bull market from 2016 to 2018, there were approximately five strong upward waves, each rising 20-30%. These were typically followed by a breather or a correction of around 10% lasting 2-3 weeks. In the 2020-2022 period, there were four strong upward waves, with an average increase of 37-52%. After each wave, the market underwent corrections of 13-16%.

By studying these historical patterns, investors can anticipate potential correction phases to realize profits or buy at attractive levels, avoiding unexpected downturns. A classic example is the VN-Index’s 64-point plunge on July 29, which saw many “hot” stocks reversing sharply.

Currently, the uptrend from the April lows can be divided into two waves. The first wave rose over 25% from the April lows to the 1,350 level. The second wave, from the technical support of 1,310 to the current level of around 1,600, climbed nearly 23%. Overall, the VN-Index has gained more than 50% from its lows, warranting caution, especially as the market approaches strong resistance levels of 1,600 and 1,650. Notably, the 1,650 level coincides with the trendline connecting the 2022 and 2023 peaks.

From a valuation perspective, the VN-Index’s RSI has crossed above 70. Historically, when more than 20-30% of stocks in the VN-Index basket have an RSI above 70, the market tends to experience significant volatility or corrections. As of the week ending August 8, this ratio stood at 18.4%. If the market continues to rise, it may surpass 20% and trigger a warning signal.

Another indicator to watch is the VN-Index’s distance from its 50-day moving average (MA50). When the VN-Index deviates significantly from its MA50 (1.06-1.14 times), a correction is more likely. Currently, the VN-Index is 1.11 times its MA50, suggesting a “hot” market.

In terms of valuations, after surging over 50% from its lows, the VN-Index’s P/E and P/B ratios have approached the 10-year average, shifting from undervalued to fairly valued territory. Typically, when valuations reach fair levels, the market tends to consolidate.

According to Mr. Son, markets tend to exhibit overreactions during uptrends or downturns. These are evident when the RSI surpasses 70 or even 80, when prices rise significantly from their previous lows, or when trading volumes spike.

Since the beginning of 2025, the leading sectors have been top real estate stocks, banks, and securities companies. After a strong upward phase, these leading sectors often enter a breather or corrective phase, prompting money flows to rotate into sectors with less upward movement and more attractive valuations.

Technically, money flows remain focused on banks, securities, and real estate, spilling over into infrastructure, oil and gas, chemicals, retail, and seafood. This indicates a rotation phase, where profit-taking occurs in the leading sectors, creating opportunities for other stocks to rise.

VPBankS’ expert believes that the uptrend cycle is likely to extend into 2026. Therefore, during the expected technical corrections in the short term, investors can still find opportunities to participate in the market.

– 6:45 PM, August 11, 2025

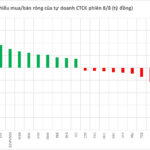

The Smart Money is Back: Brokerages “Accumulate” Stocks in Surprising Friday Trading

The domestic investment community went against the flow of foreign investors, with securities companies returning to net buying with hundreds of billions of dong on the HoSE exchange.