National Patriotic Emulation Congress of the Ministry of Finance – Photo: VGP/HT |

State budget management has achieved significant results

Mr. Nguyen Minh Tan, Deputy Director of the State Budget Department (Ministry of Finance) said that in the period of 2021-2025, the world economy faced many complex changes, with some issues beyond prediction. The COVID-19 pandemic lasted from 2020 to the end of 2022, causing severe economic and social damage; international geopolitical tensions escalated; global supply chains were disrupted; energy and food prices fluctuated sharply; and strategic competition among major countries intensified, especially in trade, investment attraction, and the development and application of new technologies.

Fiscal and monetary policies in many countries shifted from an expansionary stance to support post-pandemic recovery to tightening to control inflation and ensure public debt safety. Natural disasters and climate change continued to evolve complexly, negatively affecting global economic recovery.

Domestically, implementing the Resolution of the 13th Party Congress, under the leadership of the Party and the supervision of the National Assembly, the entire political system, the people, and the business community effectively controlled the pandemic and quickly transitioned to the stage of economic recovery and development. In particular, the Government focused on directing the review of legal system inconsistencies and issuing important policies such as streamlining organizational apparatus, promoting decentralization, removing obstacles for stagnant projects, and promoting the private sector, science and technology, innovation, and digital transformation.

As a result, the macro economy remained stable, inflation was controlled, and growth was maintained at a relatively high level compared to the region and the world. The average growth rate in the 2021-2025 period is estimated at about 6.2%/year, and in 2025, it is expected to increase by 8% or more. Fiscal policy was coordinated synchronously with other macroeconomic policies; public investment was allocated and utilized more efficiently; national defense and security were maintained; and Vietnam’s international position continued to be enhanced.

However, the economy still faced many challenges: US trade policies and countervailing duties, slow progress on internal issues, and negative impacts of natural disasters and climate change.

Mr. Nguyen Minh Tan, Deputy Director of the State Budget Department (Ministry of Finance) shares information – Photo: VGP/HT

|

Regarding state budget revenue, the Ministry of Finance directed the effective implementation of tax laws, closely managed budget revenue, and focused on key sectors and areas such as land, real estate transfer, business on digital platforms, e-commerce, and foreign suppliers without a permanent establishment in Vietnam. Efforts to expand the tax base and combat tax evasion were strengthened, along with inspections, and coordination in anti-smuggling and anti-trade fraud activities, with strict handling of violations.

|

To support businesses and people, the Ministry of Finance advised and proposed to competent authorities to issue policies on tax exemption, reduction, and extension with a scale of about VND 840 trillion in the 2021-2025 period (including about VND 360 trillion of exemption and reduction and about VND 480 trillion of extension). Thanks to effective management and timely support policies, budget revenue in 2021-2024 exceeded the estimates approved by the National Assembly. Based on these results and the revenue targets set in Resolution No. 01/NQ-CP and Resolution No. 25/NQ-CP, the estimated total budget revenue for the whole period is VND 9,300 trillion, exceeding the target of VND 8,300 trillion; the ratio of mobilization to the budget is about 18.1% of GDP, of which tax and fee revenue accounts for about 14.6% of GDP. |

The Ministry of Finance continued to reform administrative procedures, modernize, and apply information technology, as well as implement electronic tax management; develop a proposal for a central database for electronic invoices, and apply artificial intelligence in data analysis.

On the other hand, regarding state budget expenditure, from the stage of making estimates, the Ministry of Finance coordinated with ministries, sectors, and localities to thoroughly save regular expenditures, cut unnecessary tasks, reduce spending on conferences, ceremonies, and overseas trips, and allocate resources for development investment.

Budget allocation and utilization closely followed strategies, enhanced accountability, increased transparency, and gave autonomy to budget users. When unexpected tasks arose, the Ministry required a review and rearrangement of priorities based on urgency and feasibility.

Budget sources ensured funding for national defense, security, social welfare, COVID-19 prevention and control, implementation of the Program for Socio-economic Recovery and Development, institutional reform, science and technology development, and national digital transformation; provided free tuition for students in public schools from kindergarten to high school; and guaranteed salary reform and stable lives for officials and civil servants.

Regarding budget balance and public debt, based on the targets set in Resolution No. 07-NQ/TW and Resolution No. 23/2021/QH15, the Ministry of Finance advised on flexible and efficient management of budget deficit; in 2022-2023, the National Assembly allowed an increase in the average budget deficit of 1-1.2% of GDP/year to support the Socio-economic Recovery Program; and in 2025, the budget deficit was adjusted from 3.4% of GDP to about 4-4.5% of GDP to mobilize resources for development investment, with a growth target of 8% or higher.

The average budget deficit in the period of 2021-2024 was about 3% of GDP, lower than in the period of 2016-2020. The Ministry proactively restructured public debt sustainably, reducing it from 42.7% of GDP at the end of 2021 to about 34.7% of GDP in 2024, striving for 35-36% of GDP in 2025.

The issuance of government bonds closely followed budget revenue and disbursement progress, focusing on long-term bonds (10-15 years), low-cost mobilization, and effective use of state treasury. Bond interest rates in the period of 2021-2024 were maintained at about 2.3-3.4%/year, much lower than in the period of 2016-2020. The basic wage in the public sector was adjusted from VND 1.49 million/month (2019) to VND 2.34 million/month from July 2024.

Key solutions to strive to complete the goals in the final year of the plan

According to the leader of the State Budget Department, with key solutions in 2025, the year 2025 is the last year of implementing the 2021-2025 Socio-economic Development Plan and, at the same time, building the plan for the period of 2026-2030. The Ministry of Finance has identified the following key solutions.

Firstly, the Ministry of Finance will closely monitor domestic and international political and economic developments, especially the policies of the US and other major partners, to promptly propose appropriate solutions.

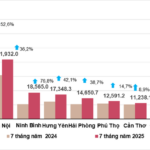

Secondly, it will study and propose fiscal policies to support the economy and remove difficulties for businesses, especially those affected by US countervailing tax policies; improve institutions and promote digital transformation, striving for a 10% increase in budget revenue in 2025 compared to 2024, with a mobilization ratio of over 16% of GDP.

Thirdly, the Ministry of Finance will manage budget expenditure closely within the estimates, save 10% of the increase in regular expenditures for salary reform, and allocate another 10% for investment in the Lao Cai – Hanoi – Hai Phong railway project; ensure resources for key projects and free tuition for public school students. It will also promote the disbursement of 100% of public investment capital, giving priority to key projects, expressways, inter-regional and coastal roads; and promptly remove obstacles related to land and site clearance.

Fourthly, the Ministry of Finance will manage budget deficit and public debt flexibly, taking advantage of the available space to mobilize resources for development investment and ensure timely repayment of principal and interest.

Finally, the Ministry of Finance will complete the legal framework, supervise the financial and securities markets, corporate bonds, and strictly handle violations; restructure and improve the efficiency of state-owned enterprises, accelerate equitization and capital withdrawal, and ensure the collection of estimated budget revenue.

Anh Minh

– 15:09 10/08/2025

A New Wave of Investment is Coming to Ho Chi Minh City

Amidst the backdrop of its expanded geographical boundaries, now encompassing Binh Duong and Ba Ria-Vung Tau, Ho Chi Minh City is bracing for a wave of new investments. Experts weigh in, citing the city’s most formidable challenge: sustaining this influx of capital by promptly adapting to the evolving policies and demands of investors.

Ho Chi Minh City’s Budget Soars: A Stellar 472,000 Billion VND in Just 7 Months

The Chairman of Ho Chi Minh City People’s Committee has set an ambitious target of 8.5% growth in GRDP for the city, and it is now imperative for all departments to step up. This target is a mandate, and we must ensure that each sector contributes to this collective goal with clear and measurable objectives. It is essential that we, as a city, unite and work towards this common vision with a sense of urgency and dedication.

Unlocking Legal Hurdles for Billion-Dollar Projects: Ho Chi Minh City’s Record-Breaking Land Revenue

By 2025, Ho Chi Minh City is expected to generate approximately 860 trillion VND from land price calculations for 153 projects across the city. This significant revenue stream underscores the city’s thriving development and strategic vision for the future.

The Great Business Survival: 174,000 New and Returning Ventures, Yet 144,400 Exited the Market in 7 Months

As of July 2025, Vietnam witnessed an impressive surge in business activities with 174,000 new and returning enterprises, marking a significant 22.9% increase compared to the same period last year.