The International Dairy Board, Lof, has announced the appointment of Mr. Doan Huu Nguyen as the new CEO, effective August 5th, 2025. Mr. Nguyen, with over 20 years of experience in the food and beverage industry, will also become the new legal representative of the company, alongside Chairman of the Board, To Hai.

IDP’s New CEO, Mr. Doan Huu Nguyen

|

The new CEO, Mr. Nguyen (born in 1977), has held several senior positions at Kido, Pepsico Vietnam, Cau Tre Corporation, and Left Brain Connectors. He joined IDP in 2013 as the Marketing Director and became the Executive Director in 2018. He has also been a member of the Board of Directors since October 2021 and was re-elected for the 2025-2030 term.

Mr. Nguyen does not currently hold any shares in IDP. However, he is the Chairman of the Board of Directors of Long Thanh Dairy Joint Stock Company, a newly established enterprise in Dong Nai with a charter capital of VND 4 billion.

The former CEO, Mr. Bui Hoang Sang, who took on the role in February 2024, will step down. Prior to his role as CEO, Mr. Sang was a strategic advisor to IDP from March 2020. During Mr. Sang’s tenure as CEO, the company changed its name to International Dairy Company Lof and proposed to move its headquarters from Ba Vi, Hanoi to Bau Bang Industrial Park, Binh Duong.

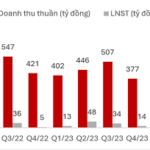

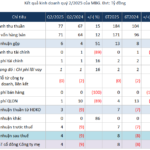

IDP is known for its popular brands such as Kun, LOF, and LOF MALTO, with factories in Ba Vi and Cu Chi and a nationwide distribution system. However, the company has been facing challenges in terms of financial performance. In the second quarter of 2025, IDP reported a loss of over VND 36 billion, a significant decline from the profit of nearly VND 288 billion in the same period last year. This is the first time the company has reported a quarterly loss in its history. While revenue for the quarter increased by 9% to VND 2,113 billion, the gross profit margin dropped to a record low of 37%. In the first half of 2025, net profit was nearly VND 72 billion, the lowest in six years and a decrease of 86% compared to the previous year.

The company attributed the loss to an increase in cost of goods sold by nearly 18% due to changes in product structure, along with higher selling, marketing, management, and borrowing expenses.

| IDP reports its first quarterly loss |

In terms of investment activities, the IDP Board of Directors has recently approved the establishment of Redpine Joint Stock Company with a charter capital of VND 258 billion. The new company, headquartered in Ho Chi Minh City, will mainly provide management consulting services (excluding finance, accounting, and legal fields). Redpine also plans to raise over VND 600 billion in credit to serve working capital and invest in technology equipment.

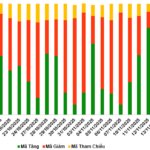

IDP’s stock price has been trading around VND 200,000 per share, making it one of the few three-digit priced stocks on the exchange. However, contrary to the general upward trend of the market, IDP’s stock price has decreased by 9% in the last month and 18% in the last year, with low liquidity, averaging just over 1,000 shares traded per session.

| IDP’s stock price movement since the beginning of 2025 |

The above news article provides an overview of the recent changes in IDP’s management and financial performance. It is important for investors and stakeholders to stay updated on such developments to make informed decisions.

– 10:54 11/08/2025

“WCS Shares 20% Profit, Hits Quarterly Earnings Peak as HNX’s Priciest Stock”

In Q2 of 2025, Western Bus Terminal Joint Stock Company (HNX: WCS) reported a record-breaking profit of over VND 22 billion. The company also announced a 20% stock dividend, increasing its charter capital to VND 30 billion to meet the minimum capital requirements for public companies. WCS’s share price soared to VND 411,000 per share, the highest on the HNX exchange.

Record-Breaking Revenue and Profits: Nafoods Group Breaks Ground on Nasoco Project Phase 2

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.

The Masterful Wordsmith: Crafting Captivating Copy with a Twist

“Unveiling the Secrets of Capital Retreat: A Chairman’s Tale”

Quoc Bao Van Ninh JSC has announced its plan to offload its entire stake in MBG Group JSC, amounting to 4.25 million shares or 3.54% of the charter capital. The proposed transaction, aimed at restructuring the company’s finances, is scheduled to take place between August 8 and September 5.