|

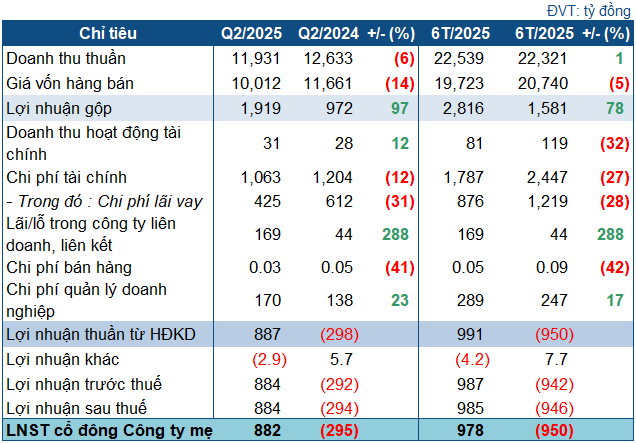

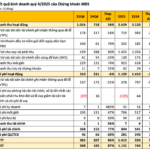

PGV’s Business Targets in Q2 2025

Source: VietstockFinance

|

In the second quarter, PGV recorded almost VND 12 trillion in net revenue, a 6% decrease compared to the same period last year due to lower electricity sales. However, cost of goods sold retreated by 14% to over VND 10 trillion, resulting in a gross profit of VND 1.9 trillion, nearly double that of the previous year.

Financial income increased significantly to VND 31 billion, up 12% year-on-year. In contrast, financial expenses decreased by 12% to over VND 1,060 billion due to lower interest expenses. Another notable improvement was the profit from joint ventures and associates, which reached VND 169 billion, nearly four times higher than the previous year.

With these positive changes, PGV ended the second quarter with a net profit of VND 882 billion, a strong recovery from a loss of VND 295 billion in the same period last year.

For the first six months of the year, PGV achieved more than VND 22.5 trillion in net revenue, a 1% increase year-on-year, with a net profit of VND 978 billion (compared to a loss of VND 950 billion in the previous year).

As of the end of the second quarter, PGV’s total assets stood at nearly VND 53 trillion, slightly down from the beginning of the year, with short-term assets of almost VND 16.7 trillion, remaining stable. Cash and cash equivalents amounted to over VND 3.3 trillion, a 5% decrease.

Accounts receivable stood at nearly VND 9.1 trillion, a slight decrease. Inventories were recorded at nearly VND 2.9 trillion, an 18% increase.

On the capital side, short-term debt decreased by 15% to nearly VND 11.7 trillion, of which over VND 5.9 trillion was borrowings. Long-term debt amounted to over VND 24.6 trillion, a 5% decrease. The company did not provide detailed information about these debt obligations.

– 10:13 11/08/2025

92 Digiworld Staffers to Buy Shares at a Discount Through ESOP Scheme

Digiworld is set to offer its employees a generous ESOP scheme, with 2 million shares on offer at a price of just 10,000 VND per share. This price represents a significant 78% discount on the current market value.

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”