Illustration

According to Oilprice, Russia is offering steep discounts on its Urals crude oil to the Chinese market as global energy trade flows rapidly shift following US additional tariffs on Russian oil imports to India.

Trade sources indicate that the Urals-to-London Brent price differential has narrowed to $1.50 a barrel, significantly lower than last week’s $2.50 a barrel. This move reflects Moscow’s efforts to seek new customers as demand from the key Indian market wanes.

Historically, Urals crude oil has been predominantly transported from Russia’s western ports, such as Primorsk and Novorossiysk, to Indian refineries. In contrast, China—Russia’s top crude oil importer—consumes mostly ESPO oil, shipped from the Far East port of Kozmino, benefiting from shorter distances and lower logistics costs.

Russia’s offer of Urals oil to Chinese refineries marks a significant shift in export market structure. However, the longer transportation distance from Russia’s western ports to China has been a cost-prohibitive factor for Urals oil trade in the Chinese market.

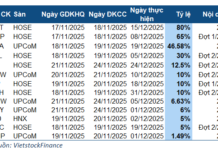

On August 7, US President Donald Trump signed an executive order imposing additional tariffs of 25% on Indian goods, specifically targeting imports of Russian oil. Concurrently, a blanket 50% tariff on Indian goods will take effect 21 days after August 6, creating significant pressure on the country’s energy importers.

Faced with the prospect of higher costs, India’s largest state-owned refineries have backed out of plans to buy Russian oil for immediate delivery in October. Instead, they have signed contracts to purchase at least 22 million barrels of non-Russian oil, expected to be delivered in September and October, from suppliers in the US, the Middle East, and Canada.

This is a notable shift, as India has been the top buyer of Urals oil for over two years due to deep discounts offered compared to Brent, especially after Western sanctions were imposed on Russia.

Analysts suggest that even if China increases its purchases of Urals oil, it is unlikely to absorb the entire volume that India previously imported. The Chinese market already has a stable supply of Russia’s ESPO oil and imported oil from the Middle East and Africa.

This presents a challenge for Moscow in finding new destinations for its surplus oil. Potential options include expanding market share in Turkey, Brazil, or some African countries, but the scale of these markets is limited compared to India’s demand.

Experts predict that Brent oil prices could face downward pressure if the surplus of Urals oil floods the Asian market. Conversely, if Russia successfully navigates its export flows to multiple markets simultaneously, the price impact may be mitigated.

“After India, the US Sets Its Sights on the Second Largest Oil Importer: Who’s Next on the List?”

This country risks facing similar repercussions to those imposed on India, as these nations continue to purchase oil from Russia despite sanctions.

The Trump Administration’s Tariff Details on US Trading Partners

On August 7th, the new round of countervailing duties took effect for countries and territories trading with the United States.