Samland is a subsidiary of SAM Holdings JSC (HOSE: SAM), focusing on the real estate sector. Established in 2008 with an initial charter capital of VND 200 billion, Samland has since increased its capital to nearly VND 786 billion.

In 2018, Samland received confirmation from the State Securities Commission for its registration as a public company, and successfully registered the stock code SLD. As of March 18, 2025, Samland had 602 shareholders, with SAM as the sole major shareholder and parent company, holding 85.71% of the capital.

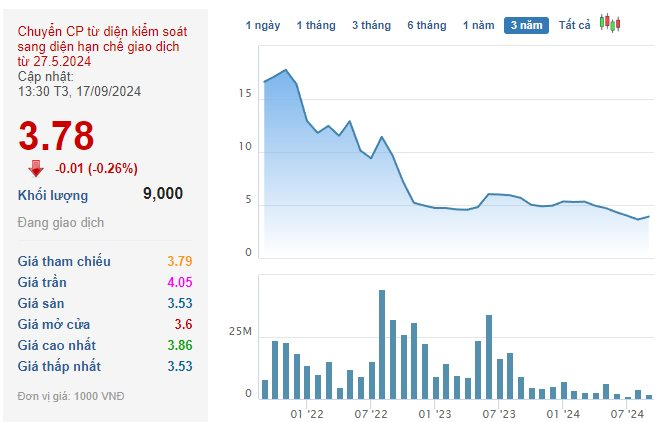

Following the news of the subsidiary’s preparation for listing, SAM’s stock price surged to its daily limit on August 11, 2023, reaching VND 8,890 per share – the highest since the beginning of 2023. Additionally, the matching volume on August 11, 2025, reached nearly 4.2 million shares – the highest since the start of that year.

| SAM’s stock price movement from 2023 up to now |

The company targets middle and high-income customers. Some of Samland’s key investment projects include Samland Riverview, Samsora Riverside, Samland Nhon Trach residential area, Samland Riverside, and Samland Airport apartments. Additionally, the company is a secondary investor in two apartment projects: Samland Giai Việt B2 and Hoang Anh Riverview.

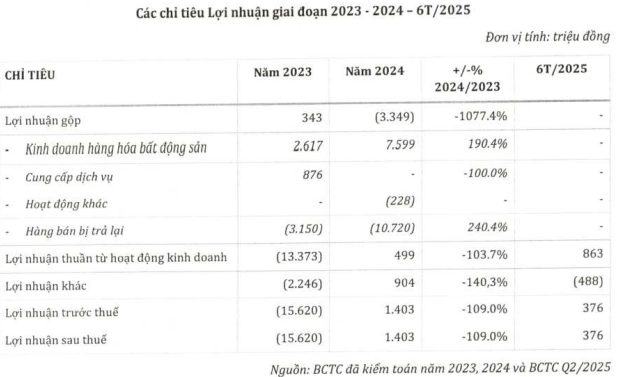

In terms of business results, from 2023 to the second quarter of 2025, Samland focused on resolving legal issues for two key projects: Samland Nhon Trach residential area and Samland Riverside apartment project. As these projects are still in the process of completing legal procedures and site clearance, they have not generated any revenue. Consequently, the company did not record any business income during the first half of 2025.

However, in its financial activities, Samland earned nearly VND 5.5 billion in revenue from interest on deposits and investment cooperation. In contrast, the company only incurred financial expenses of VND 269 million due to the reversal of allowance for impairment of trading securities. As a result, Samland’s after-tax profit reached nearly VND 376 million, a 12% increase compared to the same period last year.

Samland maintains a healthy debt situation, with its only loan (VND 50 billion) obtained from Sacom – Tuyen Lam JSC, another subsidiary of SAM. The loan has an interest rate of 6.8% per annum, with no collateral, and is intended to supplement the company’s working capital.

Moving forward, Samland’s strategy is to maximize the development of residential real estate products. In addition to apartment projects in central areas, the company aims to expand into Ho Chi Minh City and neighboring regions such as Dong Nai and old Binh Duong, offering mid-range to upper-mid-range apartment complexes.

Furthermore, the company aspires to develop large-scale urban areas ranging from 150-250 hectares on the outskirts of Ho Chi Minh City, such as Binh Chanh and old Thu Duc, with synchronous technical and social infrastructure. These urban areas would offer a diverse range of products, including townhouses, villas, and commercial centers.

Samland’s current Chairman of the Board of Directors is Ms. Nguyen Thu Hang (born in 1972), who holds a Master of Business degree. In addition to her role at Samland, Ms. Hang is also the Chairman of the Board of Directors of Capella Group JSC.

Capella Group’s member unit, Capella Land, specializes in investing in and developing industrial parks. Their projects include Gia Binh Industrial Park (307 hectares), Thanh Liêm Industrial Park (143 hectares), Yên Lư Industrial Park (377 hectares), and industrial clusters such as Nham Sơn – Yên Lư and Đoan Bái – Lương Phong 2. They are also developing the Tam Thăng 2 Industrial Park, which spans 103 hectares.

The current General Director of Samland is Mr. Nguyen Dinh Ba (born in 1977), a Civil Engineering graduate. Mr. Ba is also the Chairman of the Board of Directors of Gia Phat Real Estate Services JSC and the Technical Director of Conic – Construction Investment and Development Joint Stock Company.

– 15:58 08/11/2025

“IDP Appoints New CEO Amidst Record Losses and Plummeting Stock Prices”

In a bid to turn around its fortunes, International Dairy Products Joint-Stock Company (IDP) has appointed Doan Huu Nguyen as its new CEO and legal representative. This move comes after the company reported a net loss of over VND 36 billion in Q2 2025, marking the first time it has fallen into the red in its history. Nguyen replaces Bui Hoang Sang, who took on the role just over a year ago.

The Largest Province Cracks Down on Real Estate Brokers

The Lam Dong Provincial Department of Construction has advised all property developers to ensure they have adequate financial capabilities and refrain from illegal fundraising practices. According to the latest guidelines, developers are only permitted to sell future homes if they meet the conditions stipulated in the Housing Law and the 2023 Real Estate Business Law.

A Real Estate Firm with a 14x Land Bank Increase in Just 5 Years

The Real Estate Investment Joint Stock Company, Taseco (TAL), announced its consolidated revenue for the second quarter of 2025, which amounted to VND 557 billion, a 12% decrease compared to the same period last year. This revenue stream primarily comprises earnings from real estate ventures and, to a lesser extent, construction contracts.