Gold prices in Vietnam have been on a strong upward trajectory in recent days, with both gold bars and gold rings seeing significant increases.

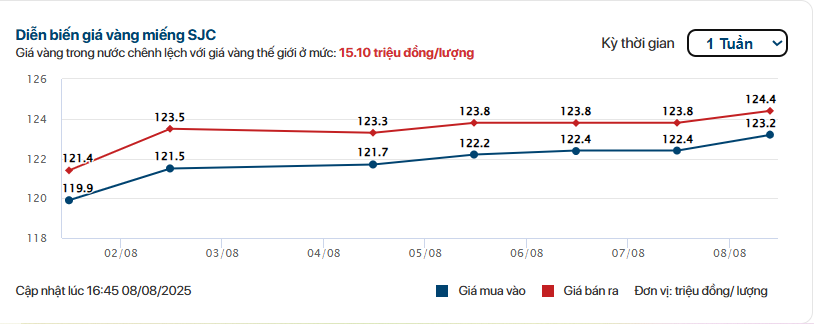

As of this afternoon’s survey, SJC gold bars traded at 123.2 – 124.4 million VND per tael (buy-sell), while other gold companies such as PNJ, DOJI, and Bao Tin Minh Chau maintained their gold bar prices at 122.6 – 124.0 million VND per tael.

Similarly, gold ring prices remained at a high level, ranging from 117 – 120.8 million VND per tael, depending on the brand.

Specifically, Bao Tin Minh Chau listed gold rings at 117.8 – 120.8 million VND per tael; PNJ recorded 117.5 – 120.0 million VND per tael; SJC ranged from 117.3 – 119.8 million VND per tael, while DOJI quoted a lower price of approximately 110 – 111 million VND per tael.

In just one week, gold bar and ring prices have surged, with an average increase of 3 million VND per tael.

Gold bar price movement over the past week.

According to Dr. Nguyen Tri Hieu, a finance and banking expert, domestic gold prices are directly influenced by the upward trend in global gold prices. As of now, international gold prices have touched the $3,400 per ounce mark.

“Global gold prices are surging due to numerous uncertainties, especially geopolitical tensions, trade policies, and instability within the US economy,” said Dr. Hieu. “These developments are causing concerns and driving safe-haven demand for gold.”

The situation is further complicated by US President Donald Trump’s hardline statements regarding the FED and statistical agencies. His threats to fire FED Chairman Jerome Powell and replace the head of the labor statistics agency have raised concerns about the stability of US monetary policy, a sensitive factor that directly impacts global gold prices.

Dr. Hieu added that the Vietnamese gold market is influenced not only by global prices but also faces challenges due to domestic supply and demand dynamics. While gold supply remains limited, demand continues to surge, particularly as locals tend to view gold as a safe haven asset. This has contributed to the current domestic gold price of 124 million VND per tael.

The government is in the process of reviewing and amending Decree 24/2012/ND-CP on gold market management. However, according to Dr. Hieu, the amendment process is slow and needs to be expedited.

“The gold market needs more flexible and seamless operations,” he emphasized. “Regulatory adjustments are necessary to prevent price distortions and meet the practical needs of the people.”

Looking ahead to the end of the year, Dr. Hieu predicts that gold prices could reach the 130 million VND per tael mark if international gold prices continue to rise sharply. “There is a 60% chance of domestic gold prices hitting this level, largely dependent on international factors such as geopolitical tensions, FED policies, inflation, and unemployment rates in the US,” he added.

In an unfavorable scenario, if global gold prices surpass $3,500 per ounce, the domestic gold market will set new records. Buyers should closely monitor market fluctuations and policy developments to make informed choices in this high-risk period.

The Ever-Climbing Gold Price: How High Can It Go?

The experts’ verdict is in: domestic gold prices have reached an all-time high, and yet there’s speculation that they could continue to rise in the coming days, potentially hitting the unprecedented mark of 125 million VND per tael.

The Price of Gold Soars to New Heights: Afternoon Update, August 7th

“On August 7th, the price of gold took an unexpected surge across prominent jewelry brands, breaching the significant threshold of VND 124 million per tael.”