For the week ending August 08, the USD Index (DXY) – a measure of the greenback’s strength against a basket of six major currencies – fell by 0.42 points from the previous week’s close, settling at 98.27.

The USD came under pressure as the U.S. imposed higher import tariffs on a range of countries from August 04, sparking concerns about a potential economic slowdown. Concurrently, initial jobless claims rose to a one-month high, indicating weakness in the labor market.

These factors led to market expectations of an imminent Federal Reserve interest rate cut, diminishing the appeal of the U.S. dollar. Should economic data continue to disappoint, the Fed’s dovish stance is likely to become more pronounced, exerting further downward pressure on the USD.

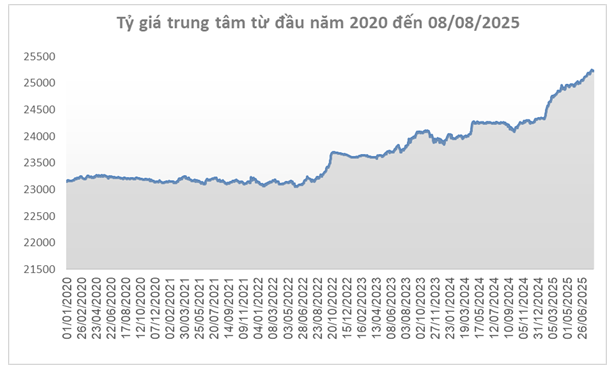

Source: SBV

|

In the domestic market, the State Bank of Vietnam set the daily reference USD/VND exchange rate at 23,967/26,489 (buying/selling) for August 08, a decrease of 21 VND from the previous week. This means that commercial banks can trade USD within a range of 23,228 – 25,748 VND/USD.

The USD/VND reference rate at the State Bank’s Foreign Exchange Management Department also retreated to 24,017-24,489 VND/USD (buying-selling), a decrease of 20 VND and 22 VND, respectively, compared to the previous week.

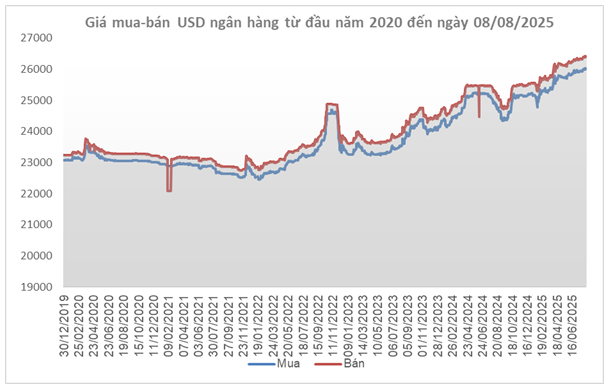

Source: VCB

|

Vietcombank’s listed exchange rate for August 08 was 23,967 – 25,748 VND/USD (buying – selling), a slight increase of 10 VND in both directions.

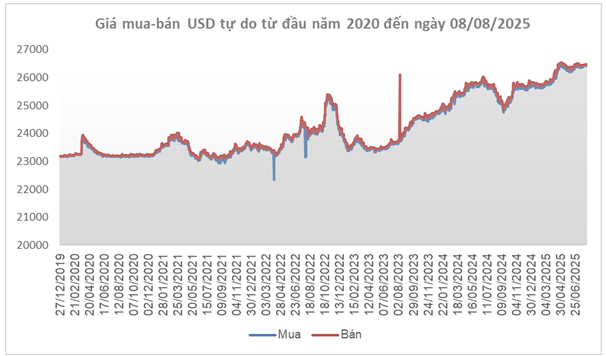

Source: VietstockFinance

|

In the free market, the USD fell by 20 VND on the buying side but rose by 30 VND on the selling side, trading around 26,420 – 26,480 VND/USD (buying – selling).

– 18:20 10/08/2025

Injecting Funds into the Economy

In the face of mounting pressure from exchange rates and rising inflation, lending rates have remained steadfastly low.

Vinaship Offloads Aging Fleet to Stem Losses

The shareholders of Vinaship Ocean Shipping JSC (UPCoM: VNA) have agreed to sell the 27-year-old bulk carrier, Vinaship Sea, in a strategic move to reduce maintenance costs and avert prolonged losses. By offloading the aging vessel, the company aims to generate capital for investing in younger, more efficient ships, thereby positioning itself for improved performance and profitability.

The Soaring USD Exchange Rate in Vietnam: What Does the State Bank Have to Say?

The high USD interest rates in the international market will put pressure on the exchange rate in Vietnam.