Illustrative image

On August 8, the Canadian government announced a reduction in the price cap on Russian oil as the conflict in Ukraine persists.

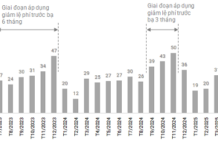

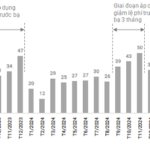

Specifically, according to a statement by the Canadian Ministry of Finance, the new price cap for seaborne crude oil of Russian origin will be lowered from USD 60 per barrel to USD 47.60. This move aligns Canada with the European Union (EU) and the United Kingdom, who announced plans in July to lower the price cap to curtail Russia’s oil revenues and increase economic pressure on Moscow.

In mid-July, the EU adopted its 18th package of sanctions against Russia, including a decision to lower the price cap on Russian crude oil from USD 60 to USD 47.6 per barrel. According to the price cap mechanism set by the G7 and the EU, Russian oil exports to third countries are only allowed access to Western insurance and financial services if the selling price does not exceed the cap. The EU stated that this adjustment reflects current global oil prices while establishing a flexible mechanism to adapt the price cap over time, ensuring the effectiveness and feasibility of the policy.

Canada’s Minister of Finance, Francois-Philippe Champagne, stated, “By further lowering the price cap on Russian crude oil, Canada and its partners are increasing economic pressure and limiting a significant source of revenue for Russia’s actions in Ukraine.”

The policy of capping prices on Russian oil was introduced by the G7 countries, the EU, and Australia in late 2022 to restrict Moscow’s oil export revenues while maintaining a stable supply for the global market.

In 2024, Canada recorded an average daily crude oil export of approximately 4.2 million barrels, a 5.4% increase from 2023. The average export price stood at USD 65.3 per barrel, bringing the total export value to USD 100.7 billion, a 5.7% increase from the previous year.

The United States remains the primary market for Canadian oil exports, accounting for 93% of the total, or about 3.93 million barrels per day. However, since the Trans Mountain Expansion Project (TMX) came into operation in May 2024, exports to non-US markets have increased by almost 60%. Notably, China has become Canada’s largest customer through TMX, with an average of 207,000 barrels per day, compared to only about 7,000 barrels per day in the previous decade. In addition to China, Canada has also expanded its exports to South Korea, Japan, India, and Taiwan.