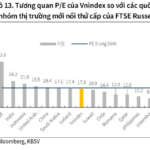

I. MARKET ANALYSIS OF STOCK MARKET BASICS ON 08/11/2025

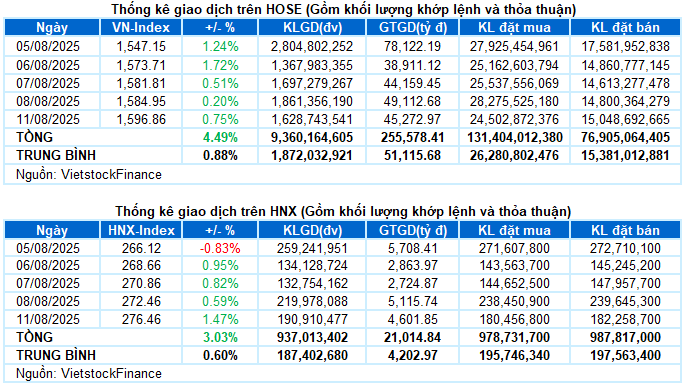

– The main indices continued to gain points in the trading session on 08/11. Specifically, VN-Index increased by 0.75%, reaching 1,596.86 points. HNX-Index broke through by 1.47%, to 276.46 points.

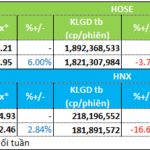

– Matching volume on the HOSE floor decreased by 12.5%, reaching nearly 1.6 billion units. HNX recorded nearly 164 million units, down 24.8% compared to the previous week’s session.

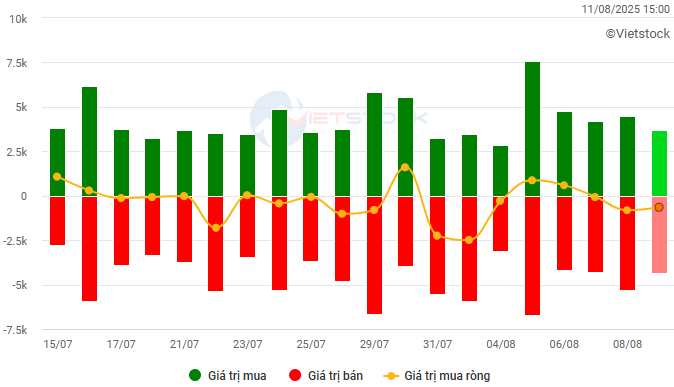

– Foreigners continued to sell a net of VND 626 billion on the HOSE floor but still bought a net of nearly VND 22 billion on the HNX floor.

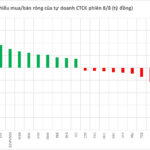

Trading value of foreign investors on HOSE, HNX and UPCOM by day. Unit: VND billion

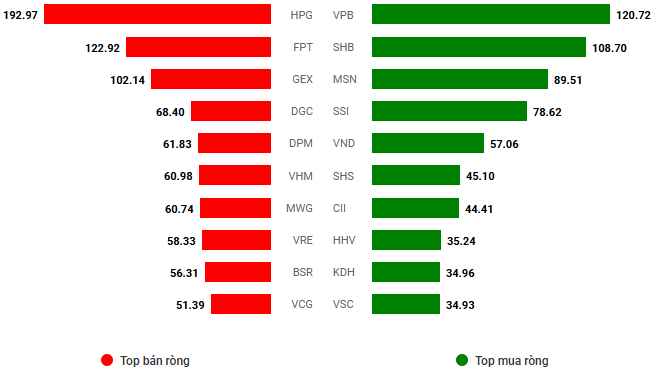

Net trading value by stock code. Unit: VND billion

– Vietnam’s stock market started the new week on a positive note. The VN-Index soon advanced to approach the 1,590-point threshold right after the opening bell. Despite facing selling pressure from some pillar stocks, buying power remained dominant and pushed the index to the 1,600-point threshold in the morning session. However, the gain slowed down considerably in the afternoon session as buying power was not strong enough to completely break through this psychological resistance. The VN-Index closed the first session of the week at 1,596.86 points, up 11.91 points from the previous week’s close.

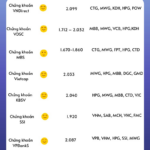

– In terms of impact, MSN, GVR, and MBB contributed the most positively, with each code bringing in nearly 2 points for the VN-Index. Meanwhile, the VIC and VHM duo exerted significant pressure in the opposite direction, causing the overall index to lose 2.5 points.

– VN30-Index ended the session up 0.74%, reaching 1,741.9 points. The breadth of the basket favored the buy side with 21 gainers and 9 losers. Notably, MSN topped the table with a ceiling-hitting gain. In addition, GVR, SSI, and MBB also rose more than 4%. On the losing side, VRE fell the most with a 2.2% decline.

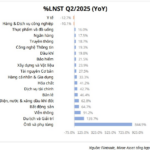

Most industry groups closed in the green. The essential consumer goods group led the market with a 1.96% gain, mainly driven by the standout performance of MSN (+7%), VNM (+1.15%), MCH (+3.79%), BAF (+1.71%), and SAB (+0.73%).

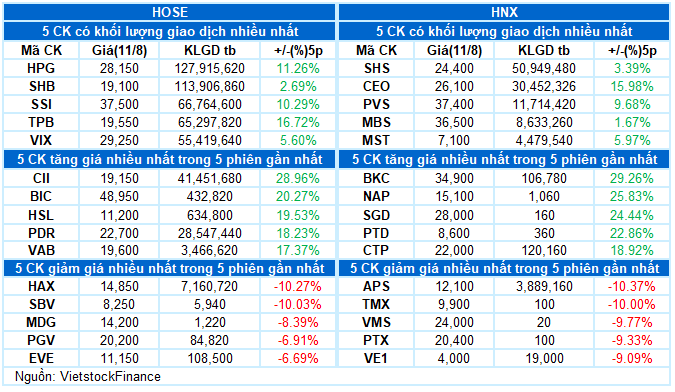

With their large capitalization, the financial and industrial groups also made significant contributions to today’s gain, with buying interest focusing on stocks such as SHB (+2.41%), VIX (+2.63%), VND (+3.35%), MBB (+4.09%), SHS (+4.27%), EIB (+4.49%), SSI (+5.63%); VJC (+2.06%), PC1 (+2.27%), VSC (+3.19%), GEE (+6.74%), and a host of ceiling-hitting stocks, including CII, VGC, HHV, SAM, G36, and HTN.

On the other hand, the energy group ranked at the bottom with a 0.82% adjustment, mainly influenced by the adjustment of BSR (-1.56%), PLX (-0.65%), PVS (-0.8%), PVT (-0.79%), and PVP (-0.98%).

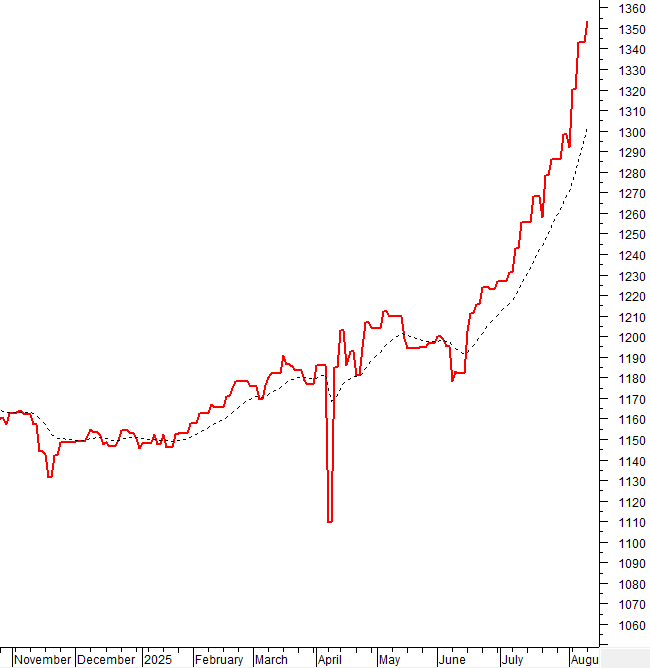

VN-Index extended its winning streak to the sixth consecutive session and closely followed the Upper Band of Bollinger Bands. However, the fluctuation when the index approached the psychological resistance of 1,600 points is worth noting. If buying power is strong enough to break through this threshold successfully, the index’s growth prospects will become even more optimistic. Along with this, the Stochastic Oscillator and MACD indicators continue to point upward after giving buy signals, reinforcing the potential for sustaining a robust uptrend in the coming period.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Closely Following the Upper Band of Bollinger Bands

VN-Index extended its winning streak to the sixth consecutive session and closely followed the Upper Band of Bollinger Bands. However, the fluctuation when the index approached the psychological resistance of 1,600 points deserves attention. If buying power successfully breaks through this threshold, the index’s growth prospects will become even more optimistic.

Along with this, the Stochastic Oscillator and MACD indicators continue to point upward after giving buy signals, reinforcing the potential for sustaining a robust uptrend in the coming period.

HNX-Index – Spinning Top Candlestick Pattern Emerges

HNX-Index continued to hit a new 52-week high with the fourth consecutive gaining session. However, trading volume has been volatile recently, indicating unstable money flow.

Currently, the MACD indicator has not shown any signs of reversing since giving a buy signal at the beginning of July 2025, reflecting the persistent positive outlook. Nevertheless, investors should be cautious about potential fluctuations in the high-price region as the Stochastic Oscillator indicator continues to dive deep into the overbought zone.

Money Flow Analysis

Movement of smart money flow: The Negative Volume Index indicator of the VN-Index is currently above the 20-day EMA. If this status continues in the next session, the risk of an unexpected downturn (thrust down) will be limited.

Foreign capital flow movement: Foreigners continued to sell a net in the trading session on 08/11/2025. If foreign investors maintain this action in the coming sessions, the situation will become more pessimistic.

III. MARKET STATISTICS ON 08/11/2025

Economic and Market Strategy Analysis Department, Vietstock Consulting

– 17:15 08/11/2025

The Top 20 Stock Market Billionaires Gain $2.4 Billion in a Week: VPB Shareholders See the Biggest Boom

“Vietnamese entrepreneur Nguyen Duc Tai, Chairman of The Gioi Di Dong, witnessed a surge in his wealth last week. With a net worth of VND 13.4 trillion, he secured a spot in the top 10 richest individuals, reflecting a remarkable 10% increase from the previous week.”