In the draft Law on Personal Income Tax (amended), the Ministry of Finance proposes to amend the provisions on personal income tax calculation for capital and securities transfers.

Accordingly, resident individuals transferring securities will be subject to a tax rate of 20% on taxable income. This taxable income is determined by subtracting the purchase price and related reasonable expenses during the tax calculation period for the year.

In cases where the purchase price and expenses related to the transfer cannot be determined, the tax will be equal to a tax rate of 0.1% multiplied by the selling price of securities, for each transaction.

For capital transfers, the agency also proposes a tax rate of 20% on taxable income, calculated for each transaction. If the purchase price and expenses cannot be determined, the seller will be subject to a tax rate of 2%.

Many investors expressed concern

Regarding the proposal to impose a 20% tax on stock profits, Ms. Phan Ngoc Mai, an individual investor with almost 5 years of experience, expressed her concern and said that if the proposal is implemented, she would probably switch to investing in another form.

“Participating in the stock market is very difficult because it entails significant risks of losses. Moreover, investors are already subject to various taxes and fees: transaction fees, a 0.1% tax when selling stocks regardless of profits or losses, and a 5% personal income tax when receiving cash dividends. With an additional 20% tax, I wonder how much profit small investors like me will be left with,” said Ms. Mai.

Mr. Nguyen Quoc Tuyen, Head of Analysis at TVI Financial Investment Joint Stock Company, emphasized that the 20% tax rate on stock profits is too high and, if implemented, will have a significant impact on the market.

He explained that the majority of participants in the stock market are small investors who hold stocks for the short term, with few long-term investors.

As an example, Mr. Tuyen said that if an investor makes a 20% profit in a year, they will have to pay a 4% tax. Compared to the previous tax rate of 0.1%, this is a significant increase in the tax burden for investors.

Additionally, determining the costs for investors to recognize profits can be relatively challenging. For instance, some investors have to purchase reports and analysis from consulting firms, and these expenses can be difficult to include in the overall costs of the investor, thereby affecting the calculation of the tax they have to pay.

Therefore, Mr. Tuyen hopes that if the 20% tax rate is adopted, the Ministry of Finance will provide a specific roadmap for the transition and reconsider the calculation of costs to ensure fairness for investors.

Experts believe that the proposed 20% tax rate on stock profits is too high, while individual investors express their concern. Photo: MINH TRÚC

|

Clarification needed on the calculation of cost price and deductible expenses

In another development, the option to choose between two tax calculation methods (0.1% on transaction value or 20% on net income if costs can be proven) is seen as a positive step by many businesses. However, they emphasize that taxation should be based on actual profits, with an appropriate roadmap, and not be implemented immediately when the data infrastructure is not yet ready.

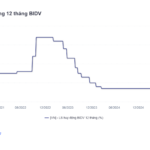

A representative of Techcom Securities Joint Stock Company (TCBS) stated that many foreign investors are keenly interested in changes in tax policies. Most investors expect tax stability to build trust in the market, rather than frequent changes that cause uncertainty. Therefore, the government’s decision to maintain the current 0.1% tax rate is welcomed.

Regarding the method of calculating the tax rate at 20% of net income, the representative of TCBS suggested clarifying the determination of the cost price, as securities companies currently apply different methods.

Additionally, when investors buy and sell securities, the cost price is often recognized based on the price at the time of transfer, which may not reflect the actual investment amount. For cases where shares are purchased before the company is listed, specific guidance is needed on determining the cost price.

The TCBS representative also proposed a clear definition of legitimate deductible expenses when calculating taxable income. For example, the cost of margin loans for securities investment.

“Compared to depositing money in a savings account with an interest rate of 5-6% per year, if an individual investor earns 10% in two years from stock investments and is then taxed at 20%, they may lose the motivation to participate in the capital market,” said the TCBS representative.

Some opinions suggest clarifying the calculation of cost price and deductible expenses… Photo: MINH TRÚC |

Regarding the taxation of bonus shares, TCBS suggested that tax should not be imposed when the investor has not actually received the income. Taxing at the time of being allocated shares forces the investor to sell other shares or use their pocket money to pay the tax.

“If the regulations are not clear, it may lead to a situation where the investor does not have enough money to pay the tax and cannot receive the shares, causing difficulties for the market and the issuing company,” they added.

From a state management perspective, Deputy Minister of Finance Cao Anh Tuan stated that for securities taxes, the current practice is to apply a rate of 0.1% per transaction for the convenience of investors. However, the Ministry is considering allowing year-end settlement to accurately reflect actual income and avoid disadvantages for long-term investors or those who incur losses.

The Ministry of Finance is also working on adjusting the tax settlement and refund procedures to make them more convenient and equitable for individuals and businesses.

In addition, the Ministry is focusing on completing data on income and taxpayers to build a fairer and more accurate tax policy.

|

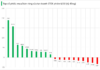

Some experts suggested that there are other ways to collect taxes to increase transparency and curb speculation in the market. According to Mr. Dao Minh Tri, Investment Consulting Expert at Yuanta Vietnam Securities Company, the government could impose taxes based on the length of time that an individual holds a stock. In other words, the longer an individual holds a stock, the lower the tax they would have to pay. “Taxing based on stock holding periods can prevent speculative money flows in the market and create transparency. In the long run, this is also a positive incentive,” explained Mr. Tri. According to data from the Vietnam Securities Depository and Clearing Corporation (VSDC), individual investors currently account for 99.82% of the market. However, about 95% of them incur losses and exit the market after just two years. This figure illustrates the inherent risks and challenges of stock investing. Imposing a high tax rate may further discourage many investors from participating in the market. |

MINH TRÚC

– 16:07 10/08/2025

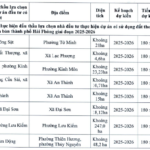

Introducing the Prime Real Estate of Dong Nai: Now Open for Business

Introducing the future of real estate in Dong Nai: a transparent and accessible journey towards your dream property. The province is set to unveil auction-bound land plots through a multi-channel approach, utilizing the power of media, e-government portals, and dynamic real estate exchanges. Get ready to navigate the exciting world of real estate with ease and confidence!

Is the Big Wave Coming? A Sneak Peek Into the Da Nang Land Market and Its Future Prospects

As investors with cash reserves ranging from 4 to 10 billion VND start returning to the market, it signals a positive shift in the Danang land market. This resurgence of investment activity post-Tet has increased liquidity and selling prices, indicating that the market is poised to ride a new wave of growth.

The Business is in the Red, but Stock Prices Soar: What do Experts Make of It?

Stock price increases are merely symptomatic; discerning investors must focus on the underlying causes. Is it a reflection of improved financial performance, positive news, or perhaps a result of price manipulation? Savvy investors delve beyond surface-level indicators to uncover the true drivers of stock price movements.