Vietnam’s Stock Market Surges as Funds Flow into the Market

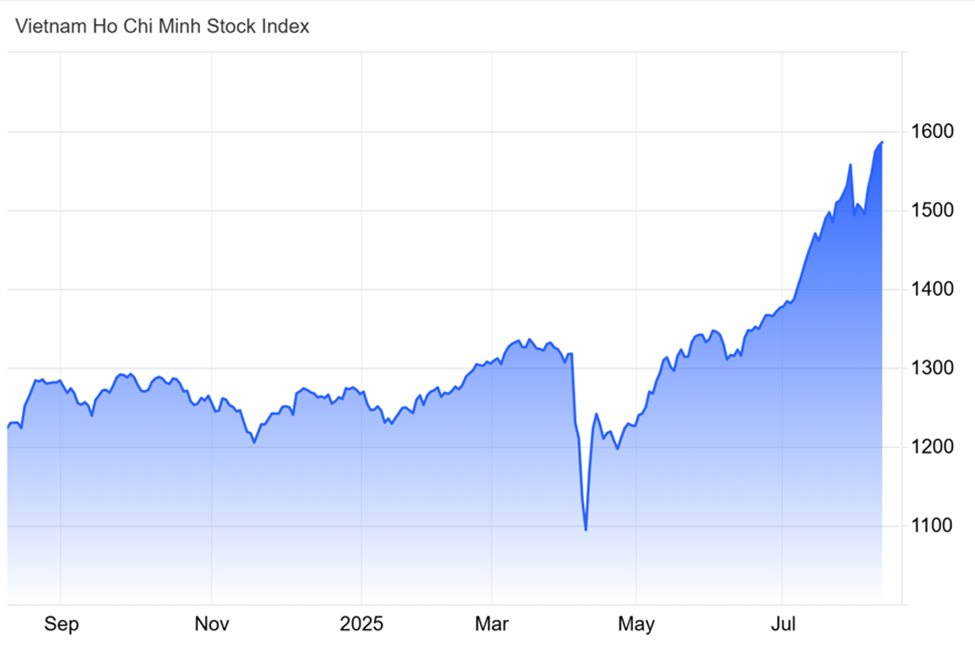

The Vietnamese stock market witnessed a historic milestone on August 8, 2025, as the VN-Index reached an all-time high of 1,584 points. Simultaneously, the VN30 index climbed to 1,729 points. Since the beginning of 2025, these stock indices have surged by over 25% and 30%, respectively, compared to their levels at the start of 2024. Other indices, such as the HNX-Index and UpCoM, also broke records, crossing the 272.4 and 108.6 marks, reflecting increases of 19% and 14% from the previous year.

This is the highest level ever achieved in the 25-year history of Vietnam’s stock market.

VN-Index Hits an All-Time High on August 8

As of August 8, the market capitalization of HOSE reached 6.84 quadrillion VND, marking a substantial increase of over 30% or approximately 1.6 quadrillion VND (nearly 62 billion USD) compared to the beginning of 2025.

The total market capitalization of stocks reached approximately 8.2 quadrillion VND, equivalent to nearly 71% of GDP (as of July 2025) – the highest level ever, reflecting a sixfold increase over the last decade.

This remarkable growth in market capitalization can be attributed, in part, to the strong performance of leading stocks in the market, including those from the Vingroup ecosystem (VIC, VHM, VRE, VEF) and GELEX (GEX, GEE), as well as banking stocks (VPB, SHB, TCB, CTG, BID, HDB, EIB) and securities stocks (SSI, VND, SHS, VCI, VIX), among others.

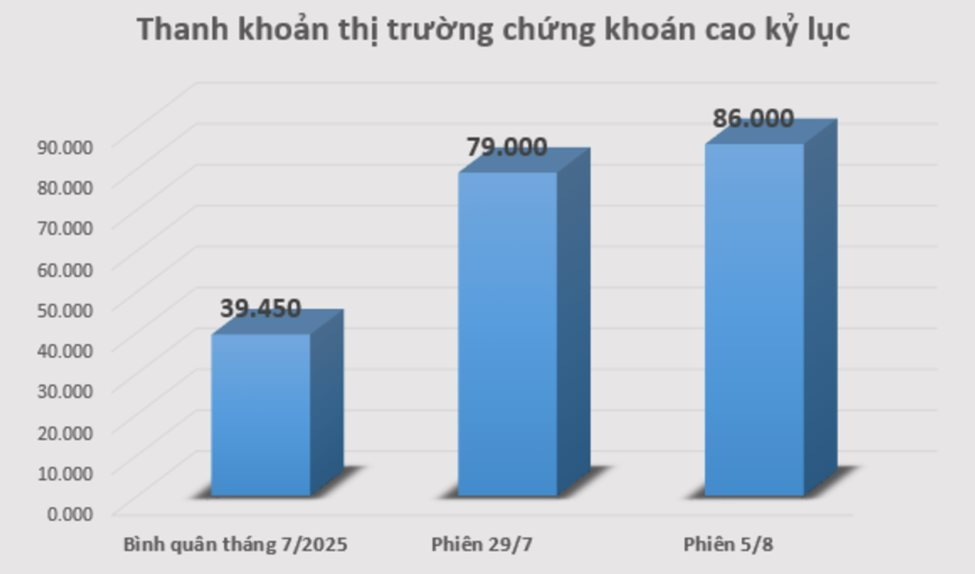

The influx of funds into the stock market is evident from the increasing number of billion-dollar matching sessions. In recent days, the market’s liquidity has consistently remained at the 2-billion-USD level per session. Notably, two record-breaking sessions occurred on July 29 and August 5, with total matching values of 79 trillion VND and 86 trillion VND, respectively. The average matching value across the three exchanges reached 39.45 trillion VND in July 2025.

The Vietnamese stock market has never witnessed such a substantial inflow of capital. This influx of funds, coupled with a preference for stocks of well-performing and financially robust listed companies, has propelled the market to new heights, solidifying its upward trajectory.

Gerald Toledano, a representative of FTSE Russell and the London Stock Exchange Group, commended Vietnam’s stock market for its impressive liquidity, noting that it surpasses that of other ASEAN countries, including Thailand and Singapore.

According to the latest data from the Vietnam Securities Depository (VSDC), domestic investors opened 226,153 new securities accounts in July. As of the end of July, the country recorded 10.447 million securities accounts, equivalent to about 10.4% of the population. This achievement surpasses the target set for 2025 and aligns with the aspiration to reach 11 million accounts by 2030.

New Impetus from Policy Reforms

Vietnam’s stock market is experiencing impressive growth, largely driven by the government’s breakthrough policy orientations. Experts attribute this momentum to policy reforms, especially given the dynamic global economic landscape.

One of the direct catalysts for this growth is ample liquidity, resulting from the loose monetary policy and low-interest-rate environment. Additionally, Vietnam’s high GDP growth, coupled with the government’s determination to achieve an 8% growth rate in 2025 and a double-digit growth trajectory for the 2026-2030 period, bolsters market confidence. The market’s upward trajectory is further supported by a stable macroeconomic foundation, aggressive public investment disbursement strategies, domestic consumption stimulation, and tax cuts.

The government has introduced several pivotal policies, including Resolution 86 on capital market development and Decision 1726 by the Prime Minister on the Strategy for Securities Market Development until 2030. Notably, Vietnam recently enacted two critical resolutions: Resolution 57 on science and technology and Resolution 68 on private economic development.

According to Don Lam, CEO of VinaCapital, these resolutions signify a strategic shift. Resolution 68, in particular, underscores the significant role of the private sector in driving the country’s economic growth.

Firstly, the establishment of a modern trading platform with the successful implementation of the KRX system (in May 2025) has paved the way for the introduction of new products.

Secondly, the market has expanded in scale and depth, now boasting over 10 million investor accounts, more than 1,600 listed companies, a market capitalization of 300 billion USD, and leading liquidity in ASEAN with an average daily turnover of over 1 billion USD.

Thirdly, efforts to enhance integration and attract foreign investment through reforms related to foreign ownership limits and corporate governance have been prioritized.

Vietnam Has Over 10 Million Securities Accounts

Expectations for FTSE Russell Upgrade in September 2025

Domestic and international investors are eagerly anticipating the potential upgrade of Vietnam’s stock market by FTSE Russell in September 2025. This upgrade would serve as a long-term catalyst for the market’s robust and sustainable growth.

Recently, the Prime Minister instructed relevant authorities to take immediate steps to upgrade Vietnam’s stock market from a frontier market to an emerging market. This entails addressing any challenges and meeting the necessary criteria for the upgrade, thereby facilitating capital mobilization for the country’s economic development.

Resolution 86, issued by the government, aims to develop a safe, transparent, and sustainable capital market, with a particular focus on transforming the stock market into a primary channel for medium and long-term capital mobilization. The resolution emphasizes the urgent implementation of measures to elevate the market’s status from a frontier market to an emerging market.

According to Vu Thi Chan Phuong, Chairwoman of the State Securities Commission, international experience demonstrates that market upgrades effectively attract foreign investment.

Furthermore, the Ministry of Finance is finalizing a draft decree amending Decree No. 155/2020/ND-CP, aiming to enhance transparency in disclosing foreign ownership ratios.

“SGI Capital: When Good News Starts Reflecting on Prices, Stock Picking and Risk Management Take Center Stage.”

The recent allure of the stock market, according to SGI Capital, has been attracting funds from various other investment avenues, including real estate and cryptocurrencies.

The Real Estate Rush: Firms Flock to Convert Bonds to Stocks

“The issuance of additional shares will dilute existing shareholders’ interests in the short term, but it is a necessary step for real estate businesses to restructure, alleviate cash flow pressures, and enhance their financial safety margins. This move strikes a balance between the interests of bondholders and the company’s long-term viability.”