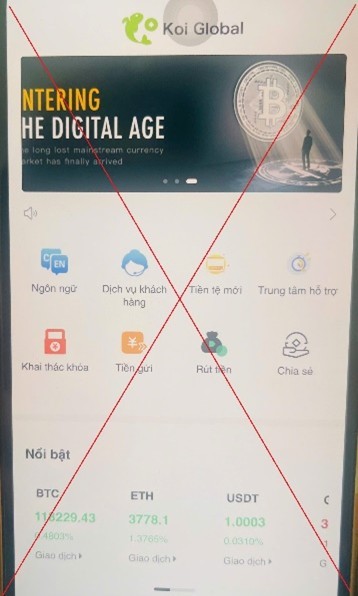

In a recent development, the Hanoi City Cyber Security and High-Tech Crime Prevention Division received a report from a victim who was scammed out of over VND 600 million in a cryptocurrency investment scheme. On July 21, 2025, Ms. D (45, Hanoi) was invited by an online acquaintance to invest in cryptocurrency through the Koi Global application.

The acquaintance proactively transferred VND 18 million to Ms. D as a trial investment. Encouraged by this, Ms. D deposited VND 60 million into her Koi Global account and withdrew VND 1.5 million in profits. Enticed by the easy money, Ms. D went on to make five more deposits, investing a total of VND 350 million.

Subsequently, the acquaintance suggested upgrading her account to VIP 1, which would cost 30,000 USDT (a type of cryptocurrency). Ms. D deposited an additional VND 280 million but still fell short of the required amount for the upgrade. At this point, the scammer started threatening and demanding that she transfer more funds. Realizing she had been conned, Ms. D reported the incident to the police.

According to the Hanoi City Police, there has been a rise in fraudulent cryptocurrency platforms offering high-interest rates. Notably, these scammers often send money to potential investors to entice them. Many people, lured by the promise of quick profits, have fallen victim to these schemes.

To avoid such scams, the Hanoi City Police advise citizens to be cautious when using online dating apps and receiving friend requests from strangers on social media. It is recommended not to invest or trade on cryptocurrency exchanges, websites, or applications.

Be especially wary of platforms that advertise high returns or attractive investment opportunities, as they may be scams aiming to steal your money. Investing in cryptocurrency exchanges, websites, or applications carries inherent risks since these platforms often lack legal representation in Vietnam, and cryptocurrencies are not legally recognized in the country.

If you encounter any suspected fraud, promptly report it to the police so that they can investigate, prevent, and take legal action against the perpetrators.

The Digital Wallet Wars: Banks and E-Wallets Battle it Out for User Verification Supremacy

As per the State Bank of Vietnam’s insights, cashless payments have witnessed a remarkable surge, with over 182 million personal accounts facilitating such transactions. Notably, several banks now process more than 95% of their transactions through digital channels, a testament to the country’s evolving digital landscape.

Revolutionizing the Banking Experience: VietinBank’s Synchronized Approach to Customer Satisfaction

Complying with Decision 2345 of the State Bank on the deployment of security and safety solutions in payment, VietinBank has implemented biometric authentication for customers since July 1, 2024, and has been recognized as one of the pioneering and effective implementers of this significant directive.