Shattering Records, Markets Shaken by Profit-Taking Pressure

In a week that saw the stock market reach an all-time high, it experienced significant volatility, dipping to 1,490 points at one stage before surging back up thanks to positive rotation across sectors.

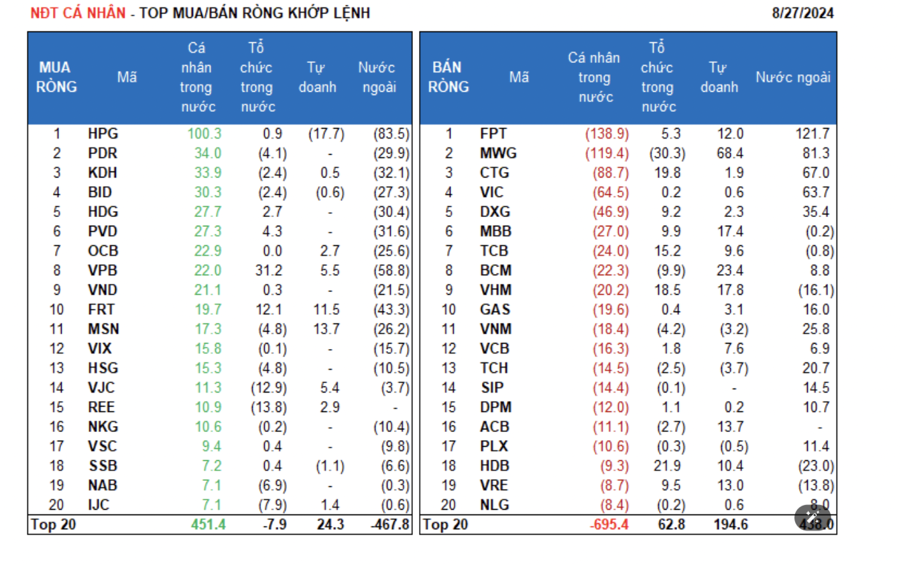

The VN-Index ended the week up 6% at 1,584 points, surpassing its previous peak. The session on August 5th broke records with 3.2 billion shares traded, valued at nearly VND 83 trillion. The VN30 rose 7.15% to 1,729 points, led by gains in steel, construction, fertilizers, agriculture, seafood, oil and gas, real estate, and financial sectors. Foreign investors, however, net sold VND 12,849 billion.

Listed companies have concluded their Q2 financial reports. Data from SSI Securities Corporation indicates that total market revenue for Q2 2025 increased by 6.9% year-on-year. After-tax profit for parent company shareholders surged by 31.5%, far exceeding the 20.9% growth in Q1.

Most sectors recorded positive growth, except for the industrial sector. Outperforming sectors included retail, fertilizers, utilities, banking, and industrial parks. On the other hand, the food and beverage industry, along with some residential real estate businesses, fell short of expectations.

Seven stocks, namely VIC, NVL, VGI, HHS, HVN, PGV, and VIX, accounted for 6.7% of the market’s profits and 14.4% of capitalization, but they contributed to half of the absolute growth in Q2 profits. Excluding this group, the market’s profit growth stood at 14.8%. Among the 80 stocks under SSI’s coverage, profits grew by 13.1%, outpacing the 10.6% growth in Q1.

Banks continued to lead the charge, contributing 44% of the total market profits and 28% of the growth. Real estate came in second, accounting for 8% of profits and 20% of growth. The utilities sector made up 7% of profits and contributed 12% to the growth.

SSI Securities Corporation’s analysts forecast that the VN-Index could target the 1,750–1,800 range in 2026, despite potential short-term volatility due to profit-taking pressure following a period of high leverage in late July. The main drivers are expected to be profit recovery, bolstered by a rebound in real estate and public investment, a favorable interest rate environment, reduced tariff risks, and expectations of a market upgrade in October.

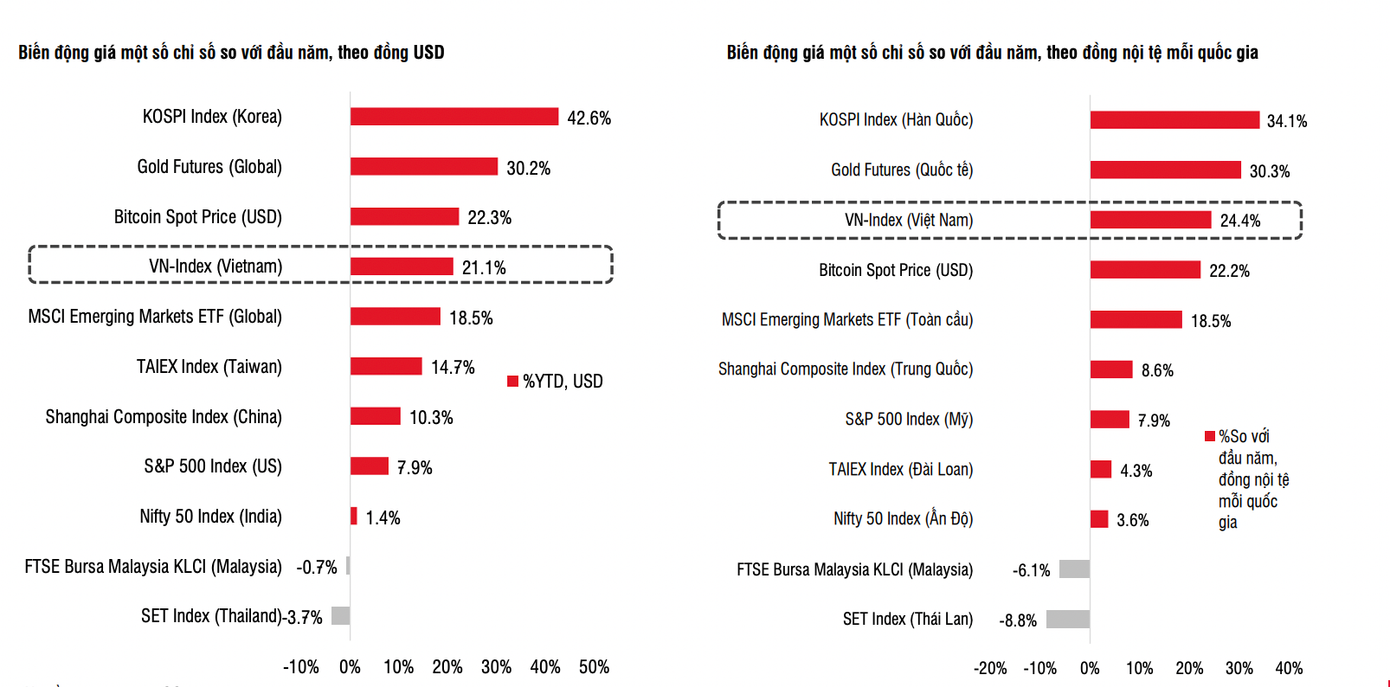

Attracting Capital Inflows with Market Upgrade Expectations. Data: SSI

Forecasts predict a 13.8% increase in the after-tax profit of parent company shareholders for the full market in 2025, corresponding to a 15.5% rise in the second half. Projected P/E has increased from 8.8 times (as of April 9) to 12.6 times (as of August 6), still below the 5-year average of 13 times and the historical peak of 15–17 times.

SSI maintains its expectation that Vietnam will be upgraded to an emerging market by FTSE Russell in October, potentially attracting approximately USD 1 billion from ETF funds tracking the index. Observations of other markets show that stocks often perform well ahead of an upgrade due to foreign capital inflows and improved investor sentiment. This will be a crucial supporting factor for the market in the second half of the year.

Warning on “Penny Stocks” Risks

Mirae Asset Vietnam Securities Company’s experts predict that after reaching a historic peak, the VN-Index will continue to experience short-term fluctuations. However, the medium and long-term trends remain positive, with the index expected to fluctuate between 1,486 and 1,600 points. The current support level is 1,486 points, and if it holds, the index may aim for the 1,600 mark. A more negative scenario would be a correction to test the 1,470 level. The outlook remains bolstered by supportive growth policies and expectations of a market upgrade in the September FTSE review.

Investors Anticipate Market Upgrade Story in September’s FTSE Review

During this period of a heated market, money flowed into smaller stocks and penny stocks, causing their prices to surge. Mr. Tran Hoang Son, Market Strategy Director of VPBank Securities Company (VPBankS), noted that many “penny stocks” have seen their prices multiply. This boom creates large waves, stimulating greed and causing investors to forget about potential risks.

According to Mr. Son, price increases are just the outward manifestation; it’s essential to investigate the underlying reasons. These could include improved business performance, positive news, stronger financial health, or price manipulation.

In the medium and long term, stocks without a solid fundamental basis will struggle to maintain their upward trajectory. When a “pine tree pattern” stock has already experienced a rapid rise, investors should refrain from participating as the risk of a sudden drop is ever-present.

Mr. Son advises that during an upward trend, investors should allocate the majority of their capital to stocks with strong fundamentals and growing business performance. Holding high-quality stocks provides peace of mind during market fluctuations and helps avoid panic selling during corrections.

While it’s possible to trade “penny stocks” during a bull market, investors must carefully time their entries and exits. If they get too caught up in the frenzy, they may find themselves unable to exit when these stocks are dumped by market makers. The crash of 2022–2023 offers valuable lessons in this regard.

The Million-Dollar Stock: Unveiling the High-Value Opportunity

The last time Vietnam’s stock market witnessed a share price surpassing the one-million-dong mark was in early 2023.

The Real Estate Rush: Firms Flock to Convert Bonds to Stocks

“The issuance of additional shares will dilute existing shareholders’ interests in the short term, but it is a necessary step for real estate businesses to restructure, alleviate cash flow pressures, and enhance their financial safety margins. This move strikes a balance between the interests of bondholders and the company’s long-term viability.”