In recent times, many banks have been diversifying their revenue streams by developing non-credit products and services, reaping significant profits from digital banking conveniences, payment card fees, credit card fees, asset management advisory, securities investment, and foreign currency trading, among others. This strategic shift has helped banks reduce their reliance on credit, mitigate risks, and improve their revenue structure towards long-term sustainability.

Financial reports attest to the effectiveness of this approach, as evident from VIB’s performance, with total operating income surpassing 9,700 billion VND and pre-tax profits exceeding 5,000 billion VND, a 9% increase year-on-year. Notably, non-interest income accounted for approximately 21% of the total, predominantly from services and payments. HDBank witnessed a remarkable surge in non-interest income, with a 210% year-on-year increase stemming from payments, digital banking, and foreign currency trading, in addition to a 15.8% rise in net interest income, reaching 17,227 billion VND. ABBank left an even stronger impression, with a significant improvement in non-interest income compared to the previous year: net income from services increased fivefold to 431 billion VND, while net income from other activities reached 894.5 billion VND, thirteen times higher than the same period last year, enabling the bank to accomplish 93% of its profit plan within just six months.

Diversifying revenue streams is an inevitable trend for banks

State-owned commercial banks also demonstrated positive results: BIDV earned over 11,000 billion VND, a 22.6% increase; VietinBank generated more than 10,000 billion VND, a 22.7% rise; and Vietcombank attained nearly 7,300 billion VND, a 20.5% growth compared to the previous year.

In addition to service and payment revenues, some banks have also increased their income through the recovery of previously written-off debts, as seen with LPBank, where non-interest income rose by 17.3%, with income from written-off debt recovery doubling compared to the same period in 2024.

Meanwhile, other banks, including Techcombank, VietinBank, Sacombank, VPBank, and ACB, have acknowledged the significant contribution of non-interest income, attributed to their multi-layered digital ecosystems and strategic leveraging of advantages in the services sector. At MB, Mr. Vu Thanh Trung, Vice Chairman of the Board of Directors, highlighted that digital transformation remains a growth driver, with key digital platforms such as the App MBBank, BIZ MBBank, and the Banking-as-a-Service (BAAS) segment contributing significantly to the bank’s expansion in terms of customer base, CASA, and revenue.

MB’s leadership recently announced a bold initiative to expand its ecosystem into the digital asset business, partnering with a top-three global leader in this field. Recognizing the potential of its 33 million customers within its ecosystem, the bank aims to offer not only banking services but also venture into fund certificates, stocks, bonds, and eventually, digital assets.

Additionally, in recent years, a notable trend has emerged, with several banks accelerating their mergers and acquisitions of securities and insurance companies to expand their market share. PGBank has approved the strategy of acquiring shares in securities, fund management, or insurance companies to become subsidiaries or associated companies, while Sacombank plans to invest up to 1,500 billion VND to own over 50% of a securities company.

According to experts, non-interest income will play an increasingly crucial role in sustaining profits, especially as the net interest margin (NIM) narrows. NIM, an indicator reflecting the difference between interest income from loans and investments and the cost of paying interest on total interest-bearing assets, has been declining, resulting in lower net interest income per unit of credit, despite expanding credit balances.

Ms. Tran Kieu Oanh, Head of Financial Services at FiinGroup’s Market Research and Consulting Division, pointed out that interest income continues to face challenges, with high non-performing loans prompting banks to increase provisions, leading to higher operating expenses. Moreover, the heavy reliance on credit has driven banks into fierce competition, forcing them to lower lending rates to retain customers, thereby compressing profit margins.

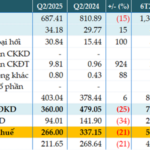

Data from the Wichart platform reveals that NIM for listed banks continued to narrow in the second quarter of 2025, reaching 3.17%, a decrease of 0.13 percentage points from the previous quarter, approaching the low recorded in the first quarter of 2019 (3.16%). As industry-wide NIM has been declining for two consecutive years, banks’ push to increase non-interest income and shift towards a more sustainable revenue structure is inevitable, helping to diversify revenue streams and foster long-term growth.

Unleashing VIB’s Fintech DNA: Engineering the Super Quartet – a Personalized Financial Ecosystem

“Vietnam is among the fastest-growing digital payment markets in the region. According to the State Bank of Vietnam, the value of cashless transactions in 2024 was 26 times the GDP, with 87% of the adult population having access to financial services. With this backdrop, superficial improvements are not enough to create a sustainable competitive advantage.”

“Introducing You to Instant Millions: SHB SAHA”

From now until December 31, 2025, refer your friends and family to open a payment account on the new-generation SHB SAHA digital banking app, and you’ll receive attractive cash gifts. This is your golden opportunity to spread the word about modern digital financial utilities while also boosting your income easily, quickly, and sustainably.

International Experts Predict HDBank’s Profit to Surpass 23,000 Billion VND by 2025

In Q2 of 2025, HDBank reported a remarkable pre-tax profit of VND 4,713 billion, bringing its total profit for the first half of the year to VND 10,068 billion. This impressive performance marks a 23% increase compared to the same period in 2024, solidifying the bank’s position among the top-performing financial institutions in the country.

“TPBank: Elevate Your Digital Life with Intelligent Banking”

TPBank is at the forefront of a transformative journey, evolving from a digital bank to a bank of intelligence. We are harnessing the power of cutting-edge technology and combining it with a heart-felt approach to serve our customers in the most unique and personalized ways.