VN-Index Surges Past 1,580 Points: Experts Predict Continued Uptrend

Despite the recent volatility, the VN-Index ended the week of August 4-9 with a 6% gain, reaching a new record high of 1,584.95 points. The highlight of the week was the historic trading session on August 5, with a record trading volume of 3.2 billion shares and a value of nearly VND83,000 billion across the market.

Looking ahead, most experts agree that the VN-Index will maintain its positive trajectory in the medium to long term. However, in the short term, there may be technical adjustments as the market prepares to conquer new peaks.

VN-Index Technical Analysis

Stock Market Enters a Phase of Stability and Acceleration

Ngo Minh Duc, Founder of LCTV Investment Finance Company

The market has witnessed a remarkable recovery since hitting a low of 1,070 points in early April, surging over 500 points to reach 1,585 points in early August. In recent sessions, the market faced profit-taking pressure around the 1,560-1,580 range.

We’ve seen a significant influx of new investors, attracted by the prospects of an upgrade and low deposit rates hovering around 4-5% per annum. Banking and securities stocks have delivered impressive returns during this period.

Mr. Duc believes that the recent volatility after reaching a record high is a normal occurrence. Following a strong rally, individual investors tend to lock in profits as their accounts show healthy gains. Additionally, while banking and securities stocks have risen by 15-20%, sectors like real estate and oil and gas have lagged, prompting a rotation of funds into these sectors.

At present, Mr. Duc assesses that the stock market is in the third phase of the year, characterized by stability and acceleration, as it gears up for the anticipated upgrade in the latter half of 2025.

The first phase lasted from January 2025 to mid-March 2025, marked by a final upward push due to monetary injections and stimulus measures for public investment. The second phase, from late March to June, was a “black swan” event triggered by changes in US tax policies. However, the conclusion of July’s negotiations has paved the way for a renewed focus on economic growth targets.

“However, given the prolonged uptrend over the past four months, a short-term correction in August cannot be ruled out as the market consolidates before aiming for new highs,” Mr. Duc opined.

The VN-Index is expected to retreat to the 1,500-1,520 range due to profit-taking pressures and rising overnight interest rates, which climbed back to 7%, along with Vietnamese government bond yields approaching 3.5% last week.

Assessing whether a market is approaching a peak or facing a trend reversal requires considering numerous factors. It is crucial for investors to distinguish between technical corrections, which are temporary pauses in an uptrend, and trend reversals, which occur when fundamental factors change, such as central bank tightening and rising interest rates.

Currently, macroeconomic conditions remain favorable, with the State Bank maintaining low-interest rates and the government pushing for credit growth and public investment. These factors will continue to fuel the stock market’s growth in the medium to long term.

Mr. Duc believes that the market is not undergoing a trend reversal but is more likely to experience technical corrections. Investors should monitor sessions where the market rallies in the early hours but sells off towards the end, with liquidity exceeding 1.8-2 billion shares, as potential warning signs.

Regarding investment strategies, as market volatility intensifies, investors should review their portfolios and consider restructuring if necessary. Diversification is key, and investors should avoid concentrating their entire position in a single stock or excessive margin trading in the coming week.

Looking ahead, the banking and securities sectors will remain in focus, as evident from their impressive second-quarter financial results.

High Probability of Uptrend Continuation

Dinh Viet Bach, Pinetree Securities’ Analyst

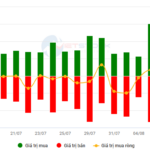

According to Mr. Bach’s observations, despite last week’s bearish signal indicated by a long red candle and high trading volume, the VN-Index defied expectations and continued its upward trajectory. It formed a strong green Marubozu candle, negating the previous week’s decline.

The week’s highlight was the resilience of buying pressure, evident in the continuous rotation of funds across sectors. Even during sessions that seemed dominated by sellers, buyers ultimately prevailed, driving the market’s recovery. Although there were moments of correction, investors’ positions remained relatively stable. This stability can be attributed to the strong performance of key sectors like banking, securities, and real estate, with some stocks doubling in value, allowing investors to comfortably take profits without creating intense selling pressure.

As a result, despite market volatility, selling pressure was absorbed, and buying support emerged. Additionally, there are signs of fund rotation into sectors that haven’t seen significant gains, such as oil and gas, industrial parks, and textiles, while previously strong sectors undergo consolidation.

“With money flowing from large-cap stocks to mid and small-cap stocks, investors can consider allocating a portion of their portfolio to these stocks for short-term gains. Conversely, for stocks that have surged or hit consecutive ceiling prices, investors should cautiously lock in profits and avoid FOMO buying if the VN-Index continues to climb,” advised the Pinetree analyst.

The Meat Platform: Masan’s Visionary Leadership in Shaping Modern Consumer Trends

The processed meat market is experiencing a robust growth spurt, with consumers prioritizing food quality and safety alongside improved income. This presents a prime opportunity for industry players to meet the evolving demands of consumers and stay ahead of the curve. With a keen focus on delivering superior products, the market is poised for a significant transformation, elevating the standards of the industry as a whole.

The Real Estate Rush: Firms Flock to Convert Bonds to Stocks

“The issuance of additional shares will dilute existing shareholders’ interests in the short term, but it is a necessary step for real estate businesses to restructure, alleviate cash flow pressures, and enhance their financial safety margins. This move strikes a balance between the interests of bondholders and the company’s long-term viability.”

Veteran Enterprise, New Horizons: Unlocking VNC’s Breakthrough Potential

VNC, the stock symbol for Vinacontrol Group, is emerging as a safe and value-laden long-term investment destination. But what sets this enterprise apart, sustaining its allure amidst market volatility?

The Vietstock Daily: Upward Momentum Persists

The VN-Index extended its winning streak for the sixth consecutive session, hovering near the upper band of the Bollinger Bands. However, the index’s movement warrants attention as it approaches the pivotal psychological resistance level of 1,600 points. A decisive breakthrough above this level, fueled by robust buying pressure, would bolster the index’s upward trajectory. Additionally, the bullish crossover on the Stochastic Oscillator and the upward trajectory of the MACD, following a buy signal, reinforce the potential for sustained upside momentum in the near term.