Seventeen years ago, StoxPlus – the predecessor of FiinGroup – was born in the early days of Vietnam’s financial information market, where the culture of paying for data was almost non-existent. A few years after its establishment, FiinGroup (formerly StoxPlus) faced a critical phase when revenue could not cover expenses. The founding team had to take on various projects, including auditing, consulting, and valuation, just to keep the company afloat.

However, it was during this challenging period that a pivotal decision was made: to transition to a financial information subscription model, despite the market’s skepticism and perceived risks. This move wasn’t just a business pivot but a testament to their vision: for the market to develop sustainably, it needed a foundation of quality data and transparency.

This journey wasn’t easy, but it proved worthwhile. Today, FiinGroup boasts a comprehensive financial data ecosystem, encompassing corporate information, credit rating analysis, and AI-powered solutions. From a startup that almost burned out, they have transformed into a trusted partner for global organizations like Nikkei and S&P Global, who have strategically invested in them.

FiinGroup is more than just a financial data technology company; they are building a new pillar for Vietnam’s capital market. From providing data to establishing FiinRatings – the first licensed credit rating agency – to developing ESG analysis platforms, green bond and stock data, they aim to support Vietnam’s market upgrade and reposition the country in the global capital flow.

That bold pivot proved to be a turning point. From a startup that almost fizzled out, FiinGroup gradually built a robust financial data, corporate information, and credit rating analysis ecosystem, serving not only domestic investors but also gaining the trust of global financial institutions. They have also attracted strategic investments from prominent partners like Nikkei and S&P Global.

Mr. Nguyen Quang Thuan shared during the talk show, “The Investors – The Resilient”: “If we want Vietnam’s capital market to go far, we cannot rely solely on bank credit. We need a tripod: Banks – Bonds – Stocks. But for this tripod to stand firm, we need an independent and transparent data foundation for investors, institutions, and businesses to stand together.”

Mr. Nguyen Quang Thuan, Chairman of the Board of Directors of FiinGroup and FiinRatings, will be the featured guest in the talk show “The Investors” Season 2 – The Resilient, a program organized by CafeF and VPBank Securities (VPBankS). In this hour-long dialogue, the Chairman of FiinGroup shares the story of creating an in-depth analytical information infrastructure for Vietnam’s capital market – from data, credit ratings to green finance, ESG investing – what he calls a “prerequisite” if Vietnam truly wants to make the most of the market upgrade, attract cheap and long-term capital, and reposition the country on the global investment map.

FiinGroup is emerging as a leading financial data technology company in the region, contributing to smarter investment, credit, and trade decisions. Moreover, they aim to accompany the government and financial institutions in establishing ESG standards, upgrading the country’s credit rating, and paving the way for green, long-term, and sustainable capital.

The story of Mr. Nguyen Quang Thuan and FiinGroup is not just about a company’s journey of overcoming challenges but also a testament to the power of long-term vision, perseverance, and a spirit of serving the market.

For young investors seeking reasons to believe in and commit to Vietnam’s stock market for the long term, this is the model: start with the smallest things but always aim for the most significant impact – towards a transparent, efficient, and sustainable market for all.

Following the success of the inspiring talk show series “The Investors” (Season 1), CafeF, in collaboration with VPBank Securities (VPBankS), proudly presents Season 2 – The Resilient. This year’s talk shows celebrate resilient investors who persevere through market storms, marking the next step in our journey of sharing authentic, profound, and emotional investment stories.

“The Investors” Season 2 will be aired every Tuesday at 10:00 AM on the CafeF, CafeBiz, and VPBankS fan pages.

VPBankS is the only securities company in the VPBank ecosystem, with a charter capital of VND 15,000 billion, ranking among the market leaders. VPBankS continuously expands strategic collaborations and enriches its product ecosystem, offering personalized investment experiences in stocks, bonds, derivatives, fund certificates, model portfolios, and asset management to cater to diverse risk appetites and client needs.

“Japanese Giant, Sumitomo, Seeks Investment in Van Phong 2 LNG-to-Power Plant and Offshore Wind Projects in Khanh Hoa Province”

The Sumitomo Group has diversified its investments in Vietnam’s economy, spanning across various sectors. With a strong presence in the country, the Group has ventured into industrial parks, urban railways, power plants, and airport, logistics, and real estate projects.

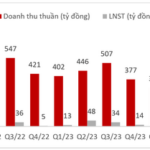

“Record-breaking Revenue and Profits: Nafoods Commences Construction of NASOCO Phase 2”

Nafoods Group (HOSE: NAF) has reported record-breaking revenue and profits for the second quarter of 2025 and the first half of the year. Along with this impressive financial performance, the company is also embarking on an expansion journey with the second phase of the Nasoco project, positioning itself to capitalize on future growth opportunities.

The Greener Industrial Park: Unveiling the $126 Million Transformation in Tay Ninh

On the morning of August 9, the People’s Committee of Tay Ninh Province inaugurated the Infrastructure Investment Project for Thu Thua Industrial Park. This is the first new industrial park project in Tay Ninh Province since the merger of Long An and Tay Ninh, marking an important step in the local industrial development strategy for the gateway connecting the Eastern and Western regions of Southern Vietnam.