Vietnam’s stock market witnessed a surge in cash flow, driving the VN-Index to briefly surpass the 1,600-point mark during the trading session on August 11th. At the closing bell, the VN-Index climbed nearly 12 points to 1,596.86, setting a new all-time high. High trading volume persisted, with a matching value of VND44,328 billion on the HoSE.

Foreign investors continued their strong selling trend, recording a net sell-off of VND649 billion across the entire market. Here’s a breakdown:

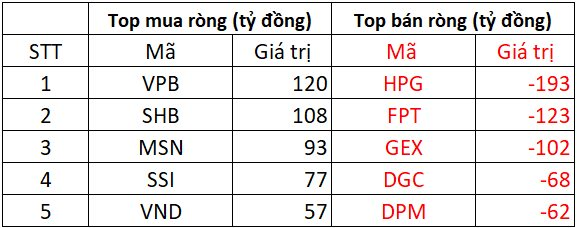

HoSE: Net foreign sell-off of over VND619 billion

On the buying side, VPB and SHB stocks witnessed the strongest net buying by foreign investors, with values of VND120 billion and VND108 billion, respectively. Following closely were MSN, SSI, and VND stocks, which saw net buying in the range of VND57-93 billion each.

Conversely, HPG stock experienced the largest net sell-off by foreign investors, amounting to VND193 billion. FPT and GEX stocks followed suit, with net sell-offs of VND123 billion and VND102 billion, respectively. Additionally, stocks like DGC and DPM faced significant selling pressure, with net sell-offs ranging from VND62 billion to VND68 billion.

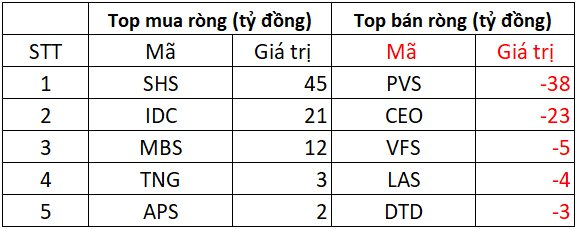

HNX: Net foreign buying of approximately VND17 billion

On the HNX, SHS stock witnessed the strongest net buying, with a value of VND45 billion. IDC and MBS stocks also attracted net buying in the range of VND12-21 billion each. TNG and APS stocks saw modest net buying of a few billion VND each.

Conversely, PVS and CEO stocks experienced net sell-offs of VND38 billion and VND23 billion, respectively. Additionally, LAS, VFS, and DTD stocks faced net selling pressure, with values ranging from VND3 billion to VND5 billion.

UPCOM: Net foreign sell-off of nearly VND47 billion

On the buying side, NCS, TV1, and MCG stocks witnessed modest net buying of a few hundred million VND each. CSI and IFS stocks also saw slight net buying on the UPCOM during this session.

Conversely, ACV and MCH stocks faced significant net selling, with values of VND21-22 billion, while VEA, MSR, and TIN stocks experienced smaller net sell-offs.

“Generous Cash Dividend Announcement: Nam Tan Uyen Shares 60% with Investors”

“Nam Tan Uyen plans to dish out nearly VND 144 billion in dividends for its shareholders, amounting to a generous 60% dividend payout ratio for the fiscal year 2024. Mark your calendars, as the registration deadline for this lucrative opportunity is set for August 25, 2025, with payments being made a month later on September 25, 2025. Don’t miss out on this chance to reap the rewards of your investments!”

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.