The Industrial Park Development and Investment Joint Stock Company Nam Tan Uyen (Stock Code: NTC, on UPCoM) has just announced the resolution of its Board of Directors regarding the 2024 dividend payment.

Specifically, the company plans to pay a 60% cash dividend for 2024, meaning that shareholders owning 1 share will receive VND 6,000. The record date for this dividend payment is August 25, 2025, and the payment will be made on September 25, 2025.

With nearly 24 million NTC shares currently circulating in the market, it is estimated that Nam Tan Uyen will have to spend nearly VND 144 billion for this dividend payout to shareholders.

Illustrative image

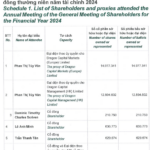

As of June 30, 2025, Phuoc Hoa Rubber Joint Stock Company owned nearly 7.9 million NTC shares and is estimated to receive more than VND 47.3 billion in dividends from Nam Tan Uyen.

In addition, the Vietnam Rubber Industry Group – Joint Stock Company will receive more than VND 19.4 billion in dividends by holding over 4.9 million NTC shares, and Saigon VRG Investment Joint Stock Company will receive over VND 28.7 billion by holding nearly 4.8 million shares.

In terms of business results, according to the second-quarter 2025 financial report, Nam Tan Uyen recorded net revenue of over VND 143.2 billion, 2.1 times higher than the same period last year. After deducting expenses and taxes, the company reported a net profit of over VND 97.2 billion, an increase of 47.9%.

For the first six months of 2025, Nam Tan Uyen’s net revenue reached over VND 277.3 billion, up 124.2% compared to the same period in 2024, and after-tax profit was nearly VND 166.3 billion, an increase of 27%.

As of June 30, 2025, the company’s total assets decreased by 16.2% compared to the beginning of the year, to nearly VND 6,164.1 billion. Holdings to maturity decreased by 69.9% to VND 535.3 billion, accounting for 8.7% of total assets, while long-term prepaid expenses accounted for 72.5% of total assets, amounting to nearly VND 4,469.8 billion.

On the liability side of the balance sheet, total liabilities were nearly VND 4,888.8 billion, a decrease of 21.7%. Loans and finance leases accounted for 19.5% of total liabilities, at nearly VND 951.1 billion, while unearned revenue accounted for 76.2% of total liabilities, at nearly VND 3,725.3 billion.

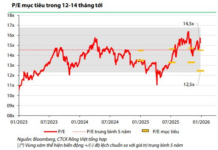

The Flow of Capital: Navigating the New Uptrend in the VN-Index

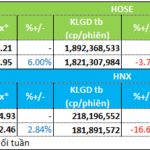

After a week of adjustments and corrections from July 28 to August 1, the Vietnamese stock market entered a new phase of growth in the week of August 4–8. However, the money flow exhibited a strong differentiation, even within individual sectors.

What’s Happening with FPT: Foreigners Sell for 12 Straight Sessions, Record High Room of 140 Million Shares Despite High Profit Growth

Despite the stock market’s relentless surge to new highs, FPT stock has lagged, falling 20% from its mid-January peak.