Institutions are the foundation of the “economic house” |

In sports, a game is only truly exciting and fair when the rules are clear, consistently applied, and all teams abide by them equally, competing to the best of their abilities. The same goes for the economy.

Institutions are the rules of the economic game – clearly defining who can do what, how it should be done, and where the limits lie. When the rules are transparent, stable, and fair, all businesses – big and small – have the opportunity to thrive, compete on a level playing field, and contribute to the country’s prosperity.

Resolution 68-NQ/TW of the Politburo affirmed: “The private sector is the most important driving force of the socialist-oriented market economy”. But this driving force can only be fully unleashed when institutions are sufficiently open, transparent, and stable to protect and encourage the entrepreneurial spirit.

General Secretary To Lam and Prime Minister Pham Minh Chinh have repeatedly emphasized that institutions are the breakthrough of breakthroughs, but they are currently a bottleneck; and requested that by 2025, the removal of “bottlenecks” caused by legal regulations must be basically completed.

Why, among all the breakthrough solutions, are institutions the most important pillar?

Why are institutions the most important pillar?

First, institutions are the foundation of the “economic house”. A strong foundation will enable other pillars – capital, technology, human resources, and infrastructure – to reach their full potential. Conversely, if the foundation is weak, all investment and innovation efforts may collapse. International experience shows that countries with strong institutional reforms, such as New Zealand and Denmark, consistently rank high in global competitiveness.

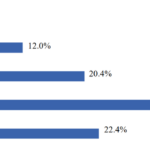

Second, institutional reform helps to address root causes. Most of the private sector’s difficulties – from cumbersome procedures, red tape, access to land, to informal costs – stem from institutional shortcomings. VCCI’s 2023 PCI report reveals that 59% of businesses still face obstacles due to unclear legal regulations, and 41% experience informal costs.

Third, good institutions create a strong spillover effect. True competitive equality can only be achieved with fair rules. Businesses will have easier access to capital when the legal framework for the financial market is streamlined. Innovation will flourish when institutions encourage R&D and protect intellectual property rights. OECD research indicates that a competitive equal environment can boost enterprise productivity by an average of 20% over five years. In Israel, a strict intellectual property protection system has attracted many international technology corporations to establish R&D centers, contributing to high-tech exports of over 40% of total exports.

Lessons from developed countries are clear evidence. South Korea in the 1960s enacted a series of reforms in investment, trade, and industrial laws, while simplifying import and export procedures, increasing exports from $55 million (1962) to over $10 billion (1977). Singapore, from a small port in 1965, built a transparent institutional system, an efficient electronic customs clearance procedure, and ensured property rights, ranking first globally in the ease of doing business index for many years. Israel, since the 1990s, has implemented a legal framework that encourages startups, provides tax incentives for R&D, and establishes matching funds for startups, earning its title as the “Startup Nation” with over 6,000 high-tech companies, contributing about 15% of its GDP.

All this evidence proves that: institutions are not just one pillar, but the fundamental pillar that determines the strength and scope of the private sector.

How to succeed in institutional reform?

Institutional reform can only succeed when certain critical conditions are met, with political determination being the key starting point. In all successfully reformed countries, from Singapore and New Zealand to Estonia, the role of the top leader has been decisive. Strong commitment at the highest level helps maintain the reform trajectory despite political changes or pressure from interest groups.

Institutional reform is not just about serving a group of businesses, but about opening doors of opportunity for all people with legitimate aspirations to get rich. |

Singapore in the 1960s and 1970s is a classic example: Prime Minister Lee Kuan Yew resolutely changed numerous regulations, creating a conducive investment environment, raising average income from about $500 to over $4,000 in just two decades. In Vietnam, the mindset needs to shift from “managing” to “enabling” – the state should act as a pathfinder rather than merely a controller.

Reform must focus on the biggest bottlenecks, instead of being scattered. Areas such as investment procedures, land access, business conditions, construction permits, and public procurement account for 60-70% of the total administrative processing time for businesses (according to PCI 2023). Addressing the right bottleneck can have an immediate effect. In fact, when the business registration procedure was reduced from 34 days to 6-7 days in 2015, the number of newly established enterprises increased by more than 25% in just one year.

Additionally, laws must be designed to be transparent, understandable, and enforceable. A “less is more” legal framework will prevent overlaps and contradictions, giving businesses confidence in long-term investment planning. International experience shows that countries with stable legal systems attract 30% more FDI than the average (WEF). New Zealand is a prime example, maintaining a concise legal system, uniformly applied nationwide, and always consulting the business community from the drafting stage.

However, good laws are meaningless if enforcement is poor. UNDP’s 2021 report indicates that in many countries, 50-60% of procedural reforms are nullified in the implementation phase due to delays or arbitrary application by some officials. Estonia’s experience is worth noting: the country has not only digitized all procedures but also made public data on licensing, bidding, land allocation, etc., for citizen and media oversight, significantly reducing negative factors and vested interests.

Lastly, social consensus and effective communication are indispensable. Institutional reform often touches the interests of certain groups, leading to covert opposition. OECD research shows that reforms with well-planned communication campaigns are 20-30% more likely to be accepted and sustained long-term. Japan, when reforming its labor market, organized hundreds of dialogues with industry associations and transparently communicated objectives and benefits through the media, thus reducing opposition pressure.

In conclusion, successful institutional reform is the result of strong political determination, focusing on the right breakthroughs, designing transparent laws, strict enforcement, and gaining broad social consensus. This is the path proven by global practices – and also the path Vietnam should steadfastly follow to turn institutions into a solid pillar for private sector development.

Institutional reform is the golden key to developing the private sector |

Sea Chart & Ship

Institutions and the private sector are like a sea chart and a ship. No matter how strong the ship is or how brave the sailors are, it is difficult to set sail without an accurate sea chart or a channel full of underwater rocks. Transparent and open institutions are the right sea chart, paving the way for the ship of Vietnam’s private sector to sail the high seas.

We reform institutions not just to serve a group of businesses, but to open doors of opportunity for all people with legitimate aspirations to get rich.

“A strong nation is one where all people have the opportunity to get rich legitimately, and all businesses can venture out into the open sea.”

Commitment to the Future

Institutional reform is the golden key to developing the private sector. When the rules of the game are clear, transparent, and strictly enforced, we will witness a wave of private enterprises rising, bringing Vietnamese brands to all continents.

This is not just an economic choice – it is a historical mission to turn the aspiration of “a rich, strong, prosperous, and happy country with prosperous people” into reality.

Dr. Nguyen Si Dung

The Crypto Conundrum: Unraveling the Future of Digital Asset Exchanges

The Ministry of Finance is finalizing a pilot project for the crypto asset market. This development comes after a thorough examination of international experiences and domestic realities. The proposal is currently under review by the government, which will then be reported to the Politburo for approval to proceed with a pilot, complete with a transparent roadmap and clear criteria.

“Challenges Abound, but Business Confidence Remains Shaky”

The Business Confidence Survey for 2025, conducted by the Private Economic Development Research Board (Board IV), reveals a faltering business sentiment amid “headwinds” from the global economy and persistent old challenges.

“Techcombank – Revolving Leadership, Optimizing the Power of the Ecosystem”

As of August 1st, 2025, the Techcombank – One Mount – Masterise Group ecosystem underwent a strategic shift with a leadership transition. This move underscores the ecosystem’s commitment to harnessing the synergy of finance and technology, solidifying its pledge to accompany the nation’s digital transformation journey by leveraging the pillar of talent.

The Art of Drafting: Crafting a Compelling Title for “Finalizing the Draft Decree on Policies for Officers during the Streamlining of Apparatus”

According to Minister Pham Thi Thanh Tra, regarding policies for officers, civil servants, and public employees in the context of organizational restructuring, the Ministry of Home Affairs has finalized the draft decree. The decree has been reported to the Party Committee and the Government’s Steering Committee for a report to the Politburo in the nearest time.

The Rise of Binh Duong: No Longer a Backwater in Economic Development

The southern region of Binh Duong Province is envisioned to become a dynamic, multi-sector economic hub, with a particular focus on trade and services. This strategic shift underscores the province’s commitment to economic diversification and improving the quality of life for its residents. By not solely relying on industrial development in the north, Binh Duong demonstrates its forward-thinking approach to creating a well-rounded and prosperous future for all.