The VNMITECH index comprises constituent stocks (a minimum of 30 and a maximum of 50) selected from the VNMAT, VNIND, and VNIT sector index constituent lists, subject to screening criteria.

The screening process follows a set order, starting with the stock lists from the three sector baskets. Stocks are then filtered based on market capitalization (minimum of VND 1,500 billion in step 1), followed by average matched trading value (a minimum of VND 20 billion/day in step 2). Finally, the official portfolio is selected, comprising a maximum of 50 and a minimum of 30 stocks (step 3).

If the number of stocks after step 2 is less than 30, additional stocks with the largest market capitalization will be included (prioritizing higher matched trading value when market capitalization is equal) from the list of stocks that meet the step 1 criteria.

The VNMITECH price index is calculated based on market capitalization adjusted for free-float, with capitalization limits applied to individual stocks and groups of stocks selected from the VNMAT basket. The index also incorporates liquidity weight limits for stocks. The price index is calculated in real-time and published every 5 seconds during trading hours.

The VNMITECH Total Return Index (TRI) is derived from the VNMITECH price index and reflects price changes and dividends of constituent stocks reinvested in the index. The total return index is calculated once and published at the end of the trading day.

According to HOSE data, VNMAT currently comprises 42 stocks with over 17 billion shares outstanding and a total market capitalization of nearly VND 500 trillion. Notable stocks include HPG, GVR, and DGC. VNIND consists of 74 stocks with nearly 13 billion shares outstanding and a total market capitalization of almost VND 450 trillion, including REE, GEX, and VTP. VNIT comprises 5 stocks – FPT, DGW, ELC, CMG, and ICT – with a combined market capitalization of nearly VND 180 trillion and over 2 billion shares outstanding.

On the other hand, VN50 Growth includes 50 stocks selected from the VNAllshare constituent list, meeting specific screening criteria. HOSE currently has 312 stocks in the VNAllshare basket, with a total market capitalization of nearly VND 5.7 trillion.

The stock screening process involves two steps: selecting stocks with a minimum market capitalization of VND 2,000 billion and a minimum matched trading value of VND 20 billion/day (step 1), and then determining the official and reserve index baskets (step 2). The 50 stocks with the largest market capitalization are included in the official index basket, while the next 10 stocks with the largest market capitalization are selected for the reserve index basket. When market capitalizations are equal, priority is given to stocks with higher matched trading value.

The VN50 Growth price index is calculated based on market capitalization adjusted for free-float, with capitalization limits applied to individual stocks and groups of stocks in the same industry. The index also incorporates growth weight limits for stocks. The price index is calculated in real time and published every 5 seconds during trading hours.

The base index value for both new indices is set at 1,000. The indices will be reviewed periodically (semi-annually in January and July) on the last trading day of December and June. Updates will be made quarterly (in January, April, July, and October) on the last trading day of the respective months, including adjustments to free-float ratios, circulating volume, capitalization limits, growth weight limits for stocks in VN50 Growth, or liquidity weight limits for stocks in VNMITECH.

Between the data cut-off date and the effective date, the official and reserve index baskets will be updated to exclude stocks that are under warning for violations of information disclosure regulations, under control, restricted in trading, temporarily suspended from trading (except for temporary suspensions due to corporate events lasting less than 30 trading days), or subject to trading halts or delisting.

The introduction of these two new indices is expected to diversify the index system, enhance market representativeness, and cater to the evolving investment needs of Vietnam’s financial market.

Huy Khai

– 15:17 12/08/2025

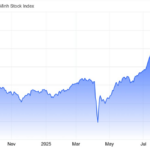

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.

TNG Issues Over 6 Million ESOP Shares at VND 10,000 Each, with the Chairman’s Family Planning to Purchase Nearly 40%

The Hanoi-based Investment and Trading Joint Stock Company TNG (HNX: TNG) plans to offer over six million shares to its employees and stakeholders at a discounted price of 10,000 VND per share, which is significantly lower than the current market price. This move will see the company’s Chairman, Nguyen Van Thoi, and his two sons being offered nearly 40% of this allocation.

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.

“A Plethora of Policies Support Vietnam’s Stock Market Surge to All-Time Highs”

The government and regulatory policies are fueling a new impetus, ushering in a prospective growth cycle for the stock market. With an aim to attract high-quality domestic and foreign capital, these policies are poised to foster the development of businesses and the economy alike.