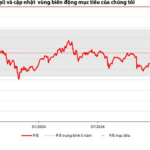

Market liquidity decreased compared to the previous week’s session but remained above the 20-session average. The matched trading volume of the VN-Index reached nearly 1.6 billion shares, equivalent to a value of more than 44 trillion dong; HNX-Index recorded nearly 164 million shares, equivalent to a value of 3.8 trillion dong.

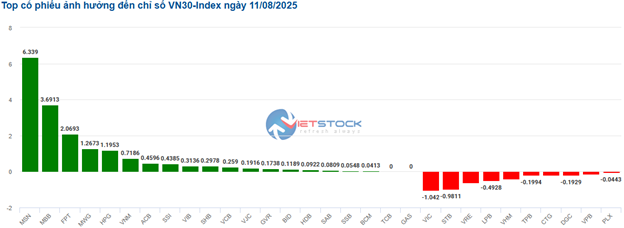

Profit-taking pressure remained as the VN-Index approached the 1,600-point mark, causing the index to fail to successfully surpass this psychological resistance level. In terms of impact, MSN, GVR, and MBB were the stocks with the most positive influence, bringing in nearly 6 points for the VN-Index. In contrast, the duo of VIC and VHM significantly hindered the overall upward momentum, taking away 2.5 points from the index.

| Stocks with the Most Impact on VN-Index |

Meanwhile, the HNX-Index performed more positively in the afternoon session, expanding its gains and closing near the session’s high. Today’s notable active traders included IDC (+7.84%), CEO (+1.95%), SHS (+4.27%), MBS (+1.11%), VFS (+2.17%), TNG (+4.19%), L14 (+2.79%), and NTP (+1.69%)…

| Stocks with the Most Impact on HNX-Index |

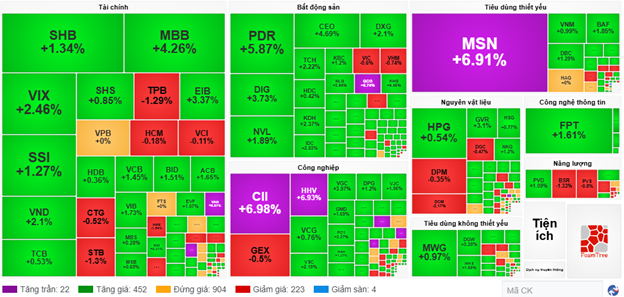

Most sectors closed in positive territory, with essential consumer goods leading the market. Notable performers included MSN, which hit the ceiling price, MCH (+3.79%), VNM (+1.15%), and BAF (+1.71%). This was followed by materials, media & publishing, and financial sectors, all rising by more than 1%. Conversely, energy was the worst-performing sector in the first session of the week, mainly due to adjustments in stocks like BSR (-1.56%), PLX (-0.65%), PVS (-0.8%), PVT (-0.79%), PLX (-0.65%), and PVB (-1.9%).

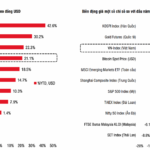

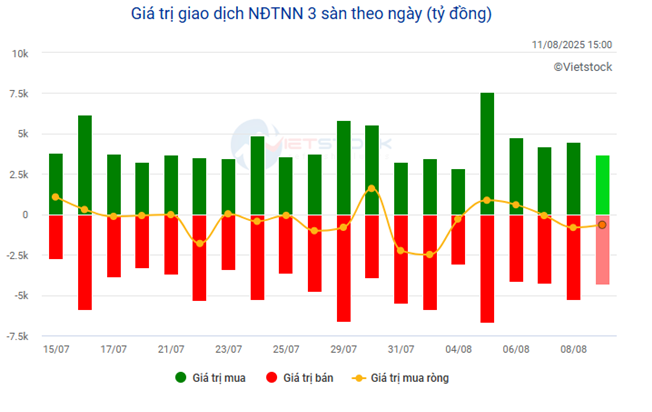

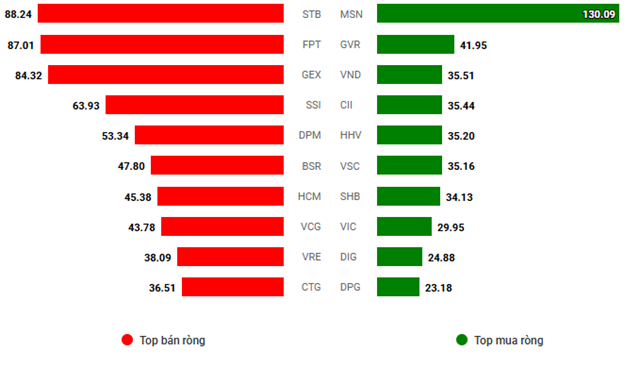

In terms of foreign trading activities, foreign investors continued to net sell over 626 billion dong on the HOSE exchange, focusing on HPG (192.97 billion), FPT (122.92 billion), and GEX (102.14 billion). On the HNX exchange, foreign investors net bought for the sixth consecutive session, with a value of nearly 22 billion dong. SHS was the top stock purchased by foreign investors, with a net buy value of 45.1 billion, followed by IDC with 20.69 billion.

Source: VietstockFinance

|

11:30 AM: Fluctuating around the 1,600-point mark

The market maintained its positive momentum until the end of the morning session, but there was a tug-of-war around the 1,600-point level. At the midday break, the VN-Index gained over 15 points (+0.98%), climbing to 1,600.41 points; HNX-Index also rose by 0.86%, reaching 274.81 points. The market breadth was positive, with 459 advancers, 265 decliners, and 846 unchanged stocks.

In terms of impact, GVR and MSN were the two stocks with the most positive influence, contributing about 2 points each to the VN-Index. Additionally, MBB, VCB, and VIC also added a total of more than 4.5 points to the overall index. On the other hand, CTG and VRE were the stocks with the most negative influence, taking away 0.7 points from the index.

Looking at sector performance, most sectors traded in positive territory, with essential consumer goods temporarily leading the market in the morning session. Notable performers in this sector included VHM (+1.15%), MCH (+2.35%), MML (+1.57%), BAF (+1.57%), TID (+2.2%), and MSN, which hit the ceiling price.

Moreover, the industrials and real estate sectors also witnessed active trading as buying interest concentrated on stocks such as CII, HHV, GEE, SAM, VGC, HTN, and G36, which all hit the ceiling price, along with VSC (+3.19%), PC1 (+2.27%); DIG (+2.63%), PDR (+5.16%), CEO (+3.52%), IDC (+4.79%), KHG (+2.99%), and QCG, which also hit the ceiling price.

On the flip side, the energy and healthcare sectors continued to struggle, with selling pressure dominating the large-cap stocks in these sectors. Specifically, in the energy sector, selling pressure was observed in BSR (-1.11%), PLX (-0.65%), PVS (-0.8%), MVB (-2.17%), PVC (-0.75%), and PVB (-1.9%). As for the healthcare sector, selling pressure was seen in IMP (-1.11%), PMC (-2.23%), DP1 (-1.6%), and TTD (-11.58%).

| Stocks with the Most Impact on VN-Index |

Foreign investors remained net sellers, offloading a total of 648.13 billion dong across all three exchanges. The selling pressure was concentrated on STB, FPT, and GEX, with net sell values ranging from 84 to 88 billion dong. In contrast, MSN topped the net buy list, with a net buy value of 130.09 billion dong, far exceeding the net buy values of other stocks.

Source: VietstockFinance

|

10:30 AM: VN-Index surpasses 1,600 points

VN-Index once again set a new record by reaching the 1,600-point milestone, marking a historic moment in the Vietnamese stock market.

As of 10:30 AM, the market maintained its positive momentum, with the VN-Index surpassing the 1,600-point level, trading at 1,600.41 points. The HNX-Index also rose by more than 2.8 points, climbing to 275.36 points.

Within the VN30-Index basket, the number of gainers slightly outnumbered the decliners. Notably, MSN, MBB, and FPT contributed the most to the VN30 index, adding 6.3 points, 3.7 points, and 2.1 points, respectively. On the other hand, VIC and STB faced selling pressure, taking away about 2 points from the overall index.

Source: VietstockFinance

|

Most sectors traded in positive territory, with essential consumer goods attracting strong buying interest. Notable performers in this sector included MSN, which hit the ceiling price, MCH (+3.25%), MML (+1.12%), BAF (+1.57%), DBC (+1.45%), and VLC (+1.25%).

Following closely was the media & publishing sector, which also contributed significantly to the market’s gains. Stocks in this sector that performed well included VGI (+2.25%), CTR (+1.38%), SGT (+3.6%), and VNB (+1.04%)

In contrast, energy and healthcare were the only two sectors that ended in negative territory, with selling pressure dominating these sectors. Specifically, in the energy sector, selling pressure was observed in BSR (-1.11%), PLX (-0.65%), PVS (-0.8%), and MVB (-2.17%). Similarly, in the healthcare sector, selling pressure was seen in IMP (-1.11%), PMC (-2.23%), DP1 (-1.6%), and TTD (-11.58%).

Compared to the opening, the buying side continued to dominate. There were 452 advancing stocks and 223 declining stocks.

Source: VietstockFinance

|

9:30 AM: Positive Start

The Vietnamese stock market started the week on a positive note, with the VN-Index surpassing the 1,590-point level shortly after the opening bell. However, the downward pressure from a few large-cap stocks narrowed the gains. As of 9:30 AM, the VN-Index gained nearly 3 points, reaching 1,587.99 points, while the HNX-Index traded around the 275-point level.

MSN was the leading stock in the early session, contributing 1.2 points to the VN-Index. On the other hand, the duo of VIC and VHM faced selling pressure, taking away nearly 2 points from the index.

In terms of sector performance, the media & publishing sector temporarily led the market, thanks to the positive trading of VGI (+2.62%), CTR (+0.64%), VNB (+3.65%), and YEG (+1%). Following closely was the essential consumer goods sector, with notable gainers including MSN (+4.69%), MCH (+1.35%), DBC (+1.29%), VNM (+0.66%), MML (+1.57%), and VLC (+1.25%)…

On the flip side, the real estate sector struggled to gain momentum due to the downward pressure from the Vingroup trio: VIC (-0.6%), VHM (-1.05%), and VRE (-1.5%). Although most other stocks in this sector traded in positive territory, with many even hitting the ceiling price, such as NVL (+2.43%), KDH (+2.37%), KBC (+2.56%), DXG (+3.27%), PDR (+6.34%), TCH (+2.42%), and CEO (+5.86%).

TNG Issues Over 6 Million ESOP Shares at VND 10,000 Each, with the Chairman’s Family Planning to Purchase Nearly 40%

The Hanoi-based Investment and Trading Joint Stock Company TNG (HNX: TNG) plans to offer over six million shares to its employees and stakeholders at a discounted price of 10,000 VND per share, which is significantly lower than the current market price. This move will see the company’s Chairman, Nguyen Van Thoi, and his two sons being offered nearly 40% of this allocation.

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.