Binh Son Petroleum Refinery Joint Stock Company (BSR) has just announced an extraordinary disclosure regarding seeking shareholders’ approval in writing regarding the approval of BSR’s charter capital increase plan and other matters within the competence of the General Meeting of Shareholders.

The record date for fixing the list of shareholders is August 28, 2025. The time for collecting opinions will take place from September 9 to September 30, and the vote counting day is expected to be October 1.

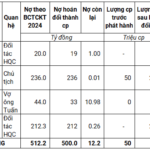

Previously, on December 24, 2024, the Vietnam National Oil and Gas Group (Petrovietnam – PVN) approved the plan to increase the charter capital of Binh Son Petrochemical to over VND 20,000 billion, from VND 31,000 billion to VND 50,073 billion (equivalent to nearly USD 2 billion), an increase of 61.5%.

The capital increase plan can be implemented through the issuance of bonus shares and dividend payment in shares, using the source from the Development Investment Fund and undistributed post-tax profits.

According to BSR, the increase in charter capital is an urgent requirement to meet the capital needs and improve the efficiency of the Project for Upgrading and Expanding the Dung Quat Oil Refinery – an important project that has been approved by the Prime Minister for investment policy.

The project’s goal is to increase the plant’s production capacity to 171,000 barrels/day, diversify input materials, ensure stable and long-term supply, optimize production costs, and enhance competitiveness.

Regarding business operations, in the report at the conference to review the work in the first 6 months of 2025 of Petrovietnam, BSR said that the company’s output in the first half reached more than 3.84 million tons of products, exceeding the plan by 16%. Consumption volume reached 3.83 million tons (up 17% over the plan).

Total revenue recorded at the company reached more than VND 69,365 billion, up 22% over the plan. Pre-tax profit is estimated at about VND 800 billion, up 93% over the plan, and the state budget contribution reached VND 7,411 billion, up 13% over the plan.

As of June 30, 2025, BSR’s total assets reached more than VND 84,000 billion. The company’s cash and bank deposits were about VND 42,000 billion. Inventories decreased by 25% over the beginning of the period, to more than VND 11,800 billion.

Construction in progress increased by 22%, to more than VND 1,640 billion, mainly in costs for the Dung Quat Oil Refinery Upgrade and Expansion Project. Meanwhile, short-term debt was just under VND 26,800 billion, down 16% from the beginning of the year, of which VND 11,300 billion was loan debt.

According to the assessment of Vietnam Joint Stock Commercial Bank for Industry and Trade Securities Company (VCBS), BSR’s prospects are positive thanks to the completion of the refinery’s maintenance, increasing gasoline demand, recovering Asian oil refining profit margins, and the E10 gasoline regulation from 2026, which will increase ethanol demand, providing long-term growth opportunities.

“A Challenge for Petrovietnam: Aiming for a Top 5 Spot Among Southeast Asian Enterprises”

On August 3, in Hanoi, Comrade Pham Minh Chinh, Politburo member, Secretary of the Government Party Committee, and Prime Minister of Vietnam, attended and directed the 4th Congress of the Party Committee of the Vietnam National Oil and Gas Group (Petrovietnam) for the 2025-2030 term.

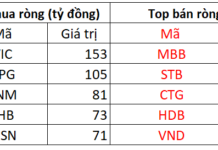

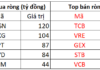

MBB Stock Surges Ahead of Dividend Payout

Military Commercial Joint Stock Bank (MB, HOSE: MBB) has announced that August 14th is the ex-dividend date for shareholders to receive a combination of stock and cash dividends for the fiscal year 2024. Ensure you are a shareholder by the end of the trading day on August 13th to be eligible for this dividend payment.

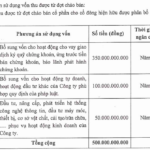

“ASEANSC Offers 50 Million Shares to Boost Capital to VND 1,500 Billion”

AseanSc is proud to announce that it is seeking shareholder approval for a proposed sale of 50 million shares. This move is part of our ambitious plans to raise our capital to 1,500 billion VND. We are confident that this decision will drive our company’s growth and open up new avenues for expansion.