Q2 Records-breaking Revenue and Profit

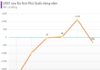

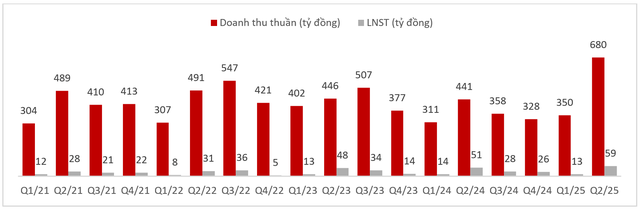

In Q2 2025, Nafoods Group achieved remarkable results with record-high revenue of over VND 680 billion, a 54% increase compared to the same period last year. This growth is attributed to the strong performance across all business segments, driven by flagship products such as passion fruit, crispy jackfruit, and dragon fruit.

Illustrative image

Gross profit reached VND 170.8 billion, a 25.5% increase compared to the previous year. While the gross profit margin decreased by 5.8 percentage points to 25.1%, it showed significant improvement from the previous quarter’s 16.9%. Net profit after tax amounted to VND 58.7 billion, a 14.7% increase year-on-year, marking the highest quarterly net profit since the company’s inception.

On track with Semi-annual Financial Targets

Nafoods Group also witnessed record-breaking semi-annual revenue and net profit. Specifically, in the first six months, the company’s revenue reached nearly VND 1,030 billion, a 37% increase compared to the same period last year. Gross profit neared VND 230 billion, a slight increase of 0.7% year-on-year. Selling and management expenses decreased by 24.1% and 2.4%, respectively. As a result, net profit after tax stood at VND 71.6 billion, an 11.9% increase compared to the previous year.

With these impressive results, Nafoods Group has accomplished 51.9% and 53.0% of its annual revenue and net profit targets, respectively, in just the first half of the year.

Illustrative image

Leverage Increases: Securing a $6 Million Investment from a Reputable Swiss Investment Fund

As of June 30, 2025, the company’s total assets amounted to over VND 2,586 billion, a 27.5% increase from the beginning of the year. Short-term assets reached nearly VND 1,532 billion, a significant 54% increase, mainly due to higher accounts receivable and inventory levels. Long-term assets stood at nearly VND 1,055 billion, a slight 1.6% increase compared to the beginning of the year.

On the liabilities side, the company’s total liabilities amounted to nearly VND 1,555 billion, a 49% increase from the start of the year. Shareholders’ equity, as of the end of Q2 2025, was VND 1,031 billion, a modest 4.7% increase. The debt-to-equity ratio stood at 1.51, a notable increase from 1.06 at the end of the previous year.

In its Q2 2025 Investor Newsletter, Nafoods announced that after a rigorous evaluation process lasting nearly a year, the company signed a contract on June 30, 2025, to secure a $6 million secured loan from ResponsAbility Investments AG (RIAG), a reputable Swiss investment fund focusing on sustainable impact investing in emerging and developing markets.

“The receipt of investments from reputable international financial institutions, such as RIAG, IFC, and Finnfund, underscores Nafoods’ credibility, transparent governance, robust financial health, and commitment to sustainable development. It also testifies to the company’s long-term growth potential and its ability to positively impact the environment and community,” stated Nafoods in its Investor Newsletter.

Nasoco Project – Phase 2 Construction Commencement

During the quarter, Nafoods also held a groundbreaking ceremony for the Nasoco Project – Phase 2 in Tay Ninh (formerly known as Long An) province. This project is expected to enhance the company’s capacity for deep processing of key industrial products, such as concentrated juice, puree, and IQF, for the international market. Additionally, it opens up opportunities to develop new product lines that cater to domestic consumption and demanding markets like Europe, North America, Japan, and South Korea.

Stock Price Surges towards Historical Peak

Illustrative image

In the stock market, NAF shares have been on a remarkable upward trajectory, with strong price increases and impressive liquidity in recent times, reflecting investors’ growing interest. On August 1, 2025, NAF closed at VND 26,950 per share, a 35% increase since the beginning of the year and a nearly 60% surge compared to the time of the US government’s tariff announcement in early April. This marks the highest price for NAF shares in over three years, dating back to November 2021.

“IDP Appoints New CEO Amidst Record Losses and Plummeting Stock Prices”

In a bid to turn around its fortunes, International Dairy Products Joint-Stock Company (IDP) has appointed Doan Huu Nguyen as its new CEO and legal representative. This move comes after the company reported a net loss of over VND 36 billion in Q2 2025, marking the first time it has fallen into the red in its history. Nguyen replaces Bui Hoang Sang, who took on the role just over a year ago.

The Greener Industrial Park: Unveiling the $126 Million Transformation in Tay Ninh

On the morning of August 9, the People’s Committee of Tay Ninh Province inaugurated the Infrastructure Investment Project for Thu Thua Industrial Park. This is the first new industrial park project in Tay Ninh Province since the merger of Long An and Tay Ninh, marking an important step in the local industrial development strategy for the gateway connecting the Eastern and Western regions of Southern Vietnam.

The Capital’s Conundrum: Two Decades and the Urban Project Remains Stuck in Limbo

The approved land area for compensation and site clearance for the Chi Dong New Urban Area project spans approximately 70 hectares. Even after two decades, 17.35 hectares of land earmarked for this project remain uncleared.