Multiple Factors Boost Investor Confidence

According to the latest report from SGI Capital, after a strong buying spree in the first half of July, foreign investors resumed net selling as the VN-Index surpassed the 1,500 mark, resulting in a net buying value of just over VND 8,500 billion. The net selling trend has continued and intensified in August as the VN-Index approached the 1,600 level. Meanwhile, most ETFs experienced net outflows, and the net selling trend was observed in most Asian stock markets.

SGI noted that there were no clear signs of foreign capital inflows ahead of the market upgrade, and the excitement and expectations were primarily driven by domestic capital. With liquidity surging to $2 billion per session, foreign capital inflows related to the market upgrade, ranging from $1-3 billion, would not significantly alter the supply-demand balance.

This month, domestic capital has been pouring into the market as the VN-Index surpassed the 1,400 level, consistently pushing the index and trading volume to new highs. The belief in a strong GDP growth cycle of 8-10% annually, coupled with the upcoming market upgrade, low-interest rates, and the strongest investment promotion in years, has collectively bolstered investor confidence and enthusiasm. This contrasts with the sentiment four months ago when Vietnam was unexpectedly hit with high tariffs by the US.

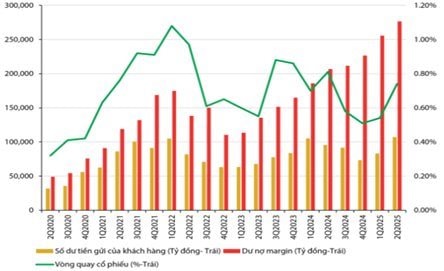

Cash balance in accounts is being outpaced by margin balance, source: SGI Capital.

SGI Capital suggested that the stock market’s recent appeal has attracted funds from other investment channels, such as real estate and digital assets. Along with the surge in liquidity, the use of margin has also surpassed the 2022 peak. However, the cash balance in investor accounts has been increasing at a slower pace and has not yet surpassed the 2022 peak, indicating a potential risk factor.

In summary, the Vietnamese stock market has witnessed an impressive 45% growth in the past four months, pushing valuations to the ten-year average. Some sectors and stocks have surged to expensive levels, prompting selling by investors as daily trading volume reaches 3-5% of market capitalization. Conversely, there are still attractively valued stocks for investors to choose from during this period of low-interest rates and the upcoming market upgrade.

” As many positive factors are already reflected in stock prices, careful stock selection and risk management should be given higher priority ,” emphasized the SGI team.

Prolonged Low-Interest Rates May Trigger Liquidity, Exchange Rate, and Bad Debt Risks

On the macroeconomic front, SGI pointed out that the strong credit growth in the first seven months of the year has made sensitive interest rates, such as the overnight interbank rate and government bond yields, heat up. Despite the State Bank of Vietnam (SBV) injecting more than VND 200,000 billion through open market operations (OMO) and providing 0% loans to support banks’ restructuring, the interbank interest rate has continued to rise and remained above 5% in recent weeks.

Source: SGI Capital

The rapid credit growth, coupled with slow deposit mobilization due to unattractive interest rates, is forcing some banks to seek high-cost liquidity in the interbank market. With the economic growth target set at 8.3-8.5% for this year, credit growth is expected to reach around 18-20%.

Liquidity pressure will continue to mount in the remaining months of the year, putting pressure on deposit interest rates to ensure sufficient capital for credit activities. The gap between deposits and credit is widening, posing the most significant challenge for the banking system in the last months of this year and in 2026 if it aims to maintain high growth while keeping interest rates stable.

Another noteworthy point is that the VND is still depreciating against the USD, despite the high interbank interest rates, a weak USD Index, and the favorable tariff rates imposed by the US on Vietnamese goods compared to major competitors like China and India.

SGI assessed that the Fed’s upcoming rate cut and the weak USD Index are providing short-term support for the exchange rate. However, as the VND’s depreciation nears the 4% mark, the SBV may need to shift its policy priority from monetary easing to exchange rate stability. With the current level of foreign reserves, selling USD for intervention may not be a preferred tool.

Consequently, any additional exchange rate pressure from now until the end of the year could compel the SBV to use interest rates and liquidity tightening as tools to stabilize the VND.

In a balanced and healthy macroeconomic environment, interest rates should be maintained at a level attractive enough compared to inflation to protect the value of the VND, attract foreign currency to supplement foreign reserves, and enhance the system’s liquidity.

“Prolonged ultra-low interest rates can lead to credit explosions that exceed the capacity for mobilization, impacting liquidity and putting upward pressure on interest rates. It becomes more dangerous when this borrowed money flows into speculative asset channels, driving up asset prices, causing inflation, and generating future bad debts,” SGI Capital stated.

Expert Insights: Equities Enter a Phase of Stabilization and Acceleration, with Potential Short-Term Adjustments

“With a consistent upward trajectory over the last four months, a short-term market correction in August is not out of the question. This breather could be necessary to build momentum for conquering new heights,” opined the expert.

The Vietstock Daily: Upward Momentum Persists

The VN-Index extended its winning streak for the sixth consecutive session, hovering near the upper band of the Bollinger Bands. However, the index’s movement warrants attention as it approaches the pivotal psychological resistance level of 1,600 points. A decisive breakthrough above this level, fueled by robust buying pressure, would bolster the index’s upward trajectory. Additionally, the bullish crossover on the Stochastic Oscillator and the upward trajectory of the MACD, following a buy signal, reinforce the potential for sustained upside momentum in the near term.

The Flow of Capital: Navigating the New Uptrend in the VN-Index

After a week of adjustments and corrections from July 28 to August 1, the Vietnamese stock market entered a new phase of growth in the week of August 4–8. However, the money flow exhibited a strong differentiation, even within individual sectors.