Silver prices have seen a surge, offering buyers a profitable week with a 2.5% increase.

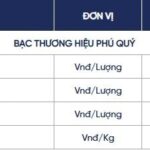

Phú Quý Group, a renowned Vietnamese gold and jewelry company, reports that the buying price of silver is VND 1,458,000 per tael, while the selling price stands at VND 1,503,000 per tael in Hanoi. Meanwhile, the 1kg silver bar trades at VND 38,879,903 (buy) and VND 40,079,900 (sell) as of 8:30 am, August 11th.

Globally, silver prices experienced a slight dip, settling at $38.1 per ounce.

Silver trades above $38 per ounce, fueled by expectations of US rate cuts and the uncertainty surrounding new tariffs.

The recent rise in jobless claims, coupled with a weaker-than-expected non-farm payrolls report, has led traders to price in a Federal Reserve rate cut for September, with another potential cut in December.

On the political front, President Donald Trump has nominated Stephen Miran, Chairman of the Council of Economic Advisers, to replace Adriana Kugler on the Federal Reserve Board of Governors. Markets are also considering reports that Fed Governor Christopher Waller, considered a moderate, could be Trump’s pick to lead the central bank, reinforcing expectations of a more accommodative policy stance.

In terms of trade, Trump’s comprehensive retaliatory tariffs took effect on August 7th, imposing rates ranging from 10% to 41% and heightening concerns about a potential drag on the US economy.

Technical analyst Christian Borjon Valencia believes that a strong buying force is necessary to surpass the crucial resistance level of $39.00 per ounce. Should this occur, silver prices could retest the year’s high of $39.52 per ounce before aiming for the psychological level of $40.00 per ounce – a threshold considered a pivotal barrier for the medium-term uptrend.

“Silver Prices Slip in Early Monday Trading; Investors Await Further US Economic Data and Dollar Reaction”

Silver prices dipped during the opening trading session of the week, both domestically and globally.

![[On Seat 47] ‘EC40 Wants to Win, Volvo Vietnam Needs to Educate Customers: Using Electric Cars Without Public Charging Stations is Normal’](https://xe.today/wp-content/uploads/2024/12/v-quote-te-100x70.jpg)