Sonadezi Long Thanh JSC (SZL) recently approved a resolution on the record date for the 2024 dividend payout.

Accordingly, Sonadezi Long Thanh plans to pay a 30% cash dividend for 2024; corresponding to each share will receive a dividend of VND 3,000. The record date is August 29, 2025, and the payment date is September 19, 2025.

With more than 27.3 million SZL shares currently circulating, the company is expected to pay out approximately VND 82 billion in dividends. SZL stocks closed at VND 45,300 per share on August 8, 2025, up 0.11% from the previous session’s close.

Illustration: SZL

With a 56.16% stake as of June 30, 2025, Sonadezi Industrial Park Development Joint Stock Company (Sonadezi, SNZ) – the parent company of SZL, is expected to receive approximately VND 46 billion in dividends in this round.

It is known that this rate was approved at the 2025 Annual General Meeting of Shareholders in April 2025. The meeting also approved the 2025 dividend payout ratio of 30%, of which 10% will be deducted from the Development Investment Fund and the remaining 20% will be deducted from the remaining funds.

In terms of business results, according to the Q2/2025 financial statements, Sonadezi Long Thanh’s net revenue reached VND 137.5 billion, up 10% over the same period in 2024.

The main business segment of industrial workshop leasing continued to play a key role, with revenue reaching VND 57.4 billion, up 21%, accounting for more than 41% of the company’s quarterly revenue.

The modest increase in cost of goods sold helped gross profit reach VND 51.4 billion, up 31% over Q2/2024.

Financial revenue decreased by 33% to VND 8.6 billion, mainly due to the decrease in interest income and dividends received.

In terms of expenses, selling and administrative expenses increased by 27% to VND 12.2 billion, leading to a 19% increase in total expenses compared to the same period last year. After deducting taxes and fees, Sonadezi Long Thanh’s net profit in Q2/2025 was VND 34.6 billion.

Accumulated in the first half of 2025, Sonadezi Long Thanh recorded net revenue of nearly VND 263 billion, up 9% over the same period, and after-tax profit reached VND 60.9 billion, up 6%.

As of June 30, 2025, Sonadezi Long Thanh’s total assets reached nearly VND 2,013 billion, up 7% from the beginning of the year. In particular, cash and cash equivalents increased sharply by 66%, to over VND 85 billion, and short-term receivables increased by 48%, to VND 116.7 billion.

On the other side of the balance sheet, total liabilities as of the end of Q2/2025 were nearly VND 1,410 billion, up 12% from the beginning of the year. Loans and finance leases stood at VND 220 billion, accounting for about 16% of total debt, equivalent to the rate at the beginning of the year.

TNG Issues Over 6 Million ESOP Shares at VND 10,000 Each, with the Chairman’s Family Planning to Purchase Nearly 40%

The Hanoi-based Investment and Trading Joint Stock Company TNG (HNX: TNG) plans to offer over six million shares to its employees and stakeholders at a discounted price of 10,000 VND per share, which is significantly lower than the current market price. This move will see the company’s Chairman, Nguyen Van Thoi, and his two sons being offered nearly 40% of this allocation.

Why the Rush to Buy Real Estate Stocks?

“The VinaCapital member fund demonstrates its confidence in the real estate sector by purchasing 850,000 KDH shares of Khang Dien House Trading and Investment Joint Stock Company. In a similar move, Mr. Pham Hong Chau, a member of the Board of Management and CEO of Van Phu – Invest Real Estate Joint Stock Company, has registered to purchase 400,000 VPI shares. This strategic acquisition will boost his stake in the company to an impressive 1.75 million shares.”

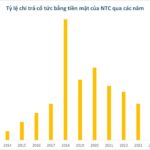

The Ultimate Guide to Dividends: Maximizing Your Returns

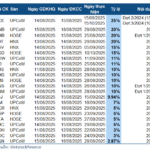

“This week, from August 11 to 15, 2025, a total of 22 companies will be finalising their dividend payments with cash, offering rates of up to 25% – meaning shareholders owning 1 common share will receive a dividend of VND 2,500.”