I. MARKET ANALYSIS OF SECURITIES ON AUGUST 12, 2025

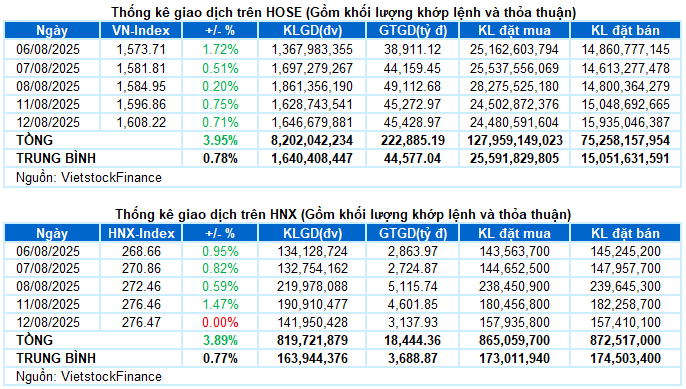

– The main indices remained in the green during the trading session on August 12. Specifically, the VN-Index increased by 0.71%, reaching 1,608.22 points. The HNX-Index barely stayed above the reference level, ending at 276.47 points.

– The matching volume on the HOSE slightly decreased by 0.4%, reaching nearly 1.6 billion units. The HNX recorded over 141 million units, a 13.9% drop compared to the previous session.

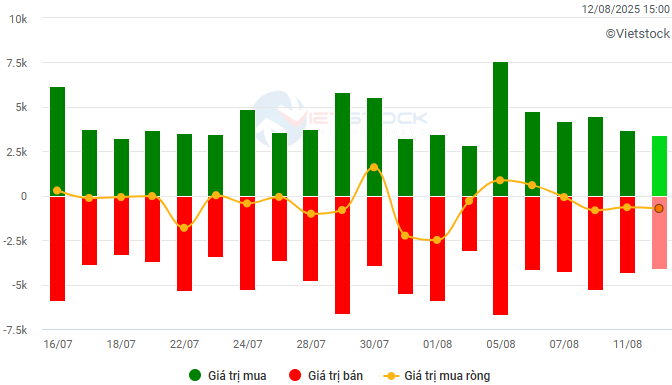

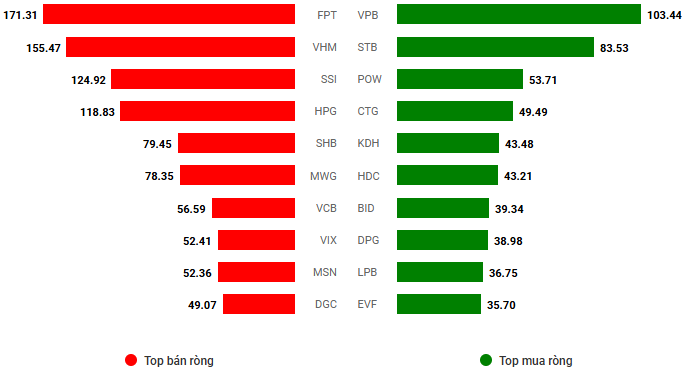

– Foreign investors continued to net sell with a value of VND 677 billion on the HOSE and nearly VND 18 billion on the HNX.

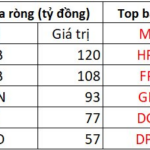

Trading value of foreign investors on the HOSE, HNX, and UPCOM. Unit: VND billion

Net trading value by stock. Unit: VND billion

– The securities market started the session on August 12 on a positive note, with the VN-Index quickly surpassing the 1,600-point threshold and maintaining its position in the first half of the morning session. However, profit-taking pressure at higher prices caused the index to reverse. From a gain of nearly 11 points, the VN-Index turned negative before the lunch break. In the afternoon session, the tug-of-war around the reference level continued until strong buying pressure returned in the late session, helping the VN-Index end its seven-day winning streak. The index closed at 1,608.22 points, up 11.36 points from the previous session.

– In terms of impact, BID and LPB made the most positive contributions, adding 2.2 points and 1.7 points to the VN-Index, respectively. They were followed by VCB, MBB, and HDB, which together contributed an additional 2.7 points. In contrast, VHM, SSI, and GEE were the most negative influences, causing the index to lose more than one point.

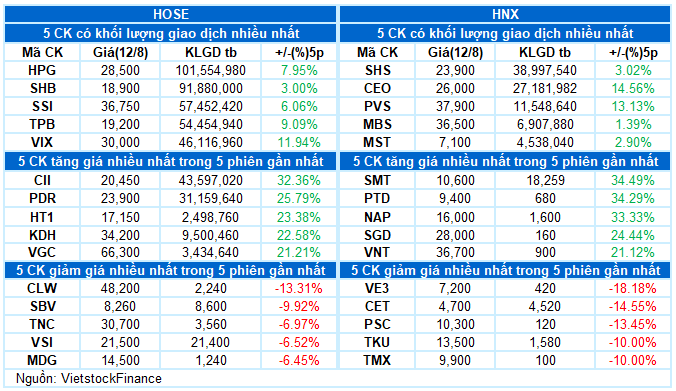

– The VN30-Index closed 0.77% higher at 1,755.25 points. The buying side maintained its dominance with 19 gainers, 9 losers, and 2 unchanged stocks. LPB topped the chart with an outstanding increase of 6.3%. It was followed by HDB and BID, which also surged by more than 3%. On the other hand, VIB and SSI were the two worst performers in the basket, falling by 2%.

The green hue persisted across most industry groups. Notably, energy stood out with a remarkable gain of 1.94%, mainly driven by BSR (+3.61%), PLX (+1.45%), PVS (+1.34%), CST (+3.95%), TD6 (+4.65%), TVD (+5.71%), and AAH, which hit the daily limit-up.

The industry group also made a strong impression today, with a series of stocks, including CII, VSC, HAH, VOS, VGC, LHC, STG, and PSP, hitting the daily limit-up. However, the overall industry index rose slightly by only 0.24% as many large-cap stocks in the industry faced significant selling pressure. Examples include ACV (-2.1%), GEX (-2%), VEF (-2.06%), GEE (-3.01%), VTP (-1.19%), and HBC (-2.33%).

On the contrary, the media and communications services group was the only one that moved against the overall market trend, falling by 1.21%. This decline was mainly influenced by adjustments in VGI (-1.35%), FOX (-1.22%), VNZ (-0.95%), and YEG (-0.99%).

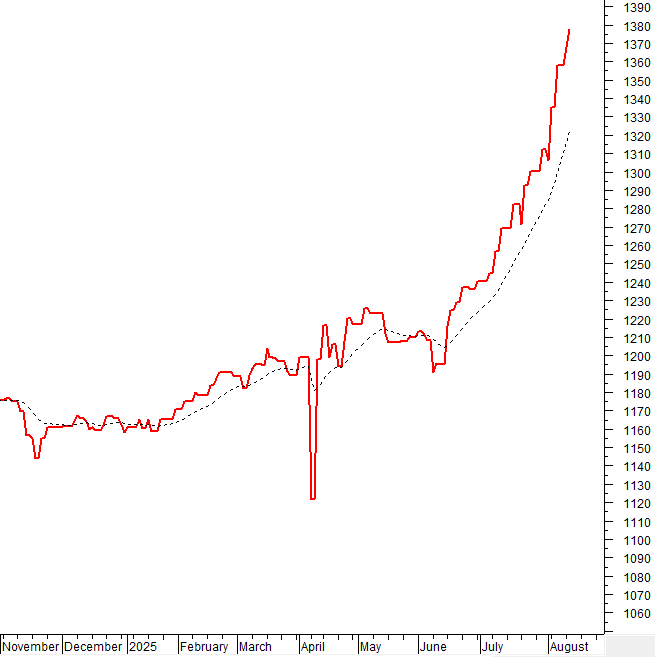

The VN-Index successfully surpassed the 1,600-point threshold despite facing strong fluctuations during the session. However, the emergence of candles with long shadows and volatile volumes in recent sessions reflects investors’ indecision. At present, the Stochastic Oscillator indicator continues to rise and ventures deeper into the overbought zone. There is a possibility of further technical fluctuations in the short term as the index advances towards new highs.

II. TREND AND PRICE MOVEMENT ANALYSIS

VN-Index – Stochastic Oscillator Indicator Enters the Overbought Territory

The VN-Index successfully broke above the 1,600-point level despite facing strong fluctuations during the session. However, the emergence of candles with long shadows and volatile volumes in recent sessions indicates investors’ hesitation.

At present, the Stochastic Oscillator indicator continues to climb and ventures deeper into the overbought zone. There may be further technical fluctuations in the short term as the index advances towards new highs.

HNX-Index – Trading Volume Drops Below the 20-session Average

The HNX-Index experienced a tug-of-war with trading volume continuing to drop below the 20-session average, indicating investors’ uncertainty.

As the index trades near its 52-week high, the Stochastic Oscillator indicator venturing deeper into the overbought zone suggests potential short-term fluctuations. Investors should remain cautious if the indicator signals a sell-off and exits this zone.

Money Flow Analysis

Changes in Smart Money Flow: The Negative Volume Index indicator of the VN-Index is currently above the 20-day EMA. If this situation persists in the next session, the risk of an unexpected thrust down will be limited.

Changes in Foreign Investment Flow: Foreign investors continued to net sell during the trading session on August 12, 2025. If foreign investors maintain this stance in the coming sessions, the situation may turn more pessimistic.

III. MARKET STATISTICS ON AUGUST 12, 2025

Economic and Market Strategy Division, Consulting Department, Vietstock

– 17:01 12/08/2025

Technical Analysis for August 11: A Silver Lining Amidst the Gloom.

The VN-Index and HNX-Index both climbed in the morning session, but the lack of significant improvement in liquidity revealed investors’ ongoing dilemma.