|

Techcombank’s CEO – Jens Lottner

|

This is Jens Lottner’s second consecutive term as Techcombank’s CEO. With over 30 years of experience in the financial and banking industries, he has worked with leading global organizations such as McKinsey & Company, Boston Consulting Group, and Siam Commercial Bank (Thailand), spending over two-thirds of his career in Asia.

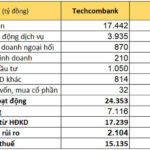

In terms of financial performance, Techcombank reported a pre-tax profit of over VND 15 trillion in the first half of 2025, with VND 7.9 trillion in the second quarter alone, marking the highest quarterly profit in the bank’s history. As of June 30, 2025, Techcombank’s total assets exceeded VND 1 quadrillion, a more than 6% increase since the beginning of the year.

On the HOSE exchange, TCB shares opened at VND 37,750 per share on August 12, 2025, up 53% since the beginning of the year. The average daily trading volume exceeded 18 million shares.

| TCB Share Price Movement in 2025 |

|

|

– 08:38 12/08/2025

The Leader’s Insider Trading: A Bold Move for LHC Shares at All-Time Highs

Amidst LHC’s record-breaking second-quarter profits and near-completion of its annual plan within just six months, the move to increase ownership among the leader’s family is a notable development.

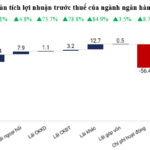

The Profit Picture: Unraveling the Complexities of Bank Groups’ Earnings

The Q2 report reveals a 17% growth in profits for commercial banks compared to the previous year. This is an encouraging figure, yet it masks a significant disparity in the performance of individual banks. A closer look at the numbers reveals a wide gap in provisioning policies, which warrants further investigation and raises several concerns.