The Prime Minister chairs the regular July 2025 meeting of the Government (Photo: Government Portal)

The Government has just issued Resolution No. 230/NQ-CP on the regular meeting of the Government in July 2025 and the teleconference between the Government and localities.

According to the Resolution, in July, the world situation is forecast to continue to fluctuate complexly and unpredictably, with risks increasing. Domestically, although many sectors and fields continue the recovery and positive prospects; many policies and solutions to remove difficulties and obstacles have been promoted effectively, but difficulties and challenges remain greater than opportunities and advantages.

The Government requests that ministers, heads of ministerial agencies, Government agencies, and Chairpersons of the Provincial People’s Committees, based on their functions, tasks, and authority, actively and proactively focus on the implementation of tasks and solutions in a drastic, timely, effective, focused, and targeted manner in various fields following Resolutions, Conclusions of the Central Executive Committee, Politburo, Secretariat, National Assembly, Standing Committee of the National Assembly, Government, and directions of key leaders; especially overcoming difficulties, limitations, and shortcomings to take advantage of time and seize all opportunities to strive to achieve socio-economic development goals for 2025, especially the GDP growth target of 8.3 – 8.5%, average CPI increase rate below 4.5%, macroeconomic stability, creating a favorable foundation for 2026 growth to reach 10% or higher.

In particular, the Government directs the State Bank to proactively, flexibly, timely, and effectively manage monetary policy, closely and harmoniously coordinating with a reasonably expanded fiscal policy and other macro policies. Direct credit institutions to continue striving to reduce lending interest rates; orient credit towards production and business fields, priority fields, and growth drivers. Manage the exchange rate flexibly, harmoniously, and reasonably balancing with interest rates; diversify foreign currency supply channels, stabilize the value of the Vietnamese dong, and improve the international payment balance.

At the same time, the Government also requests the State Bank of Vietnam, according to its functions, tasks, and authority, to proactively research, evaluate, forecast the situation, build scenarios, plans, and orientations for monetary policy management from now until the end of 2025 and 2026, reporting to the Government’s Standing Committee for consideration and direction before August 20, 2025.

Meanwhile, the Ministry of Finance shall take the prime responsibility and coordinate with the Ministry of Industry and Trade, the State Bank of Vietnam, and relevant agencies to build and submit to the Government for issuance of a Resolution on comprehensive solutions to respond promptly and effectively to the tax policy of the US, completing it before August 13, 2025….

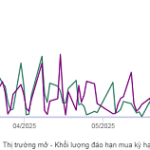

The Central Bank Pumps Over 11 Trillion VND into the Open Market

Between August 4 and August 11, the State Bank of Vietnam (SBV) continued its four-week streak of net injections into the open market, primarily through new issuances in the form of term deposit offerings.

“Pursuing Excellence: Achieving Socio-Economic Goals for 2025”

The Prime Minister has urged all ministries, sectors, and localities to rally and address challenges, limitations, and shortcomings. By seizing every opportunity, we aim to achieve the economic and social development goals set for 2025, especially targeting a GDP growth rate of 8.3 – 8.5%, keeping CPI increase below 4.5%, and maintaining macroeconomic stability. These efforts will lay the foundation for even greater success in 2026, with aspirations to reach a growth rate of 10% and beyond.

Is Real Estate and Stock Market Sucking Up Huge Capital from Banks a Concern?

The surge of credit into the stock market is a temporary blip, according to analysts. However, the real story lies in the significant flow of credit into the real estate sector, which warrants closer attention.