The Vietnamese stock market witnessed surprising developments last week, with the VN-Index surging 6% to close at 1,584.9 points on Friday, surpassing the highest peak of 2022 and astonishing many investors.

A notable highlight was the historic trading session on August 5, which saw a staggering 3.2 billion shares traded and a turnover of nearly VND83 trillion across the market. Similarly, the VN30 index also rose 7.15% to 1,729 points last week.

VN-Index Reaches Historic Peak

Various industry sectors witnessed breakthroughs, with strong liquidity across steel, construction, fertilizer, agriculture, seafood, oil and gas, real estate, and financial stocks. Market liquidity set new records, despite massive net selling by foreign investors, totaling over VND12.8 trillion on the Ho Chi Minh Stock Exchange (HoSE) this week.

Many investors expressed their disappointment to Nguoi Lao Dong reporters, as the VN-Index defied expectations of a significant decline at the peak and instead continued to reach new highs.

Numerous investors had sold off their portfolios in the 1,550-1,580 point range, anticipating a market correction. However, the market closed the week on a positive note, recovering from strong volatility.

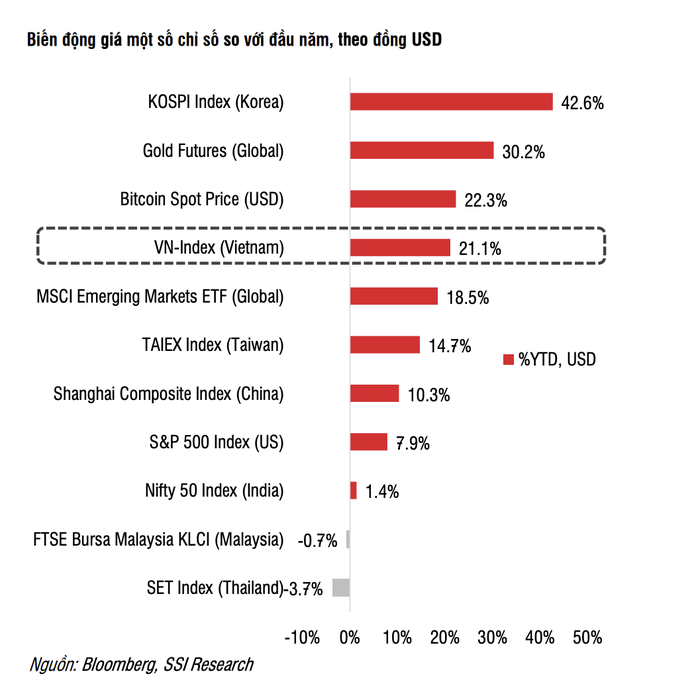

Vietnamese stock market outperformed many other countries

“I sold off my holdings in securities and banking stocks and also offloaded most of my real estate stocks during the volatile last two sessions. As a result, I am now on the sidelines, missing out on the VN-Index’s new peak,” said Nam Phong, an investor from Ho Chi Minh City.

Mr. Dinh Viet Bach, an analyst at Pinetree Securities, also expressed surprise at the market’s performance, stating that signals indicated a potential downturn last week, but the opposite occurred.

The index continued its upward trajectory, setting a new historical peak at 1,584.9 points. Buying demand remained robust, evident in the continuous rotation of money across sectors. Even during sessions where sellers seemed to dominate, buying demand prevailed, driving the market’s recovery.

“There is a high probability that the upward trend will persist next week. The trading actions of foreign investors in the coming sessions could significantly influence the overall market dynamics.

As money tends to flow from large-cap stocks to mid and small-cap ones, investors may consider allocating capital to these segments to seek short-term gains. Conversely, for stocks that have surged sharply or hit consecutive ceiling prices, investors should exercise caution, prioritize profit-taking, and avoid FOMO (fear of missing out) by chasing rising stocks if the VN-Index experiences strong gains,” Mr. Bach advised.

VN-Index hits an all-time high

Bold Prediction: VN-Index to Reach 1,800 Points?

SHS Securities shared a similar sentiment, anticipating the short-term uptrend to persist, with the VN-Index likely heading toward the psychological threshold of 1,600 points.

While the market witnessed vibrant trading with money flowing across sectors amid the rising tide, stock performance began to diverge. Short-term traders need to be cautious in the current environment and maintain a reasonable portfolio allocation.

Despite the VN-Index reaching new highs, experts from Construction Securities (CSI) noted that the upward momentum appeared to slow down during the last two sessions of the week.

There is a possibility that the VN-Index will undergo a correction in the coming week. CSI maintains a cautious stance, advising against buying on margin and favoring a high cash balance.

In its August 2025 strategy report, SSI Securities Corporation (SSI Research) suggested that short-term profit-taking fluctuations could present excellent opportunities for investors, given the sustainable long-term upward potential. SSI Research set a target for the VN-Index to reach the 1,750-1,800 point range by 2026.

Supporting this optimistic outlook are fundamental factors such as economic growth, listed companies’ profitability, a low-interest-rate environment, reduced tariff risks, and potential market upgrades.

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.

Expert Insights: Equities Enter a Phase of Stabilization and Acceleration, with Potential Short-Term Adjustments

“With a consistent upward trajectory over the last four months, a short-term market correction in August is not out of the question. This breather could be necessary to build momentum for conquering new heights,” opined the expert.