China has long been concerned about its soy deficit, solidifying its position as the world’s largest importer and benefiting farmers from the US to Brazil. However, as its economy slows, the country is quietly reshaping trade flows of products derived from the oilseed.

The world’s second-largest economy is boosting exports of soybean oil as domestic consumers cut back on dining out and surging global demand for biofuels makes selling abroad attractive. This is rare; in the past, such a scenario has seldom played out.

At the same time, China is also experimenting with importing soymeal from Argentina for the first time, instead of buying beans and crushing them domestically to produce animal feed.

While the volumes are modest, both trends mark a shift from traditional trade flows and open up the possibility of reducing reliance on US soybeans if Beijing-Washington trade tensions persist.

According to customs data, China exported about 127,000 metric tons of soybean oil in the first half of this year, surpassing 2024’s total. These shipments went to markets such as South Korea, Malaysia, and India, where vegetable oil demand remains high.

“The export increase is a result of the situation: China needs soymeal, and other countries need soybean oil,” said Fu Bo, a senior analyst at Guotai Junan Futures Co., in a report. “This reflects a global rebalancing of supply and demand in the vegetable oil market.”

The global soybean oil market continues to be underpinned by robust biofuel demand in the US, where about half of the domestic crush is used to produce renewable diesel. Meanwhile, domestic blending mandates and uncompetitive pricing in South American countries like Brazil and Argentina have limited additional supply.

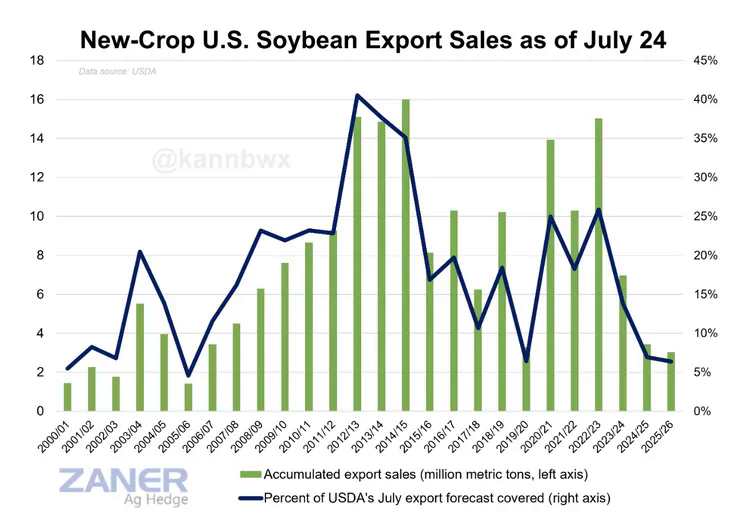

US soybean exports plunged in July 2024 as Chinese buying slowed.

At home, commercial inventories of soybean oil have climbed 70% since May to a hefty 1.12 million tons, according to Shanghai-based commodity consultancy Mysteel. Crushers are maintaining high processing volumes to ensure sufficient soymeal for animal feed, creating a rare business opportunity: exporting the excess oil from a country famed for being an importer.

On the soymeal front, China is seeking new supplies from Argentina. Bunge Global SA recently sold at least two cargoes of the protein-rich feed ingredient to Chinese buyers.

Beijing approved soymeal imports from Argentina back in 2019 amid trade tensions with the Trump administration, but it’s only now that deals are materializing. Argentina’s export tax cut has boosted the competitiveness of its products. However, the shipments also show Chinese buyers actively hedging against potential disruptions to US supplies as Beijing and Washington again lock horns over trade.

“China has excess soybean crushing capacity,” said Arlan Suderman, chief commodities economist at StoneX Financial Inc. “But their recent purchases of soymeal from Argentina send a message to the US that they’re willing to sacrifice domestic crushing to avoid buying US soybeans if Brazil can’t fully meet their needs.”

The Great Fuel Flip: Gasoline Discounts and Rising Oil Prices

After three consecutive hikes, fuel prices witnessed a mixed trend during the January 23rd revision. Specifically, gasoline prices saw a marginal decline, with E5RON92 recording a drop of 158 VND per liter and RON95-III falling by 78 VND per liter. Conversely, diesel prices surged, with various types of oil registering significant increases ranging from 404 VND per liter to 571 VND per kg/liter compared to the current base price.