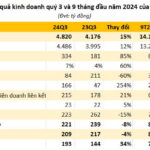

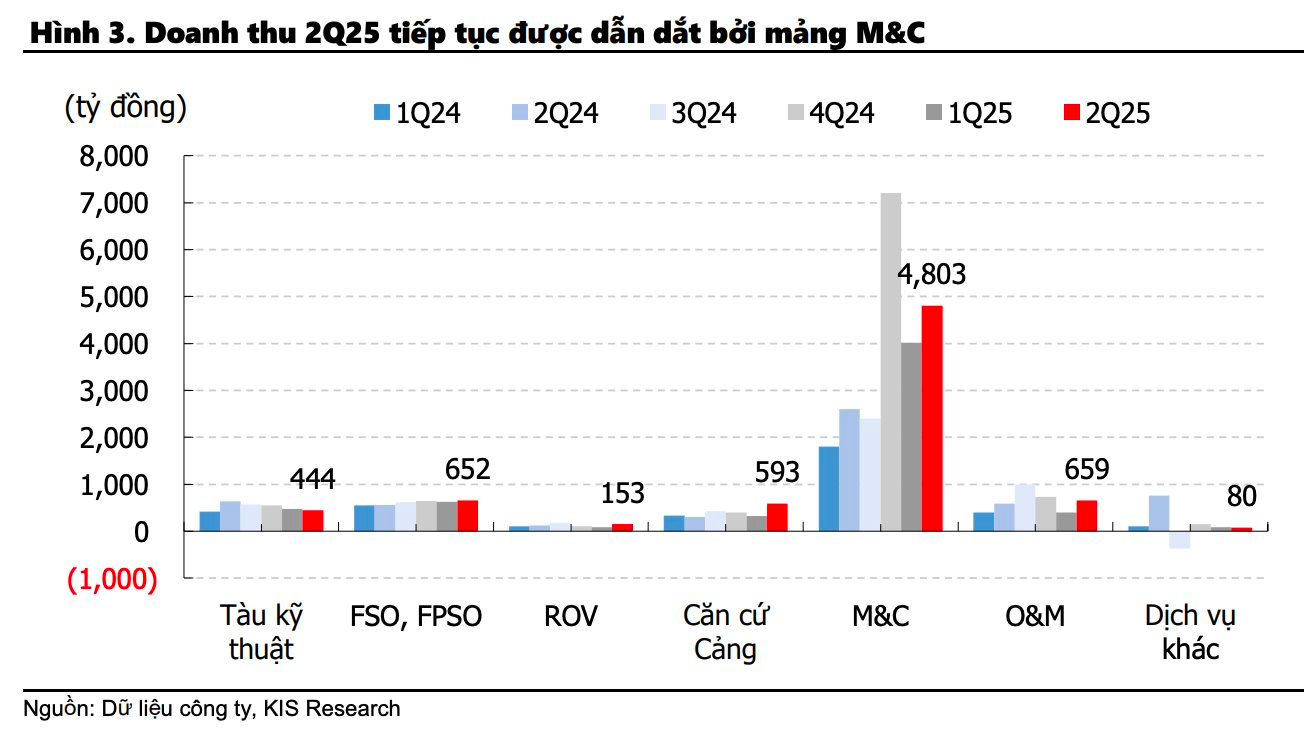

Petrovietnam Technical Services Corporation (PVS) has released its Q2 financial report and cumulative figures for the first half of 2025. Specifically, in Q2, PVS achieved VND 7,383 billion in revenue, a 32% increase compared to the same period last year. The slower growth in cost of sales led to a 83% surge in gross profit to VND 441 billion compared to Q2/2024. Gross profit margin improved from 4.3% to 6%.

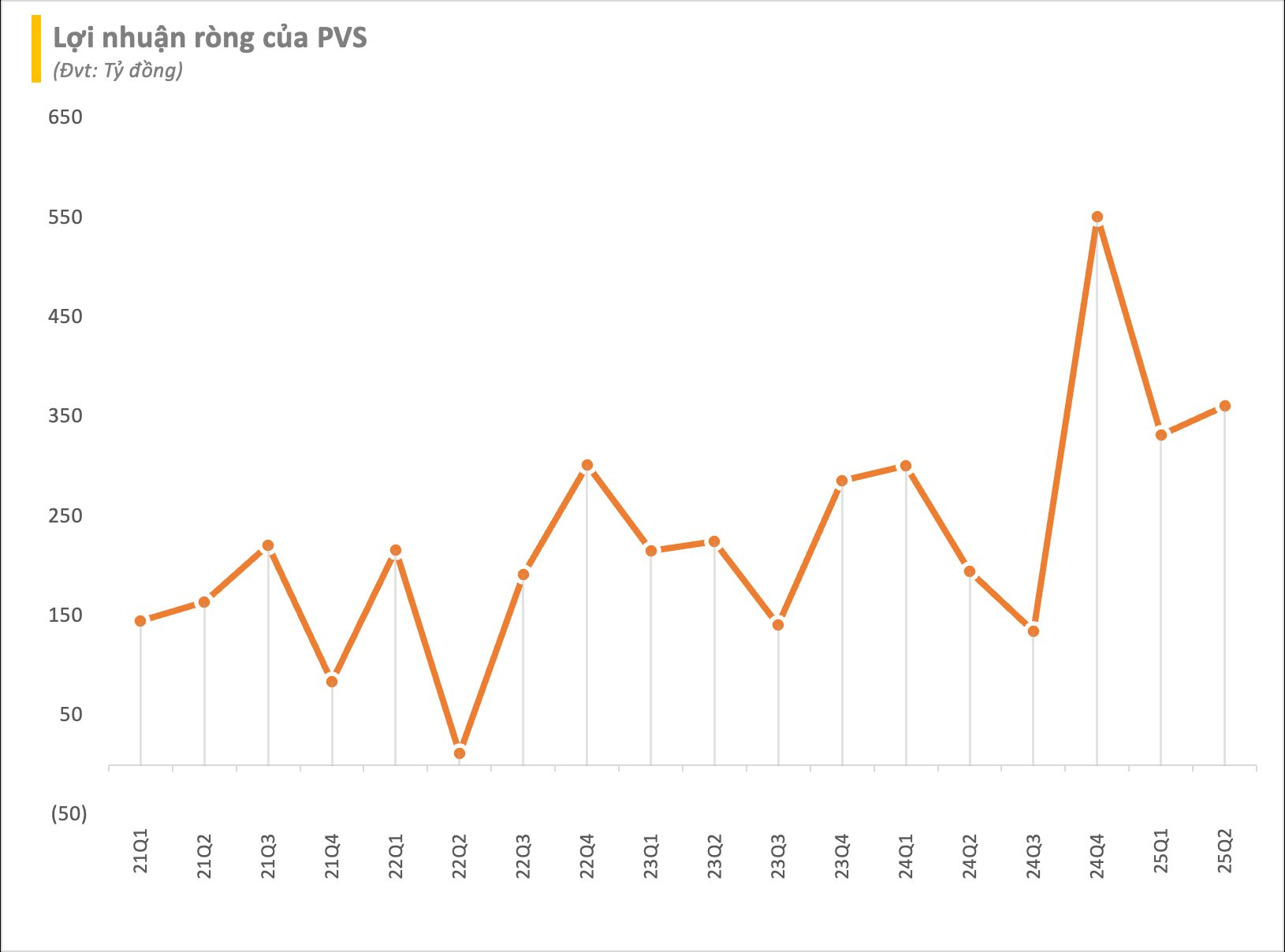

During this period, financial revenue increased by 60%, reaching VND 223 billion, while financial expenses decreased by 42% to nearly VND 30 billion. After deducting related expenses, PVS reported a post-tax profit of over VND 319 billion, a nearly 53% increase compared to the same period last year, including a net profit of nearly VND 361 billion, up 84%.

For the first six months of 2025, PVS’s net revenue was nearly VND 13,397 billion, a 44% increase compared to the same period last year. As a result, post-tax profit increased by 20% to more than VND 619 billion, while profit after tax attributable to the parent company’s shareholders reached VND 692 billion.

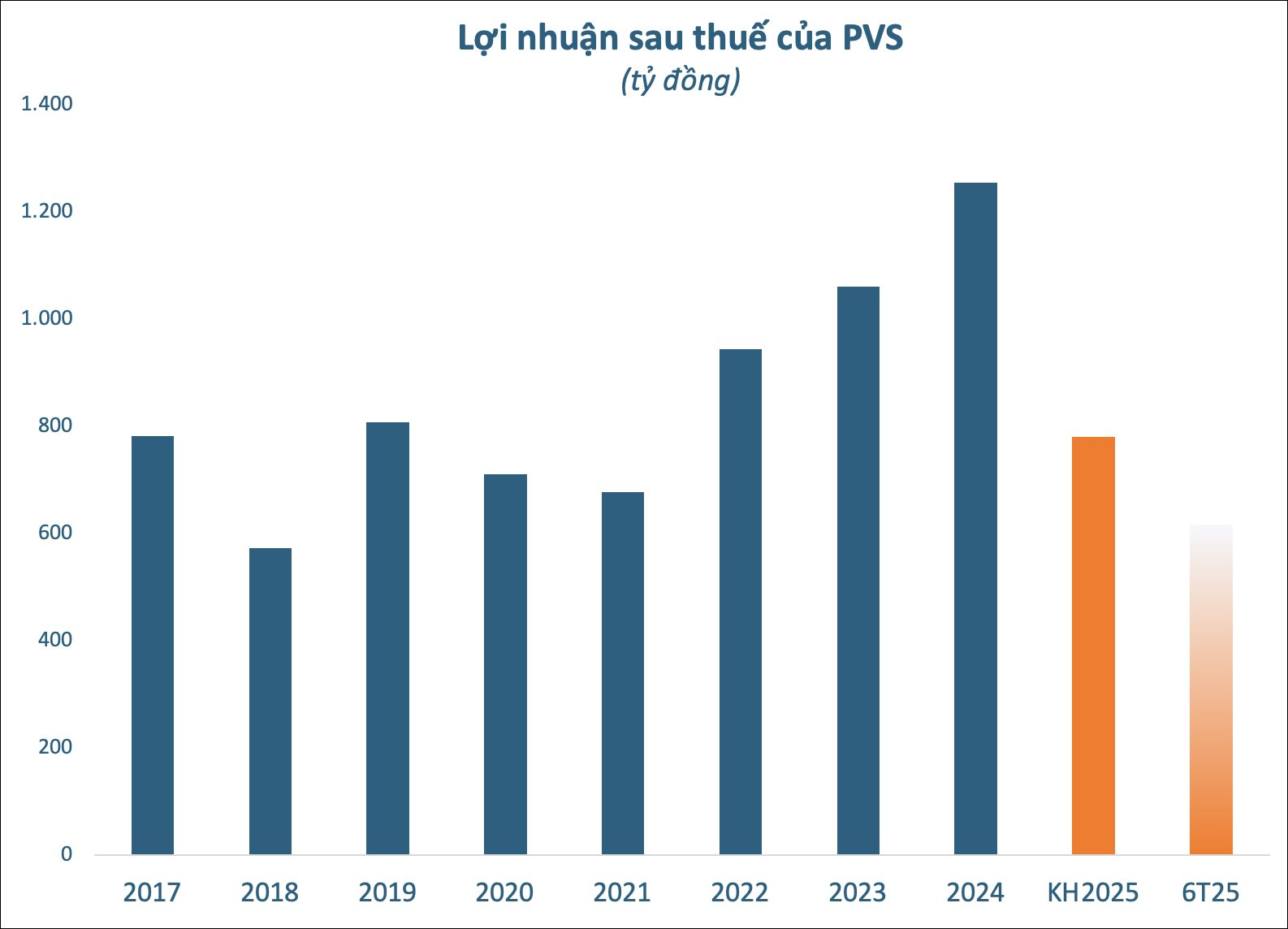

In 2025, PVS set its business plan with consolidated revenue and profit after tax targets of VND 22,500 billion and VND 780 billion, respectively, representing a 10% and 38% decrease compared to the performance in 2024. Thus, the oil and gas enterprise has accomplished 79% of its annual profit target.

However, it is important to note that PVS often sets conservative goals but consistently outperforms them. In 2024, the company recorded consolidated revenue of nearly VND 25,000 billion and a profit after tax of VND 1,255 billion, equivalent to 161% and 190% of its planned objectives. Regarding the 2025 plan, PVS’s leadership also stated that it is a cautious strategy considering the volatile international market and increasing competitive pressure.

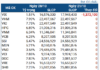

As of the end of Q2/2025, PVS’s asset scale reached VND 35,721 billion, a nearly 5% increase compared to the beginning of the year. Out of this, cash and cash equivalents accounted for nearly VND 12,677 billion, an 11% increase, constituting over 35% of total assets. On the liability side, payables amounted to VND 20,654 billion, including loans of more than VND 1,664 billion.

Anticipating Benefits from the Super Project – $12 Billion Lô B – Ô Môn

As a member of the Vietnam Oil and Gas Group (PVN), PVS is the only domestic provider of all oil and gas technical services (except drilling). The company dominates market share in related industries, such as oil and gas technical vessel services, oil and gas mechanics, base port services, and floating warehouse services.

In a recent report, KIS Securities assessed that the construction segment (M&C) is driving the growth in revenue and net profit. PVS’s revenue increased significantly in Q2 due to high workload at the Lô B – Ô Môn and offshore wind power (OWF) projects. KIS also noted that PVS typically records higher revenue and profit in the second half of the year.

Moving into Q3/2025, KIS projects that PVS’s revenue will witness robust double-digit growth, ranging from 25% to 50% year-on-year, supported by a large backlog from the Lô B project as all packages have been awarded (full LOA), unlike in Q3/2024 when limited LOA was granted until September.

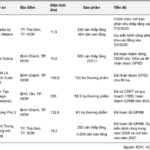

Consequently, net profit is expected to surge by 50–100% compared to the same quarter last year. The Lô B project is progressing at a satisfactory pace. PVS and its partner, Yinson, have also officially won the bid and become the FSO provider for Lô B. Regarding the progress of the packages that PVS is executing, as of June, EPCI#1 reached 25.36%, EPCI#2 achieved 55.29%, and EPCI#3 completed 27% of the work as of May. Moreover, Phu Quoc POC has selected the contractor for the offshore pipeline, a consortium of Vietsovpetro, PT Timas Suplindo, and TOS.

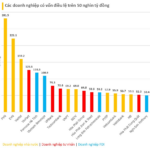

The State-owned Refinery is Set to Join the $2 Billion Capital Team, Joining the Ranks of Hoa Phat Dung Quat, MB, and Vietinbank.

Introducing the top 19 power players with a capital of over $2 billion each. This elite group is comprised of 9 state-owned enterprises, 4 foreign-invested companies, and 6 private powerhouses. Each of these businesses has an incredible story of growth and success, showcasing the diverse and dynamic nature of today’s global economy.

“Energy Giant Smashes Annual Profit Targets in Just 9 Months: Anticipating Windfalls from Vietnam’s $12 Billion Offshore Mega-Project”

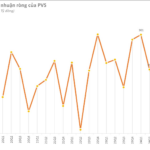

In Q3 2024 alone, the company achieved an impressive after-tax profit of VND 193 billion, a significant 34% increase compared to the same period last year.