Illustrative image

According to data from the Interbank Market Research Association (VIRA), money market rates for the Vietnamese dong (VND) with tenors of one month and below exhibited volatility last week (August 4-8) but ended the week significantly higher compared to the previous Friday. By the close of August 8, VND money market rates were quoted as follows: overnight at 6.28% (+0.88 percentage points); one-week at 6.38% (+0.93 pp); two-week at 6.20% (+0.75 pp); and one-month at 5.75% (+0.37 pp).

In the open market operations (OMO) segment during the week of August 4-8, the State Bank of Vietnam (SBV) offered VND 210,000 billion in 7-day, 14-day, 28-day, and 91-day bills, all at an interest rate of 4.0%. A total of VND 125,480 billion was mobilized across these tenors, while VND 118,125 billion matured during the week in the collateralized channel.

Consequently, the SBV injected a net amount of VND 7,355 billion into the market through its open market operations last week. There was a circulation of VND 216,460 billion in the collateralized channel. Previously, the SBV had also injected nearly VND 69,855 billion into the banking system in the week of July 21-25.

While maintaining a net injection of liquidity through the OMO channel, the SBV refrained from issuing any treasury bills.

The surge in VND money market rates narrowed the interest rate gap between the VND and the US dollar, alleviating pressure on the exchange rate. However, this also resulted in higher funding costs for banks.

So far this year, the SBV has consistently employed open market operations to reduce money market rates. This approach has enabled banks to access low-cost funding from the central bank, supporting their ability to lower lending rates in line with the government’s directives.

With the regulator’s focus on maintaining liquidity support, a cooling-off in VND money market rates is anticipated in the near future.

The Week in Forex: Central Bank Interest Rates and Interbank Rates Cool Off, SBV Cuts Liquidity Support

Last week, the interbank exchange rate fell to 25,372 VND/USD, while VND interest rates continued their downward spiral across all tenors. The State Bank of Vietnam (SBV) withdrew a net amount of VND 16,000 billion from the market through open market operations.

The Art of Financial Flexibility: Central Bank’s Credit Extension

This adjustment was made amidst well-controlled inflation, falling below the target set by the Government and the National Assembly. The move was in line with the directives of the Government and the Prime Minister to manage the monetary policy flexibly, effectively, and promptly to meet the capital needs of the economy and support production and business development.

What Does the SBV’s Net Injection Move Mean?

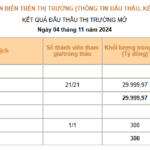

The recent net injection by the SBV on November 4th is a strong move to support liquidity, especially amidst the surging USD/VND exchange rate in both the official and free markets. The SBV’s intervention sends a clear message of their commitment to stabilizing the currency market and shielding the domestic financial sector from excessive volatility.