Attractive Valuation, VN-Index Continues to Grow

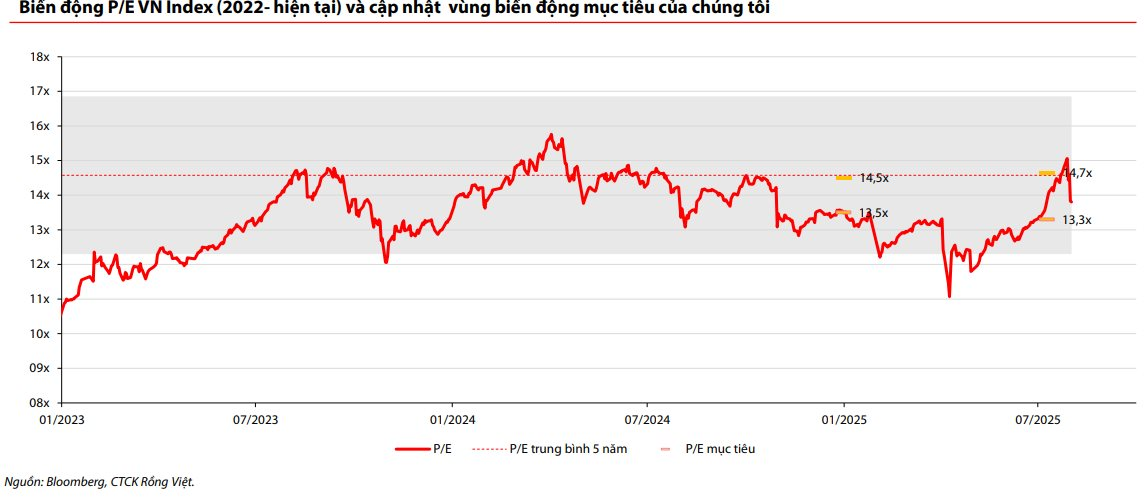

According to the latest strategic report from Rong Viet Securities (VDSC), as of Q2 2025, the trailing four-quarter EPS of the VN-Index reached approximately VND 108.7 per share and is expected to improve further to VND 112.

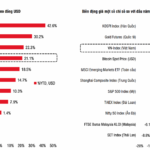

As a result, the market’s P/E valuation has decreased to 13.8 times (as of July 31, 2025), reflecting its relative attractiveness amid continued liquidity support from monetary policies and market upgrade expectations.

With these factors in mind, VDSC maintains a target valuation range of P/E from 13.3x to 14.7x, corresponding to a trading range for the VN-Index in the next three months of 1,445 – 1,646 points.

Potential Stock Picks

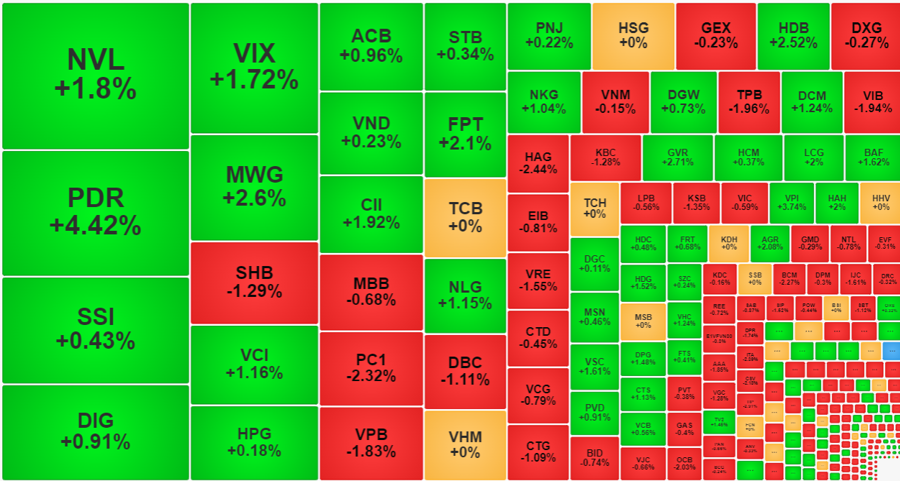

In terms of investment strategy, the VDSC analysis team continues to maintain a high allocation to listed equity assets, particularly focusing on businesses with the potential to expand their operations and withstand inflationary pressures.

With liquidity being a key factor supporting the market’s performance, capital tends to flow towards stocks with strong growth potential.

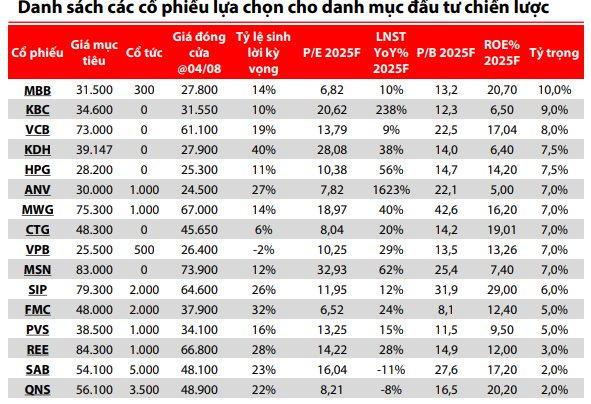

In the banking sector, VDSC holds a positive view on MBB, projecting a compound growth rate of 19% per annum for the bank’s profits during the 2025–2028 period, thanks to its distinct competitive advantages.

Additionally, MBB has the potential to rapidly expand its credit scale due to its robust digital banking platform, comprehensive financial group model, and low cost of capital. Following the acquisition of OceanBank, the bank will benefit from an increased credit limit, providing significant room for growth.

MBB is expected to maintain a more stable net interest margin (NIM) compared to its peer group, thanks to its diverse and loyal customer base, as well as its high CASA ratio. If the state ownership ratio exceeds 50%, MBB may be eligible to participate in bidding for KBNN deposits, which would be a significant advantage in terms of capital costs.

Similarly, VCB is anticipated to experience stable growth in 2025 and accelerate more noticeably from 2026 onwards as the economy enters a new development cycle. VDSC forecasts a compound growth rate of 15% per annum for pre-tax profits during the 2025–2028 period, driven by two main factors:

(1) NIM recovery to nearly 3% due to improved credit demand, and (2) reduced risk from counterparty tax.

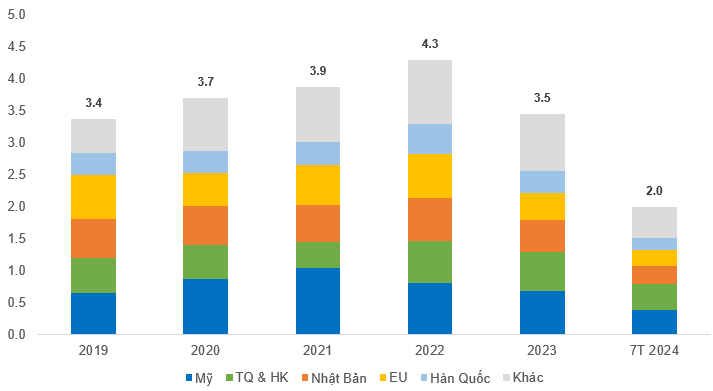

In the industrial park group, the analysis team assesses that KBC will directly benefit from the recovery of the industrial real estate sector in 2025. Notable projects include Nam Son Hap Linh, Trang Due 03, and Kim Thanh (in the North) and Tan Phu Trung, Tan Tap, and Loc Giang (in the South).

In 2026, with the advantage of cleared land and improving infrastructure, the leaseable area is expected to increase to 160ha (+14% YoY), mainly from NSHL and Trang Due 03.

Apart from industrial parks, the residential real estate segment also becomes a mid to long-term growth driver. The Trang Cat urban project (Hai Phong, 585ha) completed its financial obligations in 2025 and is expected to contribute VND 5,300 billion in revenue from 2026, equivalent to 40% of that year’s total revenue.

In the oil and gas group, the team assesses that the business performance of PVS will continue to improve in the second half of 2025, thanks to the positive progress in the construction of various offshore oil and gas and energy projects.

At the Lac Da Vang project (with a total investment of over $1.2 billion), the fabrication volume has reached 25-30%. Meanwhile, the Lo B – Om Chain of projects also shows positive progress: the key EPCI packages implemented by PVS have exceeded expectations, with Package #3 reaching 89% in An Giang and preparing for handover and construction commencement in Q3 2025.

Apart from oil and gas, PVS also performs well in the field of offshore wind power. The Greater Changhua 2b & 4 project in Taiwan completed the fabrication of 33 turbine foundations and delivered them in June 2025.

In the retail group, the stocks of MWG, MSN, and SAB are included in the potential list. According to VDSC, MWG is regaining market share in the electronics retail industry thanks to its strategy of restructuring its store system towards a more streamlined and efficient model. In the past year, the company closed 224 stores, mainly older outlets with almost fully depreciated assets, saving approximately VND 236 billion per quarter. Additionally, by reducing staff from an average of 10 to 3 people per store, MWG increased the EBIT margin of TGDĐ & ĐMX to 6.1% (+110bps YoY in Q1/2025).

Regarding MSN, the company maintains a stable growth momentum thanks to its profitable business pillars such as MCH (consumer goods) and TCB (banking), while also offering growth prospects through new segments like MML and WCM, which are now profitable, and MSR, which is narrowing its losses.

Furthermore, VDSC assesses that the mid to long-term revenue growth prospects of SAB face challenges due to the trend of tightening alcohol consumption restrictions in Vietnam. 2025 marks the implementation of Decree 168, further restricting beer consumption in on-trade channels (restaurants and pubs) – which were already impacted by Decree 100.

Nevertheless, gross profit margins could improve due to lower input costs (especially malt prices, which are currently lower than when SAB last procured reserves in mid-2022) and efforts to shift from on-trade to off-trade channels (modern retail channels) to reduce selling expenses. A bright spot in investing in SAB is its high cash dividend yield, currently around 10.4%/year, making it attractive to long-term investors following a dividend strategy.

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.

“A Plethora of Policies Support Vietnam’s Stock Market Surge to All-Time Highs”

The government and regulatory policies are fueling a new impetus, ushering in a prospective growth cycle for the stock market. With an aim to attract high-quality domestic and foreign capital, these policies are poised to foster the development of businesses and the economy alike.

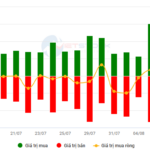

The Vietstock Daily: Upward Momentum Persists

The VN-Index extended its winning streak for the sixth consecutive session, hovering near the upper band of the Bollinger Bands. However, the index’s movement warrants attention as it approaches the pivotal psychological resistance level of 1,600 points. A decisive breakthrough above this level, fueled by robust buying pressure, would bolster the index’s upward trajectory. Additionally, the bullish crossover on the Stochastic Oscillator and the upward trajectory of the MACD, following a buy signal, reinforce the potential for sustained upside momentum in the near term.