The stock market has been on a record-breaking streak since late July, with gold prices also reaching new heights. Illustration: LE VU |

Index Soars to New Heights

Gold prices surged to a new record high during the first week of August. The SJC gold bar selling price rose to 124.4 million VND. Meanwhile, international gold prices rebounded to around $3,400 per ounce, marking a weekly increase of about 3.9% and a monthly gain of 2.1%.

In Vietnam, two persistent issues in the gold market are worth noting. Firstly, the gap between domestic and international gold bar prices remains significant (around 16 million VND, excluding conversion rates). Secondly, the large difference between buying and selling prices indicates a risky market (over 1.2 million VND).

While gold prices reached new peaks, they failed to attract investors. According to Mr. Shaokai Fan, Regional CEO for Asia Pacific (excluding China) and Central Bank Relations Director at the World Gold Council (WGC), investment demand for gold bars and coins in Vietnam decreased by 20% year-on-year and 21% quarter-on-quarter in Q2.

Jewelry gold demand also witnessed a decline (20% year-on-year and 29% quarter-on-quarter), following the global trend. Shaokai attributed this decrease to high gold prices and reduced purchasing power due to currency depreciation and the persistent gap between domestic and international gold prices.

However, long-term demand remains robust, and the total value of gold bar investments in Vietnam has increased by 12% in USD terms compared to the previous year, reaching $997 million.

As gold prices surge, investment demand wanes, contrasting the influx of capital into the stock market, which has also been scaling new peaks.

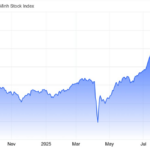

In July, the VN-Index made history by surpassing 1,557 points on July 28, followed by a steep decline due to strong selling pressure. However, the first days of August witnessed a robust recovery, pushing the index to a new high of 1,584 points. As of now, the VN-Index has surged by nearly 5.5% in the last six sessions and over 15% since the beginning of July.

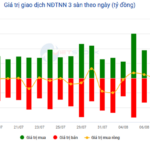

The market index consistently broke records amid surging liquidity. July witnessed an average trading value of over 32,800 billion VND per session, along with net foreign buying. The first days of August saw a significant jump in liquidity, with an average trading value of over 48,600 billion VND per session on the HOSE, including a record session of 78,000 billion VND.

Individual investors largely contributed to this surge. According to the Vietnam Securities Depository (VSD), investors opened an additional 226,000 accounts in July, bringing the total number of newly opened accounts to 1.2 million, mainly individual investors.

Opportunities for Individual Investors

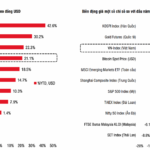

Gold prices have surged by 30% in USD terms since the beginning of the year, while the VN-Index has risen by over 13% in the past month and more than 25% since the start of 2025. Thus, the returns are almost equivalent in the context of low deposit interest rates.

However, the stock market does not guarantee universal profits. Some investors reap substantial gains, while others miss out on the VN-Index’s recent “sprint.” “The market is entering a phase with many opportunities, but the high level of differentiation means that not all investors will benefit,” said Ms. Nguyen Hoai Thu, Deputy General Director of VinaCapital Fund Management Company.

According to Fmarket, a fund distribution platform, as of the end of the trading session on July 30, many stocks hit new highs, but nearly 1,140 stocks were still more than 10% below their historical peaks, accounting for about 70% of the total number of traded codes.

Meanwhile, gold investment also carries distinct risks. The prevailing gold prices and the gap between domestic and international prices require investors to commit more capital, as explained by Mr. Shaokai.

In reality, investment prospects in the coming time depend on a common factor: policy stories. While stock market analysts paint a positive outlook, including the expected upgrade in September, gold investment also anticipates significant policy changes.

For instance, the potential increase in gold import quotas or the establishment of a gold exchange to narrow the price gap between the two markets. However, it is still too early to assess the impact of these policies, and the most critical factor driving gold prices to new highs is the limited supply and high demand, according to Mr. Shaokai.

Gold prices have been on a strong upward trajectory in the last two years, and this trend has not abated in the global market. Global investment demand for gold bars and coins increased by 11% year-on-year, the strongest first half since 2013.

While the gold price index fluctuates sideways, no analyst predicts a continued rise or a downward trend. However, the outlook depends on two main factors: the purchasing power of the “big players,” trade risks, and US dollar interest rate cuts.

The World Gold Council’s annual survey revealed that 95% of asset managers believe central banks will continue to buy gold, and 43% of surveyed central banks plan to buy gold in the next 12 months. Both figures are record highs. Central banks primarily purchase gold for two reasons: portfolio diversification (the most cited reason) and rising political risks.

The following risks depend on resolving trade issues, especially tariff disputes between the US and China and, more recently, between the US and India. With negotiation outcomes uncertain, central banks retain room to cut interest rates. These factors positively impact gold prices, a risk-averse asset. “In an environment of global instability or potential trade disruptions, gold in the investment portfolio will enhance investors’ resilience,” said Mr. Shaokai.

In reality, global volatility variables are also factors mentioned by many analysts in the stock market, especially the story of cheap money inflows in anticipation of the upgrade.

Although many stocks have surged in value recently, increasing risks, Ms. Thu believes that the market has risen significantly this year, but the gains are concentrated in a few stocks. If we broaden our perspective, many other stocks on the exchange still have room for growth.

Most analysts agree that the market outlook remains positive, given the low-interest-rate environment, the promotion of public investment projects, and the stimulation of private investment. Additional supportive factors include economic growth, listed companies’ profitability, and reduced tariff risks.

Dung Nguyen

– 16:00 10/08/2025

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.

TNG Issues Over 6 Million ESOP Shares at VND 10,000 Each, with the Chairman’s Family Planning to Purchase Nearly 40%

The Hanoi-based Investment and Trading Joint Stock Company TNG (HNX: TNG) plans to offer over six million shares to its employees and stakeholders at a discounted price of 10,000 VND per share, which is significantly lower than the current market price. This move will see the company’s Chairman, Nguyen Van Thoi, and his two sons being offered nearly 40% of this allocation.

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.