Mass Conversion

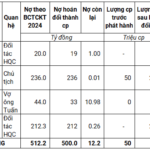

Hoang Quan Commercial Trading Services Real Estate Joint Stock Company (stock code: HQC) has just approved a plan to issue private placement shares to swap debt. Specifically, HQC will issue 50 million shares at VND 10,000/share to exchange VND 500 billion of debt. The issued shares will be restricted from transferring within 1 year from the issuance date. Notably, the issuance price is 153% higher than the market price at which HQC is currently trading.

HQC issues 50 million shares at VND 10,000/share to exchange VND 500 billion of debt.

Previously, on May 10, HQC’s shareholder meeting approved a plan to issue private placement shares to swap debt worth up to VND 500 billion, equivalent to 50 million shares. Of this, Hai Phat Investment Joint Stock Company (stock code: HPX)’s debt of VND 212 billion to HQC will be converted into 21.2 million shares, equivalent to 3.38% ownership ratio after issuance.

At the extraordinary general meeting of Novaland Group (stock code: NVL) in 2025, shareholders approved a plan to issue 168,014,696 private placement shares at a price of over VND 15,746/share to swap a total debt of over VND 2,645 billion belonging to three creditors, including NovaGroup (VND 2,527 billion), Diamond Properties (nearly VND 112 billion), and Ms. Hoang Thu Chau (nearly VND 7 billion).

The expected allocation is over 160 million shares for NovaGroup, nearly 7.1 million shares for Diamond Properties, and 424,000 shares for Ms. Chau. The issuance is expected to be implemented in Q4 of this year to Q1/2026, after approval from the State Securities Commission of Vietnam.

This is the amount that NVL has to pay to the 3 creditors who have mortgaged shares for secured loans for the company to fulfill its payment obligations, and these creditors have reached an agreement in principle to swap the debt with Novaland.

In addition, the meeting also approved a plan to issue 151,850,054 shares at a price of VND 40,000/share to swap the entire principal debt of 13 bond codes. These are bonds issued from 2021 to 2022, with maturities mainly in 2023 – 2025, with a total outstanding principal amount of VND 6,074 billion. Novaland will negotiate with bondholders, and the expected timing of the issuance is in 2026 after approval from the State Securities Commission of Vietnam.

Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company has just converted 22,822,417 bonds in the CII424002 bond lot into shares.

Previously, 228,224,170 new CII shares of Ho Chi Minh City Technical Infrastructure Investment Joint Stock Company were officially traded on the exchange. This is the new share issuance volume to convert 22,822,417 bonds in the CII424002 bond lot into shares. After this conversion, the number of CII424002 bonds outstanding decreased from 28,130,689 to 5,308,272 bonds.

The CII424002 bond lot has a par value of VND 100,000/bond, a term of 10 years, issued on January 25, 2024, and maturing on January 25, 2034, with a fixed interest rate of 10%/year. This issuance successfully raised more than VND 2,813 billion through the issuance of more than 28.13 million bonds.

Four bondholders of Hai An Transport and Stevedoring Joint Stock Company (stock code: HAH) have just agreed to convert 203 HAHH2328001 bonds into more than 8.55 million HAH shares at a conversion price of VND 23,739/share.

To raise funds for new ship construction, Hai An issued VND 500 billion of bonds on February 2, 2024, with a term of 5 years and an interest rate of 6%/year. However, just over 1 year after issuance, more than 40.6% of the total convertible bond volume of HAH has just been converted into shares with an interest rate of about 55.4%.

Harmonious Solution

According to a representative of Novaland Group, the issuance of 151,850,054 shares at a price of VND 40,000/share to swap the entire principal debt of 13 bond codes is the outstanding principal amount of private placement bonds remaining from 2023 to the present. Due to business difficulties, Novaland has not been able to fulfill its commitments to bondholders. After the additional share issuance plans are implemented, Novaland’s charter capital will increase to nearly VND 22,700 billion.

NVL issues 151,850,054 shares at an issue price of VND 40,000/share to swap the entire principal debt of 13 bond codes.

“In the short term, the additional share issuance will cause dilution for shareholders, but this is a necessary step for Novaland to restructure, reduce cash flow pressure, improve financial safety ratios, and ensure the benefits of all related parties. The company affirms that it will always be transparent and ensure fairness for all investors,” said the representative of Novaland.

According to Mr. Hoang Kim Hoai, General Director of Phuc Dien Land, the plan to convert bonds into shares will harmonize the interests of both bondholders and enterprises. Currently, real estate businesses are facing difficulties due to the stagnant market, so they do not have cash flow to pay for the bond lots issued previously.

According to data from the Vietnam Bond Market Association (VBMA), the total value of bonds maturing in the second half of 2025 is estimated at VND 131,601 billion, of which real estate bonds account for VND 69,970 billion, equivalent to 53% of the total maturing volume. Notably, in August 2025 alone, the value of maturing real estate bonds reached VND 17,500 billion, nearly double that of July, and is the highest since the beginning of the year.

Veteran Enterprise, New Horizons: Unlocking VNC’s Breakthrough Potential

VNC, the stock symbol for Vinacontrol Group, is emerging as a safe and value-laden long-term investment destination. But what sets this enterprise apart, sustaining its allure amidst market volatility?

HQC Proposes Issuing 50 Million Shares to Convert VND 500 Billion Debt

Real Estate giant, Dia Oc Hoang Quan, has unveiled plans to issue 50 million private placement shares. This move is designed to facilitate a VND 500 billion debt-to-equity swap with four creditors, including Chairman Truong Anh Tuan and his wife, who collectively hold over half of the debt.