Vietnam’s automobile and auto parts exports brought in over $1.68 billion in June, a 15.5% increase from the previous month, according to preliminary statistics from the General Department of Vietnam Customs. In the first seven months of the year, this category earned more than $9.9 billion, up 13.5%. This is the country’s sixth-largest export commodity.

Vietnam’s major export markets, which include leading automobile-producing nations such as the United States, Japan, South Korea, Thailand, and Germany, have all seen positive growth.

With more than $2 billion in exports, the United States remains Vietnam’s largest market for this commodity, up 9% from the same period last year. In July, the country imported $343 million worth of goods, up nearly 4% from the previous month.

Japan is Vietnam’s second-largest importer of this category, with over $1.8 billion, up 11.5% from the previous year. In addition, South Korea is Vietnam’s third-largest export market, with over $1 billion, up 14%.

According to the Customs Department, Vietnam’s auto parts exports have maintained double-digit growth in recent years. Experts attribute this to the shift in production from large markets like China to more promising markets in Southeast Asia, including Vietnam.

Vietnamese businesses have successfully adapted to large-scale manufacturing requirements and are increasingly integrating into the global supply chain.

There are approximately 2,000 Vietnamese companies manufacturing auto components, employing over 600,000 people, with around 300 of them participating in the global supply chain. The percentage of Japanese companies purchasing components from Vietnam has increased from 28% to 37% in the last decade.

According to experts from the United Nations Industrial Development Organization (UNIDO), Vietnamese businesses have a significant advantage in automotive wire production. In fact, Vietnam is currently the world’s third-largest exporter of this product, after only China and India. Major automotive hubs such as Japan, the United States, the EU, and even Thailand import automotive wiring harnesses from Vietnam, solidifying the country’s position as a critical link in the global automotive assembly supply chain.

On May 3, 2025, the United States Trade Representative (USTR) imposed a 25% tariff on 332 automotive part imports, ranging from mechanical and electronic parts to drive and control systems. This is part of the US government’s ongoing effort to protect the domestic automotive industry and reduce the trade deficit.

“Global Trade Strategies for 2025: Navigating the New Normal”

On August 18, 2025, VietinBank will host the “2025 Import-Export Forum: New Strategies in the Global Flow.” The forum aims to provide vital policy information directly impacting the operations of manufacturing, import, and export businesses.

“Empowering Auxiliary Industries: Focused Investments, Avoiding Over-Diversification.”

With regards to the strategic orientation of the supporting industries, representatives from the Ministry of Industry and Trade emphasized their focus on several key sectors for in-depth investment. These sectors include mechanical engineering, automobile, electrical-electronics and semiconductors, textiles-footwear and basic materials. By concentrating resources on these industries, they aim to avoid a scattered approach and foster a more concentrated and effective development.

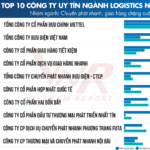

The Ultimate Guide to the Leading Logistics Companies: Viettel Post Reigns Supreme in the Express Delivery Sector, While Giao Hàng Tiết Kiệm and Giao Hàng Nhanh Make Their Debut in the Top 5.

Vietnam Report JSC has recently unveiled the Top 10 Reputable Companies in the Logistics Industry for 2024, offering a comprehensive overview of the sector’s performance over the past year.