In its newly released August strategic report, ASEAN Securities (ASEANSC Research) assesses that the market will continue to receive supportive macro-policy tailwinds, notably the push to accelerate public investment disbursement and the low-interest-rate environment, alongside expectations of an upgrade for the Vietnamese stock market.

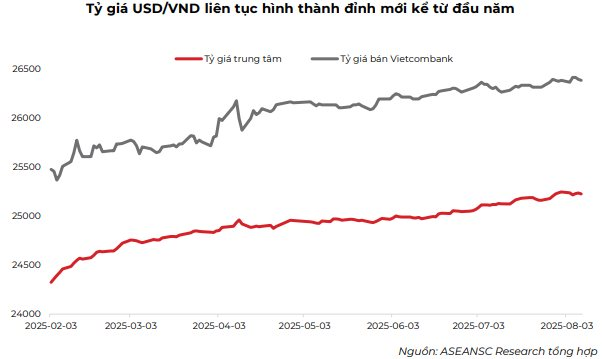

Nevertheless, the VN-Index will also face variables, including the USD/VND exchange rate and potential profit-taking after the market’s impressive rally since early April 2025.

ASEANSC Research points out that the USD/VND exchange rate remains a short-term variable and could create a cautious psychological effect on the stock market if the upward momentum from the beginning of the year persists.

However, the USD/VND exchange rate is expected to cool down in Q4 2025 as USD supply improves due to remittances, spending by international tourists, and prospects for increased foreign capital inflows following Vietnam’s stock market upgrade.

Additionally, the peak import period for domestic businesses (serving export tax evasion and the peak export season in the latter part of the year) is also passing.

Turning back to the stock market, from the perspective of Elliott Wave Theory, after forming a wave (4) decline in late July, ASEANSC Research believes that the VN-Index is currently in a wave (5) advance.

Some characteristics of wave (5) include: (1) the index frequently experiences volatile sessions, especially as the Vietnamese stock market sets new liquidity records, (2) mid and small-cap stocks may attract strong buying due to the ‘last wave’ nature of the third advancing sub-wave of the Elliott impulse wave, (3) after wave (5), the market usually enters a corrective a-b-c pattern before forming the next advancing cycle.

Based on the influencing factors and the technical state of the index, ASEANSC Research forecasts that the VN-Index will mainly fluctuate within a range of 1,500 to 1,625 points in August 2025. The index’s current support region is 1,550 +/- while there is no strong resistance due to the formation of new highs.

For short-term traders, investors with a high cash position should consider partial deployment during market and stock fluctuations, avoiding chasing rallies within sessions. Priority should be given to observing leading sectors with supportive news, such as Banking, Securities, Real Estate, and Public Investment.

Meanwhile, investors with a high stock allocation should only hold stocks with strong money flow and a short-term upward trend.

For the buy-and-hold school of investors, the ASEANSC analysis team suggests that new purchases should only be made during the corrective a-b-c phase after wave (5) concludes, as this is when potential stocks will offer appropriate discounts. Priority for buy-and-hold investors should be on leading stocks with maintained profit growth prospects in 2025.

ASEANSC Research prioritizes stocks with high profit growth potential in 2025, benefiting from macro policies or supportive narratives. Accordingly, the analysis team highlights HCM, HPG, VCG, BSR, NLG, and VIB as potential stocks for August.

Foreign Investors Continue Selling Spree: Which Stocks Are Taking the Brunt?

In the afternoon trading session, foreign investors net bought VPB and SHB stocks the most in the market, with respective values of VND 120 billion and VND 108 billion.

Market Beat on August 11th: Failing to Conquer the 1,600-Point Threshold.

The market closed with strong gains, as the VN-Index rose by 11.91 points (+0.75%), finishing at 1,596.86. The HNX-Index also climbed 4 points (+1.47%), ending the day at 276.46. It was a bullish day for the market, with 505 advancing stocks outpacing 297 declining ones. The VN30, a basket of Vietnam’s 30 largest stocks, mirrored this sentiment, as 21 stocks advanced against 9 declines.

The Ever-Changing Market: Strategies for Investors to Stay Ahead of the Curve

Contrary to expectations of a potential steep correction at the peak, the VN-Index has been consistently reaching new highs, leaving many investors scrambling to keep up.