TNG Chairman, Nguyen Van Thoi, and his two sons – Photo: TNG |

At the meeting on August 7, the TNG Board of Directors approved the plan to issue shares under the Employee Stock Ownership Plan (ESOP) for 2025 and proceeded with its implementation.

TNG plans to issue 6.13 million ESOP shares at VND 10,000 per share, equivalent to 5% of the circulating shares. The shares will be restricted from transfer for 3 years. The issuance is expected to take place in 2025, after obtaining approval from the State Securities Commission. After the issuance, TNG’s charter capital is expected to increase to over VND 1,287 billion.

The total proceeds from the ESOP offering are estimated at over VND 61 billion, which will be used to pay for raw materials purchased from suppliers.

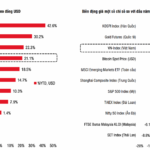

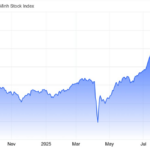

In the stock market, TNG is trading around VND 22,400 per share, up 32% in the past 3 months with liquidity of nearly 1.8 million shares per session. Compared to the ESOP issuance price of VND 10,000 per share, the market price is more than 2.2 times higher.

|

TNG share price movement since the beginning of 2025 |

|

|

ESOP issuance for nearly 500 personnel, Chairman’s family holds nearly 40%

The Board of Directors also approved the list of 494 officers, employees, managers, executives, and leaders who are entitled to purchase the entire 6.13 million ESOP shares. Among them, Chairman Nguyen Van Thoi is expected to purchase nearly 1.55 million shares. His two sons, Vice Chairman Nguyen Duc Manh and Board member Nguyen Manh Linh, are entitled to purchase nearly 752,000 shares and over 67,400 ESOP shares, respectively.

In total, the three are expected to receive nearly 2.4 million ESOP shares, accounting for nearly 39% of the issuance, equivalent to a value of approximately VND 24 billion if all rights are purchased.

According to the semi-annual governance report for 2025, Mr. Nguyen Van Thoi is currently the largest shareholder of TNG with 18.58% capital. Mr. Nguyen Duc Manh holds 8.83%, while Mr. Nguyen Manh Linh owns 0.59% capital.

In addition, General Director Tran Minh Hieu, who succeeded CEO Nguyen Duc Manh in June, is expected to purchase more than 30,300 ESOP shares.

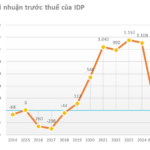

In terms of business results, TNG recorded revenue of over VND 2,500 billion in Q2 2025 and a net profit of over VND 120 billion, the highest quarterly record to date. For the first 6 months of the year, revenue reached over VND 4,038 billion, and net profit exceeded VND 161 billion, both setting new records. As of Q2, the Company has achieved 53% of its revenue plan and 51% of its profit target for the year.

The Mighty

– 15:28 11/08/2025

Are Penny Stocks Worth the Risk Amid Market Volatility?

The VN-Index, after hitting a historic peak, is expected to face profit-taking pressures and experience further volatility. Experts advise investors to focus on stocks with strong fundamentals and robust earnings growth. While “speculative” stocks may surge, they carry the risk of a steep decline once the market enthusiasm wanes.

Expert Insights: Equities Enter a Phase of Stabilization and Acceleration, with Potential Short-Term Adjustments

“With a consistent upward trajectory over the last four months, a short-term market correction in August is not out of the question. This breather could be necessary to build momentum for conquering new heights,” opined the expert.