Ho Chi Minh City Securities Corporation (HSC, HCM: HCM, HoSE) has just announced a transaction of the company’s insider trading.

Accordingly, Mr. Lam Huu Ho, HSC’s Chief Financial Officer and Chief Accountant, has registered to sell 500,000 shares for portfolio restructuring purposes. The transaction is expected to take place through order matching from August 13, 2025, to August 28, 2025.

If the transaction is successful, Mr. Ho will reduce his ownership of HCM shares from nearly 1.9 million to 1.4 million, equivalent to a decrease in capital ownership from 0.26% to 0.19% of HSC’s capital.

Illustrative image

Regarding HCM shares, Ho Chi Minh City Finance and Investment State-owned Company (HFIC) recently announced to the State Securities Commission of Vietnam (SSC), Ho Chi Minh City Stock Exchange (HoSE), and HSC about the trading of stock purchase rights by related organizations of insiders.

Accordingly, HFIC offered to sell more than 121.6 million rights (equivalent to more than 60.8 million shares) of HCM shares at a starting price of VND 6,875/right. The expected value of the transfer is nearly VND 836.3 billion.

The transaction method is auction sale through HoSE. The expected transaction time is from August 12, 2025, to August 18, 2025.

Previously, on July 23, 2025, HFIC also announced an auction sale of more than 121.6 million HCM stock purchase rights at the above-starting price. The time for investors to register and deposit money was from July 24 to 4:00 PM on August 4, 2025.

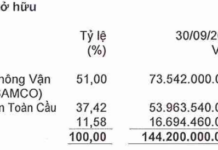

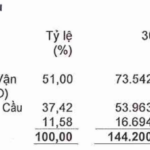

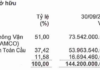

Currently, HFIC holds more than 121.6 million HCM shares, equivalent to 16.88% of HSC’s charter capital. In addition to being a major shareholder, HFIC is also an organization related to HSC’s insiders.

Specifically, Mr. Tran Quoc Tu, a member of HSC’s Board of Directors, is currently the Head of HFIC’s Legal Department and represents more than 57.6 million HCM shares (8% capital) of HFIC at HSC.

In addition, Ms. Phan Quynh Anh, Deputy Head of Finance and Accounting Department of HFIC, is also a member of HSC’s Board of Directors. She also represents HFIC’s capital contribution of more than 43.2 million HCM shares (equivalent to 6% of charter capital) at HSC.

“Hoang Quan Real Estate Plans to Issue 50 Million Shares to Swap Debt”

“Hoang Quan Real Estate plans to issue 50 million shares at VND 10,000 per share to swap VND 500 billion of debt. The list of creditors includes Chairman Truong Anh Tuan and Hai Phat Invest. This strategic move aims to strengthen the company’s financial position and consolidate its presence in the competitive real estate market.”